DYNAMIC PRICING & CUSTOMER BEHAVIOR Ahmad Faruqui, Ph. D. Fourth Annual Electricity Conference

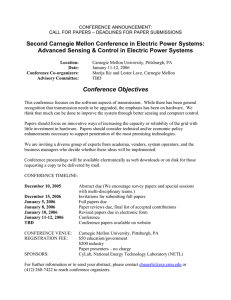

advertisement

DYNAMIC PRICING & CUSTOMER BEHAVIOR Copyright © 2009 The Brattle Group, Inc. Ahmad Faruqui, Ph. D. Fourth Annual Electricity Conference Carnegie Mellon University March 9, 2010 Antitrust/Competition Commercial Damages Environmental Litigation and Regulation Forensic Economics Intellectual Property International Arbitration International Trade Product Liability Regulatory Finance and Accounting Risk Management Securities Tax Utility Regulatory Policy and Ratemaking Valuation Electric Power Financial Institutions Natural Gas Petroleum Pharmaceuticals, Medical Devices, and Biotechnology Telecommunications and Media Transportation The potential impact of dynamic pricing The FERC projects that 20% of US peak demand could be offset by demand response programs if dynamic pricing programs are universally deployed to all electric customers in the United States This will require the universal deployment of smart meters; at this time, five percent of the meters are smart, up from one percent just two years ago; in the next five years, about 50 million of the 145 million meters are expected to become smart And it will require a major change in the way Americans think about their electric service Carnegie Mellon University 2 The FERC Assessment 1,000 BAU 1.7% AAGR 950 No DR (NERC) 1.7% AAGR 38 GW, 4% of GW 900 82 GW, 9% of 850 138 GW, 14% of 800 188 GW, 20% of 750 700 650 2009 Expanded BAU 1.3% AAGR 2011 Carnegie Mellon University Achievable Participation 0.6% AAGR 2013 Full Participation 0.0% AAGR 2015 2017 3 2019 The Top 10 states Achievable Potential Peak Reduction from Pricing with Tech: Top 10 States 18% Pricing Participants With Enabling Technology 16% Pricing Participants Without Enabling Technology Peak Reduction 14% 12% 10% 8% 6% 4% 2% 0% AZ NV Carnegie Mellon University GA FL NC 4 MD TN ID SC TX What do we know about customer behavior? Over the past decade, several pilots have been carried out within the US, Canada, the European Union and Australia These pilots have featured 70 tests of dynamic pricing some of which can be called experiments, others can be called quasi experiments and the remainders are simply technology demonstrations While there is much variation in the quality of results from the 70 tests, they have yielded valuable insights about customer response to dynamic pricing Carnegie Mellon University 5 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 % Reduction in Peak Load A bird’s eye view of the 70 tests 60% 50% 40% 30% 20% 10% 0% Pricing Pilot Carnegie Mellon University 6 The picture improves if results are sorted by pilot 60% Colorado Ontario, New Canada Jersey Connecticut Maryland Calif. DC Calif. Miss. OP GP Others ADRS % Reduction in Peak Load 50% 40% 30% 20% 10% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 0% Notes: (1) OP refers to Olympic Peninsula Pilot. (2) GP refers to Gulf Power Pilot. (3) Others include Anaheim, ESPP, Australia, GPU, Idaho and PSE pilots. Carnegie Mellon University 7 Pricing Pilot It also improves if the results are sorted by rate 60% Time-of-use (TOU) Critical peak pricing (CPP) Peak time rebate (PTR) RTP % Reduction in Peak Load 50% 40% 30% 20% 10% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 0% Rate Design Tested Carnegie Mellon University 8 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 % Reduction in Peak Load And it improves further with technology 60% TOU TOU w/ Tech Carnegie Mellon University PTR PTR w/ Tech CPP Pricing Pilot 9 CPP w/ Tech RTP w/ Tech RTP 50% 40% 30% 20% 10% 0% The newest results come from the Northeast 40% DC CT MD 35% % Reduction in Peak Load 30% 25% 20% 15% 10% 5% Pricing Pilot Carnegie Mellon University 10 27 