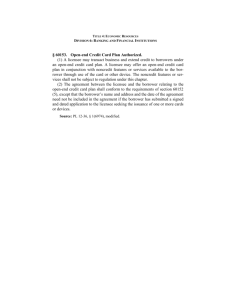

BELIZE BANKS AND FINANCIAL INSTITUTIONS ACT CHAPTER 263 REVISED EDITION 2000

advertisement