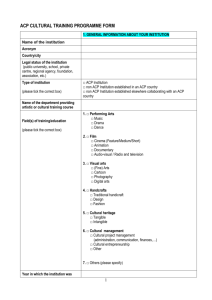

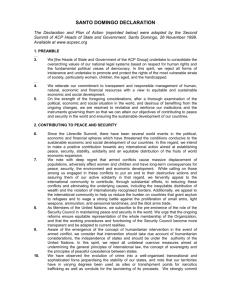

A EU-ACP E P

advertisement