26 25 24 23 22 21 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 0% There is much unexplained variation This can be probed further by using a common modeling framework, such as that provided by the widely-used Price Impact Simulation Model (PRISM) The architecture of PRISM revolves around two fundamental equations, one of which models changes in load shapes that are induced by rate design and one of which models changes in energy consumption that are induced by changes in rate level Carnegie Mellon University 11 The Zen of PRISMetrics Avoided Capacity Dynamic Rate Weather Data PRISM Load Shape CAC Saturation Carnegie Mellon University CustomerLevel Demand Response Customer Participation Forecast 12 System-wide Peak Reduction Avoided Energy Market Price Mitigation Additional Benefits For a given elasticity of substitution, demand response rises with the peak-to-off peak price ratio Peak Reduction with Different CPP Peak/Off Peak Price Ratios 30% Residential Small General Service Medium General Service Peak Reduction 25% 20% 15% 10% 5% 0% 0 1 2 3 4 5 6 7 8 9 10 Peak/Off Peak Price Ratio Carnegie Mellon University 13 11 12 13 14 15 Demand response varies with elasticity Peak Reduction with Different Elasticities (Residential Customers on CPP Rate) 30% Peak Reduction 25% 20% 15% Elasticity = -0.13 10% Elasticity = -0.122 Elasticity = -0.104 Elasticity = -0.097 5% Elasticity = -0.091 Elasticity = -0.073 0% 0 1 2 3 4 5 6 7 8 9 Peak/Off Peak Price Ratio Carnegie Mellon University 14 10 11 12 13 14 15 What we know quite well Customers respond to price by lowering usage during expensive periods Customer response rises with prices but at a diminishing rate Customer response gets a boost with enabling technologies Customer response gets a boost with hotter temperatures Customer response persists across two or three days that are called in sequence Customer response persists across two or three days Customer response is generally higher for customers who have college education, higher than average incomes and live in single family homes Carnegie Mellon University 15 What we know imperfectly Customers respond equally to peak time rebates and critical peak pricing in some tests and unequally in other tests Customers respond to informational feedback about energy usage, prices and utility bills but by how much they respond remains uncertain and whether this response would persist over time is also uncertain The variation in response across various technologies such as web portals, in-home displays and energy orbs is uncertain Carnegie Mellon University 16 What we don’t know Customer preferences for dynamic pricing over standard, flat rate pricing are poorly understood Most of the evidence comes from focus groups, attitudinal surveys and pilots In focus groups, customers who are first introduced to the notion of dynamic pricing articulate concerns about price volatility and higher bills After they have participated in a pilot, most customers are satisfied or very satisfied with dynamic pricing rates Attitudinal surveys of non-participants indicate that between 10-20 percent of customers would participate in well-designed and well-marketed opt-in dynamic pricing programs They also indicate that between 65-80 percent of customers would stay enrolled in dynamic pricing programs that are offered on an opt-out basis Carnegie Mellon University 17 Do we need more pilots? Yes, because customer needs differ across regions and because they also change over time But the next generation of pilots needs to focus on different issues than the previous generation We also need some large-scale deployments to validate the experimental results Carnegie Mellon University 18 Legend for the newest results (slide 10) Index of Pilots and Rates 1 2 3 4 5 6 7 8 9 10 11 12 13 14 CL&P, TOU