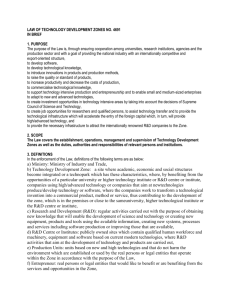

Liberalization, Knowledge, and Technology:

advertisement