commanding_heights_3..

advertisement

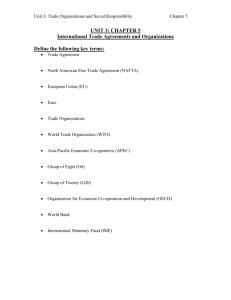

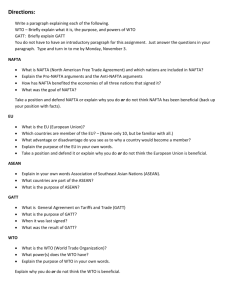

Econ 474/574: International Economics Worksheet for Commanding Heights Part 3 Spring 2010 Note: Suggested answers on page 4 and 5. Introduction 1. According to then President G.W. Bush, what terms foreign countries would likely to use to describe the United States? 2. According to the narrator, in which decade we saw the creation of a new kind of economy? What kind of new economy? 3. At the time, what two events prompted people to rethink of the new global economy and the new rules of the game? 4. Sitting in the limo, how did the author Daniel Yergin of the book Commanding Heights, describe globalization? 5. What was the economic environment in the U.S. in the early 1990s, circa 1992? 6. What happened in Europe around the same time? 7. Japan “looked invincible”… what did Japan do that showed its economic power? 8. What did then candidate Bill Clinton promise American workers? 9. But how was then candidate Bill Clinton in sync with the Wall Street? 10. How much debt did the U.S. have in the early 1990s? NAFTA 11. What does the term NAFTA stand for? Under which president the NAFTA idea was initiated? 12. According to Thea Lee (AFL-CIO), why did the labor not like NAFTA? 13. Which countries are involved in NAFTA? 14. What was the attitude of the Mexican government towards NAFTA? 1 International Finance 15. Besides commodities, what can be traded globally? 16. According to Mark Mobius, why was the U.S. interested in investing in the emerging market? 17. What are the barriers of trade? 18. What happened in Mexico in 1994, politically and economically? 19. According to then president Bill Clinton, why was the U.S. bailout money a good thing? 20. But why was the U.S. bailout money also a bad thing? Asia 21. In the video, where was the call center located? 22. Besides trade and capital flow, what policy did the U.S. government take that changed the global economy? Hints: Silicon Valley in California 23. What did Singapore represent in the video? 24. In the 1990’s, Japan had the second largest economy in the world, but what happened next? 25. According to one of Japanese politicians, what should be blamed for Japan’s problem? 26. The so-called Asian financial crisis… from which country it started? 27. What was blamed for Thailand’s problem? 28. What does IMF stands for? What was the recommendation of IMF to the Asian countries during the crisis? 29. What was blamed for the contagion of the financial crisis in Asia? 30. Which American hedge fund got into trouble? 31. Who bailouted LTCM? 2 WTO 32. What does WTO stand for? What does it do? 33. What did Lawrence Summer mean by invisible beneficiary and visible losers in global trade? 34. According to the narrator, what type of countries are anti-anti-globalization? 35. How did American politics affect the WTO meeting in Seattle? 36. Economist de Soto thought free markets worked in the U.S., but not in countries like Peru, why? 3 Suggested Answers These answers are very concise. Please be sure to be more wordy and articulate if you are answering questions in tests. 1. “Trading partner”, “friends”… 2. The 1990s, “a single market everyone has a stake but no one is in control.” 3. The collapse of the Soviet Union and the first Gulf War. (Do you recall why there was a war in the Persian Gulf and the Arabian Peninsula?) 4. An economy with increasing flow of commodities (trade), capital, people (immigration) and culture. 5. There was a recession and the U.S. industries were facing more intensive foreign competition. 6. Europe was creating a single trading block, which is now the European Union. 7. Japan was buying U.S. companies. 8. Protection of domestic industries and jobs. 9. Both agreed with reducing government budget deficits and supporting free trade. 10. 4 trillions. 11. North America Free Trade Agreement. G.H. Bush (the 41st president, the father of G.W. Bush) 12. It weakened the unions and their collective bargaining power. 13. The U.S., Canada and Mexico. 14. Very supportive. 15. Financial assets, e.g. stocks and currencies. 16. Because emerging markets grow faster. 17. Tariff, quotas, embargo, etc. 18. Uprising of rebels in the poor south, the assassination of a leading presidential candidate; foreign capital flowing out of Mexico, resulting in the depreciation of the currency peso. Mexico was forced to default foreign debt. 19. Goodwill. 20. Private banks will take more risk in the future because they now believe that the U.S. government will take care of their problems if things go wrong. 21. India 22. A more open immigration policy 23. Asia’s miracle. 24. There was an economic bubble, which burst. The economy ran into a long recession and the country accumulated debt. 25. Inability to change and fit into the new global economy. 26. Thailand 27. The financial market was open to foreign investor too fast, too soon. 28. International Monetary Funds. It recommended countries to cut government spending, raise interest rate and end corruption. 29. The West not bailing out Thailand in the first place. 30. Long Term Capital Management (LTCM) 31. Private banks in Wall Street, not the government. 32. World Trade Organization. It set rules for WTO members regarding international trade. 4 33. Laid-off workers are visible, but millions of consumers who benefit from cheaper products are not. He was commenting on the politics of trade rather than the economics. 34. Developing countries tend to support globalization. 35. Bill Clinton wanted votes for Al Gore for the 2000 election, and asked the U.S. representative to support maintaining some trade barriers, so as to appease labor unions. 36. Many countries lack the institutional framework, such as robust rule of law and protection of property rights. 5