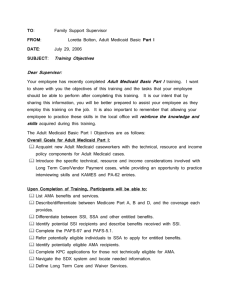

DRA PARTNERSHIPS: THREE PERSPECTIVES WHAT YOU SEE DEPENDS ON WHERE YOU’RE SITTING.

advertisement

DRA PARTNERSHIPS: THREE PERSPECTIVES WHAT YOU SEE DEPENDS ON WHERE YOU’RE SITTING. THE MODERATOR/EMCEE Steve Serfass DRINKER BIDDLE and REATH LLP A STATE VIEW Lynda Hermes Texas Department of Insurance Jimmy Perez Texas Health and Human Services Commission A LOOK AHEAD Aging population – Texans 65+ projected to increase from 2.3M in 2005 to 7.4M in 2040. Demand for Services – In 2040, half of Texans aged 65+ expected to have some type of disability and would benefit from LTC services. Unsustainable Medicaid budget increases: Medicaid pays for 67% of all Nursing Facility care Texas LTC costs could nearly quadruple from $3.5B in 2005 to $12.5B by 2040. LONG-TERM CARE (LTC) BASICS • Definition, Texas Human Resources Code (§22.0011) – “…the provision of personal care and assistance related to health and social services, given episodically over a sustained period, to assist individuals of all ages and their families, to achieve the highest level of functioning possible, and regardless of the setting in which the assistance is given.” • Services – May include personal assistance and skilled care that may be provided in the person’s home, an adult day care center, a nursing home, or an assisted living facility WHO PAYS FOR LTC? LTC PARTNERSHIP • Public-private partnership between state agencies and private insurance providers to provide high-quality insurance options and encourage purchase of LTC insurance • Encourages individual planning for LTC vs. reliance on Medicaid • Goal is to reduce Medicaid expenditures by delaying or eliminating need to rely on Medicaid for LTC services • Consumer protections and benefits – Dollar-for-dollar asset protection at Medicaid eligibility and Estate Recovery – Inflation protection – Suitability – Reciprocity – Tax qualified LTC PARTNERSHIP IN TEXAS • Originally piloted in 4 states • Federal Deficit Reduction Act of 2005 (DRA) authorized all states to establish partnership programs • Senate Bill 22 (80th Legislature, 2007) requires HHSC, TDI and DADS to coordinate efforts to implement a Partnership in Texas – Consistent with requirements in DRA – Training requirements – Adopt rules as necessary – Implement awareness and education campaign KEY FEATURES • Asset /Resource Protection – (Dollar-for-dollar model) – At initial determination of Medicaid eligibility, asset / resources protected up to the amount of benefits paid. – At the time of Medicaid Estate Recovery (MERP), asset / resources protected from MERP up to the amount of benefits paid. • Tax Eligible – – Some or all of premiums tax-deductible. KEY FEATURES (cont.) • Inflation Protection – Up to 5% compounded annually. • Reciprocity – Medicaid asset/resource protection recognized between reciprocity states. • Suitability – Ensuring appropriateness of product for the individual. TARGET POPULATION • Texans aged 45 to 65 -- currently almost 3 million Texans • Individuals of moderate income • Individuals who might otherwise rely on Medicaid to meet LTC needs • Individuals who have assets and want to protect against ‘impoverishment’ before becoming Medicaideligible QUALIFYING FOR MEDICAID • Eligibility – Financial • A person who is 65 years or older, or a person who has a disability, may receive Medicaid if he or she meets income and resource (asset) limits set by the program – Functional • Long Term Care services target individuals whose health problems may cause them to be functionally limited in performing activities of daily living, require skilled nursing care, or be at risk of nursing facility placement • Individuals must have a medical need for services as documented by a physician PROGRAM UPDATE • Medicaid State Plan Amendment submitted and approved • Medicaid eligibility rules published in Texas Register April 18, 2008 • Training for AAA Benefits Counselors, Medicaid Eligibility staff, and Insurance Agents • Awarded Center for Health Care Strategies technical assistance grant and accepted into RWJ Foundation Strategic Communications Program • Established State Office with HHSC, Medicaid/CHIP Division • TDI Rules Adopted – Policies Certified • LTC awareness/education campaign and website www.ownyourfuturetexas.org TEXAS DEPARTMENT of INSURANCE Lynda Hermes TEXAS DEPARTMENT of INSURANCE Requirements to Sell Partnership Policies in Texas –Certify policies sold comply with Partnership program LHL570(LTC) –Certify anyone who sells partnership policies has completed training LHL571(LTC)/LHL572(LTC) –Offer existing policyholders who were issued a LTC policy on or after February 8, 2006, an option to exchange TEXAS DEPARTMENT of INSURANCE Requirements to Market Partnership Policies in Texas –File all advertising materials 60 days prior to use –Deliverables at time of Application: Personal Worksheet LHL560(LTC) Potential Rate Increase Disclosure Form LHL561(LTC) Things You Should Know Before You Buy LHL567(LTC) LTC Insurance Shopper’s Guide §3.3840 TAC TEXAS DEPARTMENT of INSURANCE Specific Advertising Disclosures –Available Inflation Protection Options Ability to amend IP provision based on age bracket –Association Compensation Disclosures Process used to select policy and insurer –Contingent Nonforfeiture Benefits for Limited Pay Policies TEXAS DEPARTMENT of INSURANCE Reporting Requirements –Policy Replacement or Lapse LHL562(LTC) –Rescissions in Texas and nationwide LHL562(LTC) –Claims Denied for each class LHL564(LTC) –No. of non-partnership polices sold LHL565(LTC) –Suitability data LHL566(LTC) –Certification of association compliance LHL573(LTC) –Annual rate filings §1651.053(c) TIC TEXAS DEPARTMENT of INSURANCE Partnership Status Disclosure Notice –Explains the benefits of the partnership program –Helpful in notifying family members or others who may be administering the estate –Estate recovery exemptions available –Existing policy is exchanged –Form LHL569(LTC) AN INSURER VIEW Gail Holubinka MedAmerica Insurance Company DRA PARTNERSHIPS RISKS AND OPPORTUNITIES RISK and OPPORTUNITY PLUS + • Increase in sales • State sponsorship • Public awareness MINUS – • De-standardization • Multiple states – multiple demands • Insurer/agent liability RISK and OPPORTUNITY CHALLENGES RISK and OPPORTUNITY COMMUNICATION = + HUH? RISK and OPPORTUNITY EDUCATION The State The Insurer The Agent The Consumer RISK and OPPORTUNITY LIABILITY The State The Insurer ? The Agent The Consumer