by (1980) and Submitted to the Department of Urban ...

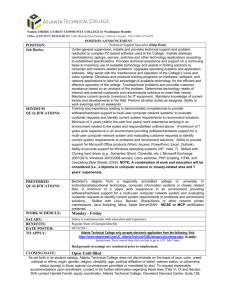

advertisement