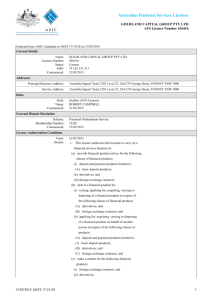

BELIZE INTERNATIONAL BANKING ACT CHAPTER 267 REVISED EDITION 2003

advertisement