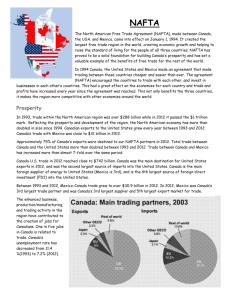

How Has NAFTA Affected the Mexican Economy? Review and Evidence WP/04/59

advertisement