CL&P, TOU-w/ technology CL&P, TOU CL&P, TOU-w/ technology CL&P, PTR CL&P, CPP CL&P, PTR CL&P, PTR-w/ technology CL&P, CPP-w/ technology CL&P, CPP CL&P, PTR-w/ technology CL&P, CPP-w/ technology Pepco DC, RTP-w/ technology Pepco DC, PTR-w/ technology Carnegie Mellon University 15 16 17 18 19 20 21 22 23 24 25 26 27 19 Pepco DC, RTP Pepco DC, PTR Pepco DC, CPP Pepco DC, CPP-w/ technology BGE, PTR BGE, CPP BGE, PTR BGE, PTR BGE, PTR-w/ technology BGE, PTR-w/ technology BGE, PTR-w/ technology BGE, CPP-w/ technology BGE, PTR-w/ technology Sources of experimental results Pilot Programs and Sources I State/ Province Experiment Utility Sources California Anaheim Critical Peak Pricing Experiment Anaheim Public Utilities (APU) Wolak, Frank A. (2006). “Residential Customer Response to Real-Time Pricing: The Anaheim Critical-Peak Pricing Experiment.” Available from http://www.stanford.edu/~wolak. California California Automated Demand Response System Pilot (ADRS) Pacific Gas & Electric (PG&E), Southern Rocky Mountain Institute (2006). “Automated Demand Response System Pilot: Final California Edison (SCE) and San Diego Gas Report.” Snowmass, Colorado. March. & Electric (SDG&E) California Charles River Associates (2005). “Impact Evaluation of the California Statewide Pacific Gas & Electric (PG&E), Southern California Statewide Pricing Pilot California Edison (SCE) and San Diego Gas Pricing Pilot.” March 16. The report can be downloaded from: (SPP) http://www.calmac.org/publications/2005-03-24_SPP_FINAL_REP.pdf. & Electric (SDG&E) Colorado Xcel Experimental Residential Price Response Pilot Program Connecticut Connecticut Light & Power Plan-it Connecticut Light & Power Company Wise Energy Pilot program (CL&P) The Brattle Group (2009). "CL&P’s Plan-it Wise Program Summer 2009 Impact Evaluation". Prepared for Connecticut Light & Power (CL&P). November. DC Smart Meter Pilot Project, Inc. (SMPPI) eMeter Strategic Consulting (2009). "PowerCentsDC™ Program: Interim Report." Energy Insights Inc. (2008a). “Xcel Energy TOU Pilot Final Impact Report.” March. Carnegie Mellon University Xcel Energy Energy Insights Inc. (2008b). “Experimental Residential Price Response Pilot Program March 2008 Update to the 2007 Final Report.” March. Pepco 20 Sources II Pilot Programs and Sources II State/ Province Florida Experiment The Gulf Power Select Program Utility Sources Borenstein, Severin, Michael Jaske, and Arthur Rosenfeld (2002). “Dynamic Pricing, Advanced Metering and Demand Response in Electricity Markets.” Center for the Study of Electricity Markets, Paper CSEMWP 105, October 31. Gulf Power Levy, Roger, Ralph Abbott and Stephen Hadden (2002). New Principles for Demand Response Planning. EPRI EP-P6035/C3047, March. Giraud, Denise. 2004. “The tempo tariff,” Efflocon Workshop, June 10. http://www.efflocom.com/pdf/EDF.pdf. France Electricite de France (EDF) Tempo Program Giraud, Denise and Christophe Aubin. 1994. “A New Real-Time Tariff for Residential Customers,” in Proceedings: 1994 Innovative Electricity Pricing Conference, EPRI TR-103629, February. Electricite de France (EDF) Aubin, Christophe, Denis Fougere, Emmanuel Husson and Marc Ivaldi (1995). “Real-Time Pricing of Electricity for Residential Customers: Econometric Analysis of an Experiment,” Journal of Applied Econometrics, 10, S171-191. Idaho Power Company. 