W T O ORLD

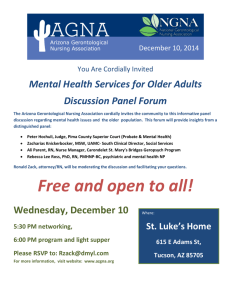

advertisement