The Contribution of the Beef Industry to the Arizona Economy

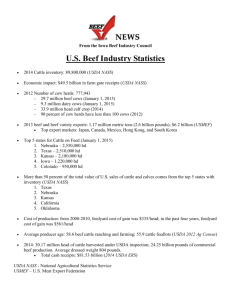

advertisement