GUAYANA DEVELOPMENT VENEZUELAN Diversification or Vertical Integration. J.

advertisement

THE ROLE OF THE GUAYANA DEVELOPMENT CORPORATION

IN VENEZUELAN INDUSTRIALIZATION:

Diversification or Vertical Integration.

by

Antonio J. Azpurua C.

Bachelor in Architecture

Simon Bolivar University, Caracas Venezuela, 1980.

Submitted to the Department of Urban Studies and Planning

in Partial Fulfillment of the Requirements

of the Degree of

MASTER OF CITY PLANNING

at the

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

May 1987

Antonio Azpurua 1987

The author hereby grants to MIT permission to reproduce and to

distribute copies of this thesis document in whole or in part.

Signature of Author

Department of Uban studies and Planning.

May 8, 1987.

Certified by

Lauren Benton.

Professor, Urban Studies and Planning.

Thesis Advisor.

Accepted by

e

VPhilip

L. Cl y.

Associate Professor, Urban Studies and Plann rIg.

Director, Master's Prog am.

MEASSACHUSETT-JS INS'MtyrE

OF TECHNOLOGY

JUN 0R 1987

LIBRA

i:O_

S

THE ROLE OF THE GUAYANA DEVELOPMENT CORPORATION

IN VENEZUELAN INDUSTRIALIZATION

Diversification or Vertical Integration

by

Antonio J. Azpurua C.

Submitted to the department of Urban Planning

on May 8th, 1987 in partial fulfillment of the requirements for

the Degree of Master of City Planning

ABSTRACT:

examines the Venezuelan Industrialization

thesis

This

that la Corporacion

the role

Process from 1936-1986 and

played in this process. The study

(CVG)

Venezolana de Guayana

weight the relative position of the main players in this process:

the government, the state-owned enterprises, and the private

sector, in order to understand how these players interact, and

help one to recognize the growing importance of the public

sector.

The current economic crisis is seen as a consequence of the

industrial strategy of import substitution followed by the

Government since 1961, and the emphasis on resource based

industrialization since 1973. CVG and its industrial program for

Ciudad Guayana was found to have played a major role in both

periods.

The thesis describes the political and institutional aspects

of the industrial development coordinated by the state and base

in Guayana since 1973. It explores the idea that the current

industrial strategy is based on previous investments but does not

satisfy the expectations of the private sector.

The thesis concludes that the role of the CVG has to be seen

Social Democratic

of the

in close relation to the role

abandon the

never

will

Democracy

Social

governments. The

the idea,

formulated

leaders

its

because

Guayana,

of

development

for its

responsible

feel

always

will

and

program,

launched the

industrial

the

by

expressed

are

goals

party's

The

progress.

strategy used to overcome the current economic recession, while

attempting to retain an public image of successful development.

The idea of the state as an engine of growth will not be

sustained by the current strategy followed by CVG if it does not

prove to be the best pathway towards progress and the production

of capital goods.

THE ROLE OF THE GUAYANA DEVELOPMENT CORPORATION

IN VENEZUELAN INDUSTRIALIZATION:

Diversification or Vertical Integration.

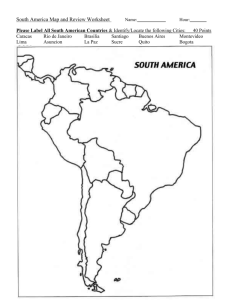

TABLE OF CONTENTS

ACKNOWLEDGEMENTS

1) INTRODUCTION

2) INDUSTRIALIZATION IN VENEZUELA

2.1) 1936-1958 period: Towards Democracy.

2.1.1) 1936-1945:

Post General Juan Vicente Gomez dictatorship

2.1.2) 1945-1958:

Struggle for power and dictatorship.

2.2) 1958-1973 period: Democratic era I.

Rise and decline of the political pact.

2.2.1) The political pact

2.2.2) The democracy and the economic plans

2.2.3)

The

role

of

"La

Corporacion

Venezolana

Fomento"

2.2.4) The industrial state and role of "La

Corporacion Venezolana de Guayana"

2.3) 1973-1983 period: Democratic era II.

