T The Growing Strategic Importance of End-of-Life Product Management

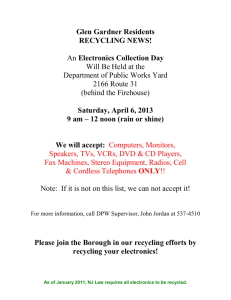

advertisement