2006. “Analysis of the Residential Time-of-Day and Energy Watch Pilot Programs: Final Report.” December. Idaho Idaho Residential Pilot Program Illinois The Community Energy Cooperative's Energy-Smart Pricing Plan (ESPP) Commonwealth Edison Baltimore Gas & Electric Company's Smart Energy Pricing Pilot Baltimore Gas & Electric Company Maryland Missouri Idaho Power Company Summit Blue Consulting, LLC. (2006). “Evaluation of the 2005 Energy-Smart Pricing Plan-Final Report.” Boulder, Colorado. August. Summit Blue Consulting, LLC. (2007). “Evaluation of the 2006 Energy-Smart Pricing Plan-Final Report.” Boulder, Colorado. RLW Analytics (2004). “AmerenUE Residential TOU Pilot Study Load Research Analysis: First Look Results.” February. AmerenUE Residential TOU Pilot AmerenUE Study Carnegie Mellon University The Brattle Group (2009). "BGE's Smart Energy Pricing Pilot Summer 2008 Impact Evaluation". Prepared for Baltimore Gas & Electric Company. April. Voytas, Rick (2006). “AmerenUE Critical Peak Pricing Pilot.” presented at U.S. Demand Response Research Center Conference, Berkeley, California, June. 21 Sources III Pilot Programs and Sources III State/ Province Experiment Utility Sources New Jersey GPU Pilot GPU Braithwait, S. D. (2000). “Residential TOU Price Response in the Presence of Interactive Communication Equipment.” In Faruqui and Eakin (2000). New Jersey Public Service Electric and Gas (PSE&G) Residential Pilot Program Public Service Electric and Gas Company (PSE&G) PSE&G and Summit Blue Consulting (2007). “Final Report for the Mypower Pricing Segments Evaluation.” Newark, New Jersey. December. New South Wales (Australia) Energy Australia’s Network Tariff Energy Australia Reform Colebourn H. (2006). “Network Price Reform.” presented at BCSE Energy Infrastructure& Sustainability Conference. December. Ontario (Canada) Ontario Energy Board Smart Price Hydro Ottawa Pilot Ontario Energy Board. 2007. “Ontario Energy Board Smart Price Pilot Final Report.” Toronto, Ontario, July. Washington Puget Sound Energy (PSE)’s TOU Puget Sound Energy Program Faruqui, Ahmad and Stephen S. George. 2003. “Demise of PSE’s TOU Program Imparts Lessons.” Electric Light & Power Vol. 81.01:14-15. Washington and Oregon Olympic Peninsula Project Carnegie Mellon University Bonneville Power Administration, Clallam County PUD, The City of Port Angeles, Portland General Electric, and PacifiCorp 22 Pacific Northwest National Laboratory. 2007. “Pacific Northwest GridWise Testbed Demonstration Projects Part 1: Olympic Peninsula Project.” Richland, Washington. October. Reading list Faruqui, Ahmad, Ryan Hledik and Sanem Sergici, “Rethinking pricing: the changing architecture of demand response,” The Public Utilities Fortnightly, January 2010. Faruqui, Ahmad, Ryan Hledik, and Sanem Sergici, “Piloting the smart grid,” The Electricity Journal, August/September, 2009. Faruqui, Ahmad and Sanem Sergici, “Household response to dynamic pricing of electricity–a survey of the experimental evidence,” January 10, 2009. http://www.hks.harvard.edu/hepg/ FERC, “A National Assessment of Demand Response Potential,” June 2009, http://www.ferc.gov/legal/staff-reports/06-09-demandresponse.pdf . Carnegie Mellon University 23 Biography Ahmad Faruqui led FERC’s state-by-state assessment of the potential for demand response, co-authored EPRI’s national assessment of the potential for energy efficiency and co-authored EEI’s report on quantifying the benefits of dynamic pricing. He has assessed the benefits of dynamic pricing for the New York Independent System Operator, worked on fostering economic demand response for the Midwest ISO and ISO New England, reviewed demand forecasts for the PJM Interconnection and assisted the California Energy Commission in developing load management standards. He has performed cost-benefit analysis of demand response options for utilities in nearly dozen states and testified before several state commissions and legislative bodies. He has designed and evaluated some of the nation’s best known pilot programs and his early experimental work is cited in Bonbright’s canon. The author, co-author or editor of four books and more than a hundred articles and papers, he holds a doctoral degree in economics from the University of California at Davis. Carnegie Mellon University 24