Political economy of petrodollars.

2.4) 1983-1987 period: Democratic era III.

Crisis and devaluation.

de

3) THE OUTCOME OF THE INDUSTRIALIZATION PROCESS

4) CORPORACION VENEZOLANA DE GUAYANA

4.1) Introduction

4.1.1) Objectives

4.1.2) Goals

4.1.3) Industrial development

4.2) Organizational evolution.

4.3) New leadership - Leopoldo Sucre Figarella ( 1983-

? )

4.4) Recent economic objectives.

4.5) Division

of Industrial

and Mining Promotion ("Gerencia

de promocion Industrial y Minero").

4.5.1) Import substitution committee-CVG

and

promotion of new industries.

4.5.2) Identification of new investment

opportunities, promotion of new

industries and the

implementation strategy.

5) CONCLUSIONS

6) BIBLIOGRAPHY

Annex 1:

List of interviews done in Ciudad Guayana, Caracas and

Cambridge.

Annex 2: List of abbreviations.

ii

ACKNOWLEDGEMENTS:

This thesis has been

help

of

many

people.

completed

I

would

with

like

the

to

encouragement and

thank

all those who

contributed, in one way or another, to its realization.

My advisor,

addition to

Dr. Lauren

Benton, deserves

special thanks. In

her useful comments on earlier drafts of the thesis,

she helped to place many ideas in this

perspectives. Dr.

Institute

for

questions

that

Richard Auty,

International

led

me

to

project in

their correct

visiting scholar at the Harvard

Development,

revise

assumptions. Carlos Sosa Franco,

or

raised

fundamental

strengthen

my original

with whom

I discussed

many of

the ideas contained in this thesis also deserves special mention.

I must thank the Corporacion Venezolana de Guayana, for giving me

their support and help during my visit to their offices in Ciudad

Guayana and Caracas,

special

thanks

Delgado and Rafael Pena Alvarez.

Mariscal de Ayacucho",

go

to

Maria

Engracia de

I am grateful to "Fundacion Gran

for providing me with financial assistance

for the duration of my graduate studies.

I also

wish to thank Shubhada Bhave, Adela Illarramendi and

Susie Macksey, who revised previous drafts

and helped

me to put

the thesis together; Roberto Smith, for his friendship and advice

on some of the topics covered in this thesis; Alberto Cantor, for

his friendship,

for convincing

me to

iii

come to

United States of

America to study, and for his moral support

during the difficult

first period of my stay here.

I wish

to express my appreciation to many others. My friends

and classmates among them,

Marisela

Montoliou,

Shubhada Bhave,

Anthony K.C. IP, Hideo Obitsu, Jeff Hyman, C.Y. Nunez Ollero; the

Professors at the faculty of Urban Studies and Planning for their

support during

the time

of my studies, particulary Alan Strout,

Lloyd Rodwin, Al van Huyck,

adviser; and

the members

and

Ralph

Gakenheimer

my academic

of the Department of Urban Studies and

Planning administrative staff, among

them,

Rolph

Engler, Carol

Escrich, Mary Grenham, Kathy Rynn, and Jeanne Winbush.

Finally I

am especially

patience, understanding and

making this

thesis possible.

who supported and encouraged

grateful to my wife Vivian, for her

support

I am

me and

difficulties that I encountered.

iv

which

were

invaluable for

also grateful to my parents,

helped me

to overcome many

I) INTRODUCTION:

The

purpose

of

this

thesis

is to explain the current and

future role of the State's Guayana

Development Corporation (CVG)

in the industrialization of Venezuela. In order to understand the

CVG's

mission

it

is

necessary

to

examine

recent

recognize the main players in the process, identify

strengths and weaknesses

special

the Guayana

attention

to

industrialization process and

into

the

strong

links

the players'

and understand how they interact.

