AND Critical Issues in the Management of

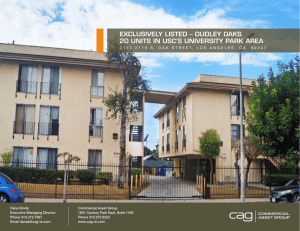

advertisement