Document 10607681

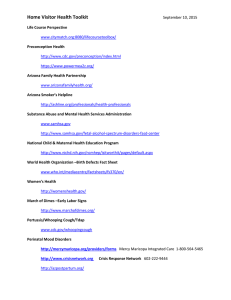

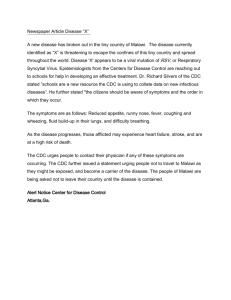

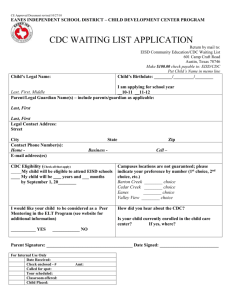

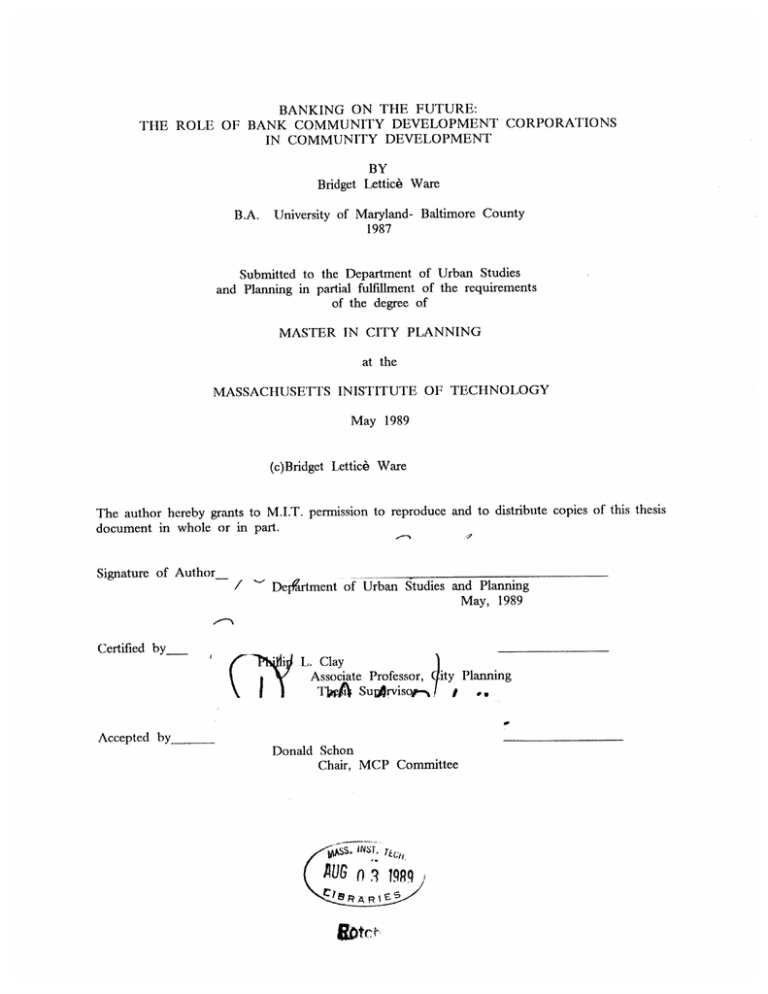

advertisement