We will concentrate on

paying

history,

the

Development Corporation,

political

trying

between

to

the

dimension of this

provide

Social

some insights

Democratic Party,

"Accion Democratica", the democratic development of Venezuela and

the Guayana

Development Corporation. We will see how the success

of Venezuela's democratic process

the Venezuelan

and of

government sufficient

spur a regional development program

beyond

the

dimensions

encountered

scope

of

in

of

the

any

projects

their

for 1980.

If it

is to

industry gave

wealth and power enough to

in

Guayana

conservative

launched

implementation

from becoming a major export center,

the oil

which

economic

and

the

went far

measure. The

difficulties

have prevented the region

as was

initially projected

become such an export center in the near

future, it will be at a very high cost to the nation.

Today, when

financial

resources

have

become

scarce

as a

result of the decline in oil prices, Venezuelan industrialization

has to accomplish two simultaneous

stage of

tasks:

advance

into

a next

import substitution and achieve vertical integration of

the oversized Guayana complex.

Even

with

diminished

economic

capabilities, the state seeks to promote the reinforcement of the

state-owned enterprises,

sector, which

particularly

supported the

in

Guayana.

state in its industrial strategy of

import substitution, seems skeptical at this

state's

goals,

new

CVG

strategy.

must

In

order

convince

opportunities exist

The private

the

to

point regarding the

accomplish its industrial

private

sector

that

real

in the development of Guayana. This would be

proved by showing profits from installed plants, prioritizing and

facilitating future

projects, and

providing business guarantees

in order to reduce risks for private investors.

From the private sector's point

required investments

is still

of

so great

view,

control and

the state. In the midst

prevalent

since

the

project

has

yet

to

projects,

where it

where it is not completely dependent on

of

the

1970's,

place all investments in

magnitude of

that it tends to prefer

diversifying its investments in alternative

has greater

the

one

achieve

worldwide

there

economic uncertainty

is a natural reluctance to

concentrated

sector.

The Guayana

the profitable results that would

encourage the private sector to participate in the process. Also,

CVG is

in many

ways limited by political factors that influence

the decision-making process in such a way that guarantees made to

private

investors

remain

insufficient,

due

to

the uncertain

nature of that political process.

The

Guayana

industrial

program

is

also

tied

to

labor

movements, and

flexibility must be considered not only in market

terms but also

in

terms

of

the

labor

force.

The industrial

specialization mentioned before must also be seen in terms of its

political risks. My research

labor movements

in Guayana

recognized

the

importance

of the

but expressly excluded this variable

as beyond the scope of the thesis.

The

occurred

interest

in

1958

of

this

when

thesis

an

import

is

to

point

out

that, as

substitution program gained

impetus, strong new alliances must be formed in

order to advance

in a new era of capital goods production and vertical integration

of the

state-owned industrial

complex with

the private sector.

This will lead to the completion of the great export center which

Guayana was meant to be.

2) INDUSTRIALIZATION IN VENEZUELA:

What we expect to discover in this first

is the historical interrelation between

parties

and

the

principal party

private

in the

sector.

part of

the thesis

the state, the political

Accion

Democratica,

Venezuelan democracy,

the

sought to achieve

its political program through the simultaneous promotion of

social reforms (mainly a

the labor

land tenure

reform), through inspiring

movement, and also through fostering an environment in

which the industrial sector could achieve

time,

based

on

nationalistic

progress. At

principles,

the

the same

state has been

progressively developing its natural resources.

As it became stronger through the

success of

the democratic

process, the state took further steps, nationalizing gas, oil and

iron ore mines. When oil prices increased dramatically,

beneficiary was

the state and its administrators, who channelled

an important portion of these new

project,

the

its main

development

of

revenues to

their most prized

the Guayana region. The return on

this investment was meant to be more than simple profit: it would

be

a

signal

of

democratic system,

the

state's

to provide

ability, within the context of a

a stable

and prosperous economic

future for Venezuela. Thus, Guayana is the crucible of Venezuelan

democracy, a symbol and image of

the democratic

experiment. Its

progress is integral to the progress of democracy in Venezuela.

Venezuelan

industrialization

parallels

the

history of the

Venezuelan democratic process. The Guayana industrial

a

manifesto

resources,

of

the

decision

to

manage

program is

Venezuela's

natural

and the promise of a diversified economy.

