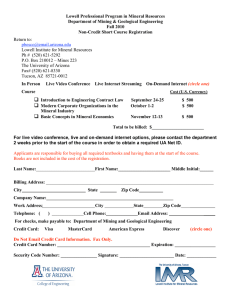

J. DAVID LOWELL PROFESSIONAL PROGRAM IN MINERAL RESOURCES

advertisement

J. DAVID LOWELL PROFESSIONAL PROGRAM IN MINERAL RESOURCES MNE 697C Mineral Economics: Concepts and Applications Fall Semester 2010 Instructor: David R. Hammond, PhD, Adjunct Professor Principal Mineral Economist Hammond International Group Credit: 1 credit, 100% Grade: A, B, C, D, E Catalog Description: This course provides students with an overview of the field of mineral economics and introduces key economic theories and methodologies as adapted to mineral commodity analysis. Students are also acquainted with the functional parameters/definitions and operational considerations associated with several of the principal mineral resource categories such as precious and base metals, iron ore and mineral fuels. Course Objectives: Obtain a fundamental understanding of the mineral economic theory, nomenclature, and analytical tools/techniques for use in the evaluation/management of mineral resource extraction projects and operations, from exploration through product supply/consumption; gain basic knowledge about the production and marketing structure and industry practices for several specific mineral commodity sectors. Topics: Course Introduction – Just What is “Mineral Economics” Anyway? Basic Mineral Economics Concepts • Microeconomic Fundamentals • Resource Scarcity: • Hotelling Theory & Ricardian Rents • Measures of Scarcity - Reserves & Resources • Resource Growth • Short/Mid/Long Term Commodity Price Drivers • Resource Demand - Intensity of Use - Elasticity - Commodity/Supply Substitution Mineral Resources & National Economies • Importance to GDP • Drivers of Economic Development • Environmental Issues • Sustainability/Resource Exhaustion - The “Resource Curse” • Role of Government: Property Rights/Environment Regulation/Trades Issues/Taxation • Supply Risk Considerations Mineral Industry Organization • Forms of Competition • Cartels/Combines/Commodity Agreements/Mergers and Acquisitions • Impacts of Externalities • Industry Supply Chains • Industry Economic Returns: Expectations & Realities 1 Cost Estimating • Issues in Mining Cost Estimation • Frameworks for Cost Analysis and Reporting • Costs and Reserves • By/Co/Joint Primary Products • Impact of Currency Exchange Rates Mineral Commodity Analysis • Commodity Cycles • Real & Nominal Dollar Prices • Cost Curves • Demand/Supply Forecasting - Short and Long Runs - Role of Scrap and Recycle - Forecasting Methodologies - Forecasting Accuracy Mineral Commodity Markets • Market Structures & Exchanges • Price Formation, Discovery and Behaviors • Contract Terms & Industry Practice • Measuring Price Volatility • Product Transportation & Storage Managing Commodity Risk • Risk Mitigation: Country/Commodity/Currency/Technology • Measuring Volatility • Hedging Strategies & Mechanics: - Forward Sales - Futures & Options - Other Derivatives Grading: Final Exam Class contribution Paper * Total 60% 15% 25% *Students will submit a concise 4-page paper (exclusive of tables, figures, graphs, and references) on a mineral economics topic which will be assigned by the instructor. The paper will be due approximately weeks after the course lectures. Recommended Textbooks and References: Suggested references for course and future use: Primary Reference Textbook: Australian Mineral Economics Monograph 24 – A Survey of Important Issues (2006), Philip Maxwell and Pietro Guj (Ed.), published by The Australian Institute of Mining and Metallurgy (AusIMM), Carlton, Victoria, Australia. A CD of this publication can be purchased from AusIMM; website: www.ausimm.com.au/Shop/Default.aspx Other Reference Texts and Papers: 2 Cavender, Bruce. (1998) Mineral Production Costs, Analysis and Management, SME Shortcourse Presentation, Denver, Colorado, June 5-6. Hammond, David R. (1999), Reserve Changes at Producing U.S. Gold Mines, 1965-1996, Ph.D. Dissertation, Colorado School of Mines, Golden, Colorado. Noabes, M. and T. Lanz (Eds.) 1993, Cost Estimation Handbook for the Australian Mining Industry, Monograph #20, The Australasian Institute of Mining and Metallurgy (AusIMM), Sydney, New South Wales, Australia.. Valmin (1994), Mineral Valuation Methodologies, The Australasian Institute of Mining and Metallurgy (AusIMM) and the Mineral Industry Consultants Association, Sydney, New South Wales, Australia. Vallée, Marcel, with Michel David, Michel Dagbert, Clément Desrochers (2002), Guide to the Evaluation of Gold Deposits, Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Special Volume 45, Montreal, White, John H. (1996), Valuation of Undeveloped Gold Deposits, Ph.D. Dissertation, Colorado School of Mines, Golden, Colorado. Mineral Information Data Sources: American Coal Council: www.americancoalcouncil.org Chicago Mercantile Exchange (includes New York Mercantile Exchange): www.cmegroup.com Energy Information Agency (US Department of Energy): www.eia.doe.gov Goldsheet Mining Directory: www.goldsheetlinks InfoMine: www.infomine.com International Copper Study Group: www.icsg.org International Energy Agency: www.iea.org International Lead & Zinc Study Group: www.ilzsg.org International Iron & Steel Institute: www.worldsteel.org Kitco: www.kitco.com Kogel, Jessica E., Nikhil C. Trivedi, James M. Barker, Stanley T. Krukowsk (Editors) th (2006), Industrial Minerals and Rocks: Commodities, Markets, and Uses, 7 edition, SME, Littleton, Colorado. London Metal Exchange: www.lme.co.uk Metal Bulletin: www.metalbulletin.com Natural Resources Canada: www.nrcan.gc.ca Nickel Institute: www.nickelinstitute.org 3 Organization for Economic Cooperation & Development (OCED): www.oecd.org/home US Department of Labor-Bureau of Labor statistics: www.bls.gov USGS (1991), Metal Prices in the United States Through 1998, USGCO. USGS, Mineral Commodity Summaries (Annual) The World Bank: www.worldbank.org World Coal Institute: www.wci-coal.com World Nuclear Association: www.world-nuclear.org Recommended Prerequisites: Familiarity with microeconomics/macroeconomics, industrial organization and engineering economics DRH: 08/10/10 4