Document 10570889

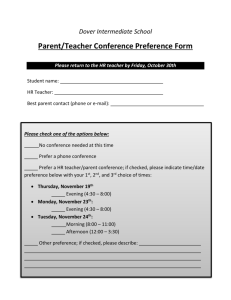

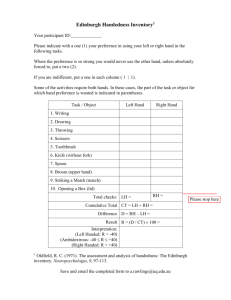

advertisement