2.1) Towards Democracy: 1936 - 1958.

2.1.1) Post J.V.Gomez-dictatorship: 1936 - 1945.

The period from 1936 to 1945 was characterized

by an average

Per Capita Annual Growth of 7 per cent and an average annual Real

Gross Domestic Product growth

moderate

rate

of

growth

of

was

more

than

3

per

cent. This

principally based on the dynamic

expansion of petroleum investments, production and exports.

After sluggish industrial growth Venezuela experienced in the

late 19th

century, Venezuelan industrialization process gained a

renewed impetus in the second half of the 1920's and in the early

1930's.

Researchers agree

that an

internal market was forming

during the period previous to 1936, due to the impact produced by

the development

of the

oil industry.

This period also showed a

reduced contribution of agriculture, and its

social consequences

(such as the growing migration from rural to urban areas).

After the

death of

the Dictator

Juan Vicente Gomez, during

the presidency of General Lopez Contreras

started

to

develop

explicit

(1936-1941), the State

policies on industrialization. In

1937

the

State

(Venezuelan

founded

Industrial

the

Banco

Bank),

Industrial

attached

to

de

the

Venezuela

Ministry

of

Development, which was geared to providing capital for industrial

activity

within

the

country.

During

this

period,

important sector was the commercial one, which was

of contacts

with foreign

most

the initiator

capital and closely related to banking

interests. At roughly the

sector was

the

same

time

(1936-45),

the industrial

slowly growing in size and economic power. It further

increased its volume and

World War

II certainly

production

capacity

after

1940, when

spurred the expansion of industry in the

country.

Sonntag

and

de

la

constant

growth

of

Venezuela's

previous

to

formulating an

1936

Cruz

provided

(1985)

internal

the

Industrial Plan

have

market

objective

that the

in the years

basis

to

start

for Economic Development. Such a

plan would make lucrative certain economic

then had

suggested

been only crudely developed.

activities that until

Authors Sonntag and de la

Cruz further suggest that the state seems to

have understood the

expectations of the growing industrial sector, and in consequence

President Medina Angarita

direction was

put into

at its disposal 60

Bs/$ at

that time)

created

a

Production

Council, whose

the hands of the private sector and had

million

Bolivars

for industrial

(Venezuelan

currency 3.30

and agricultural investment.

This was one of the first verifiable measures of direct financing

of industrialization

by the State. Sonntag and de la Cruz (1985)

also point out that

power

but

still

especially the

Venezuela's industrial

experienced

commercial

sector increased its

resistance

sector.

It

from

would

other

be

areas,

several years

before the industrial sector would become dominant.

The industrial

during

this

sector must be seen as a growing force which,

period,

was

becoming

more

clearly

defined

and

starting to make specific demands of the government.

2.1.2) The period 1945 -

During this

1958:

period we will observe how the industrial sector

was battling with the commercial sector to achieve

growing

importance

was

vital

in

the

attempt

hegemony. Its

to establish a

democratic government, with the common goal of fulfilling the job

requirements.

At

the

end

of

this

period we will observe how

political leaders as well as the industrial sector came together,

collaborating in the effort to launch Venezuela into a new era of

democratic government.

The struggle for hegemony:

1945 -

The Government of Medina

18,

1945,

and

replaced

1952.

Angarita was

by

a

military-civilian

President Romulo Betancourt.

During

middle-income

by

Democratica"

Bentancourt),

sectors,

(the

led

Social

foresaw

a

overthrown on October

this

military

Democratic

junta led by

political

officers

Party

founded

event, the

and "Accion

by Romulo

"political reappraisal of the National

Plan of the dominant class," which led towards "making industrial

development

its

goal,

even

when industrial activities did not

appear to be the most dynamic" (CENDES,

Researchers agree that

1945 was

Accion

mainly spurred

Democratica

perhaps Romulo

the

first

by the

(AD).

