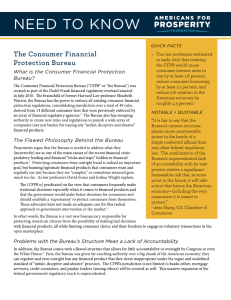

THE CONSUMER FINANCIAL PROTECTION BUREAU: FINANCIAL REGULATION FOR THE TWENTY-FIRST CENTURY*

advertisement