Document 10571164

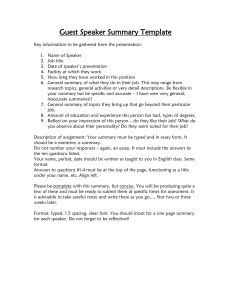

advertisement