The

democratic

experiment of

middle classes and conducted by

leaders

of

that

movement, and

Betancourt more than any other, understood that a

re-arrangement to stabilize the

representative

1981).

democracy

government

requi red

a

and

move

redefinition

towards a

of economic

planning. The private sector was still at that time controlled by

the commercial

sector, and they remained indifferent, skeptical,

even

throughout

reticent

participated in

three-year

the conspiracy

1948 military coup and a

rise to

the

power composed

new

period,

that culminated

d ictatorship,

and finally

in the November

when

a triumvirate

by M. Perez Jimenez, C. Delgado Chalbaud

and Llovera Paez.

During these

process

of

three years

of the

democratic experiment, the

went

beyond the initial phase of

industrialization

implementation. This process was

of

rural-to-urban

experienced was

migration

primarily in

the same

type of

later by

the development

growth which

reinforced by

that

began

the acceleration

in

the production

1936.

The growth

of consumer goods,

would be recommended a few years

and industrialization

policies of the

Economic Council of Latin America (ECLA). Clearly this was a type

of

import

substitution

understanding of

industrialization.

For

a

better

the government's actions during this period, we

must review Betancourt's ideas.

Romulo

Betancourt,

leader

industrialization

and

satisfy

demand.

domestic

process would

AD,

of

agricultural

recognized

reform

Understanding

were

that

both

that

necessary

the

to

industrial

be a dependant to foreign capital with the implied

flight of national capital

and

the

national

for

him the most important issue was

contciousness,

obstacles

to

that industrialization would provide jobs. Also,

revenues

would

accelerate

the

relation to other developing

recognized the

he believed,

industrialization

countries.

Even

process

oil

in

though Betancourt

importance of the industrial process in progress,

this recognition was not enough to

mentioned before,

maintain AD

in power.

As we

the strong commercial sector ultimately joined

with the young military forces to conspire against

a partnership

developing a

whose strength

was impossible

democracy, in

for Betancourt and

Gallegos to overcome.

The

military

most

important

government

measure

was

the

taken

during

founding

of

the

the

civilianVenezuelan

Development Corporation (Corporacion Venezolana de Fomento - CVF)

in 1946.

Regardless of

important state entity

purpose

was

to

the political

financing

implement

regime, CVF

industrialization.

was the most

CVF's main

the industrial strategy conceived in

Betancourt's economic plans,

resources

from

the

providing

central

a

channel

government

to

of financial

the Industry. Such

economic plans envisaged four steps for industrial development:

First,

the

promotion

(principally energy)

of

and

basic

consumer

industries

goods

(import

substitution).

Second, the development of industries complementary

to the aforementioned.

Third, the developmnet of semi-heavy industry.

Fourth,

the

production

of

machinery

and

heavy

industry.

Of

the

149

Venezolana

allocated

de

million

Fomento

towards

represented

3.8

bolivars

(CVF)

in

financing

percent

of

handled

this

by

the Corporacion

period, 89 million were

industrial

projects.

the

National

Gross

This amount

Income, 2.26

percent of which was for promotion of industrialization. However,

CVF

was

not

the

only

entity

industrialization, others were

the

in

"Banco

charge

of

financing

Industrial"

and the

Ministry of Development itself.

The

financing

measures

protective tariff

and tax

this

State

period

the

described

above

relief policies.

began

to

were

flanked

by

In addition, during

participate more directly in

industrialization by investing in various enterprises, a tendency

that was to continue throughout the years of the dictatorship and

10

intensify

with

the

advent

of

representative

democracy after

January 23, 1958.

The skepticism

and distrust of the private sector towards in

AD's economic plan contributed to shaping the events

of the next

several years. In November 1948 a coup d'etat preempted the model

of representative democracy built in 1945. Although with

regime

the

state

became

the new

more rigid, the ensuing authoritarian

government kept in motion the economic development plan

that had

been forming since the beginning of the 40's.

We

have

to

emphasize

again

between the dominant classes

and

land

ownership,

that

the existing antagonism

traditionally

with

an

related

insurgent

to commerce

class

promoting

industrialization. Because the state's acceptance of new national

objectives, proposed

by those

who were at the time committed to

the industrialization process, would signify a shift in resources

to

those

activities.

