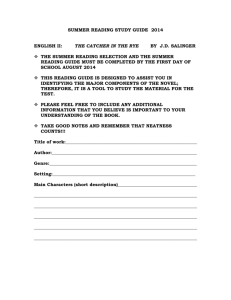

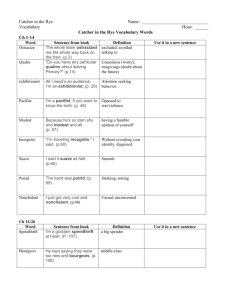

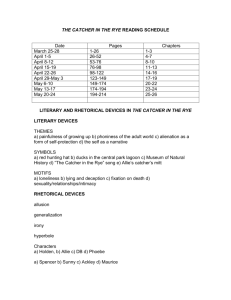

(1960)

advertisement