State

and industrialists encountered the

resistance of the other sectors: commerce and agriculture

proposed

industrial

plan.

precisely here: An attempted

leaders

of

stability

Accion

for

the

industrialization to

The

struggle

Democratica

government

(AD),

the

those who

offering

benefits

of

years

was

the civilian

as a factor of

the incipient

were able to undertake the task,

trying

plans,

sectors

traditional

those

rapprochement between

and the new industrialists

with

of

to the

11

to

develop

(commerce

their industrial

and

agriculture)

resisting change. The message was transmitted

the receptivity

was not

because other reforms

reform

and

Betancourt

seems that

enough to maintain AD in power, perhaps

such

various

but it

as

types

"oil

nationalization",

agrarian

of social reform announced by Romulo

compromised

the

possible

gains

of

the

industrialization process.

Although

the

Venezuelan

state became much more politically

rigid during the dictatorship

followed the

of Colonel

M. Perez

Jimenez that

AD government, it should not be assumed that it was

incapable of modernizing itself. In fact, the State progressed in

its

institutional

structure,

simultaneously

allowing

the

industrialization process to advance. It is mistaken in this case

to

equate

dictatorship

with

government had been rejected,

economic

but

the

stagnation:

wisdom

of

the

AD

its economic

goals remained clear.

The industrial plan in action: 1952 - 1958

The

several

Perez

Jimenez

Regional

industrialization.

manufacturing

increased from

the same

administration undertook the creation of

Development

As

sector

a

to

the

Banks

result,

Gross

the

to

promote

contribution

Industrial

Product

private

of

the

(GIP)

58.7 per cent in 1950 to 60.3 percent in 1957. At

time there

was a decrease of

from 38.1 percent to a 34.5 percent.

the construction sector

During

this

six-year

manufacturing

surpassed

industrialists

were

in

cumulated

investments

gaining

more

The

more power, particulary

and

intensive, increasingly dependent on

had a

commerce.

in

groups were investing

The industrialization process was capital

industry.

machinery, and

investments

in

international interest

since at this time

heavily

period

the

relatively high

import

of

inputs and

degree of oligopolization

and monopolization.

At the end of these six-years the State initiated a

State

such

capitalism;

a

plan

reserved

development of Venezuela's natural

resources,

iron,

steel,

for

the

plan for

State

the

resources, especially mineral

petrochemicals

and the hydro-electric

power from the Caroni river in the Guayana region.

2.2) The period 1958 - 1973:

Rise and

decline of

the political

pact.

This

period

extends

government in January 1958

oil shock)

in 1973.

from

the installation of a democratic

until the

rise of

oil prices (first

The new government led by Romulo Betancourt

promoted the use of the Import Substitution and Tariff Protection

policies

in

the

national

their capabilities at

the

industries. These policies exhausted

end

of

this

period,

but

then the

government had at its disposal large financial resources steaming

from the first oil boom that

postponed

date.

13

the

crisis

to

a later

This

saw

period

two

AD

consecutive

governments and a final COPEI (Christian

The

two

first

COPEI

the

power thanks

arrived to

democratic)

democratic) government.

suffered from political instability

governments

that ended during

(Social

this

government;

to divisions

last government

within AD just before the

1968 elections.

The political pact.

On January 23, 1958, the dictatorship of Marcos Perez Jimenez

was

defeated

and

replaced

promised to establish

private sector,

a

a civilian-military junta which

by

representative

guided by

democratic

and all the party

the industrialists

leaders, came together to launch a second democratic

main

party

AD

was

secure

industrial class. The

in

process

the

approval

culminated,

regime. The

regime; the

of the insurgent

towards

the

end of

1957, in a meeting in New York, where capitalists and politicians

established a pact. Petroleum-based

and international industrial

capital quickly sealed the alliance.

Three

summarize

documents

sectors:

(1)

Principles

and

The

"Punto

Minimum

the

Fijo"

Program

pact

Pact,

of

between the different

(2)

The

Government"

"Statement of

and

Constitution of 1961.

In the 'Minimum Program of Government' all

parties agreed on a model of development which

gave the State the responsibility for economic

planning, development of infrastructure, the

pursuit of full employment, public housing for

the

poor,

and continuing improvements in

14

(3)

the

health, education and social security. The

for

the

call

not

did

constitution

nationalization of the oil companies or other

developers of Venezuelan natural resources; it

called instead for a limitation on further

concessions and for greater participation in

income. In addition it promised protection of

domestic industry against foreign competition,

and the support of domestic industry through a

development corporation.(Scott, 1986)

Democracy and the Economic Plans:

The

young

democracy

international

would

The

corporations.

for retaining

established called

which

be

diversification

a decline in oil investments by

faced

achieved

and

development

to

be

the historical rate of growth,

through

through

plan

industrial

substantial

development

and

new exports (Ganz and

Blanco, 1969).

In addition, there was

employment

opportunities,

percent of the Gross

cent of

an

urgent

since

need

for

petroleum

National Product

new productive

accounted

but supported

for

25

only 2 per

the nation's employment. Venezuela was thus experiencing

the paradox of

high

unemployment

in

the

midst

of

a booming

economy.

The Plans

of 1963-1966

and 1965-1968

set ambitious targets

for economic growth, with fundamental changes in the structure of

production

and

employment

(Sonntag

and

de

Production of goods and services were to rise

la

at an

Cruz,

1985).

annual rate

of 7 per cent. Industrialization was to provide the main elements

15

for growth in

and net

to

production,

productive

employment opportunities,

savings for investment. Public investments were expected

continue

to

support

two

fifths

of

the

total industrial

development.

There

investment

were

to

be

policy:

(Corporacion

two

The

Venezolana

main beneficiaries of this national

Venezuelan

de

Fomento,

Development Corporation (Corporacion

CVG). The

former (CVF),

was to

policy of import- substitution

development of

new a

Development

or

CVF)

Venezolana

be responsible

and

the

industrial center

latter

Corporation

and the Guayana

de

Guayana, or

for following a

(CVG),

for the

to produce enriched and

pre-reduced iron ore, metals, chemicals, and metal fabrications.

The subsidies promised

(1957)

to

the

private

sector came

through the Corporacion Venezolana de Fomento. As was noticed, in

discussion of the previous period (1945-58),

charge

of

implementing

the

industrial

financial resources for new enterprises and

that implied a high

The Industrial

this office

strategy,

was in

providing

coordinating tariffs

level of protection to industry.

State and

the role of the Corporacion Venezolana

de Guayana (CVG).

Romulo Bentancourt had achieved

launching

the

new

democratic

the necessary

regime;

measured the possible consequences

of

however,

the

consensus for

this

time he

aggressive petroleum

the past. It is probable that the Government that he

policies of

one he had

envisioned required a "leit motif" different from the

postulated

a

oil

be provided by

motif" would

necessary "leit

exploitation. This

of

control

the

was

which

before,

decade

the development of the natural resources of the Guayana region as

a national enterprise.

The Guayana project was conceived as an integral

Plan, created to help achieve national goals

Venezuelan National

through the development of

construction

of

part of the

a

city

industry and

in

power, and

through the

what was virtually an empty space.

(Ganz and Blanco, 1969: 69).

The economic plans of the

industries

would

make

earnings by 1980. An

expected to

1965

1960's

one-fourth

important

come from

already

up

early

of

portion

of

predicted

that new

Venezuela's exchange

these

earnings was

the Guayana region. This region, which in

accounted

for

7.5

per

cent

of

Venezuela's

manufacturing production,

was counted on to provide one fifth of

Venezuelan

output

manufacturing

and

almost

a

fourth

of

an

expanded level of exports by 1980.

To accomplish such targets, the National Plans ("Planes de la

Nacion")

of the early 60's called for 10 per cent of the nation's

investments, public

and private,

to be

devoted to the Guayana-

region program in the period 1963-1966. The Guayana

share of the

national investment was substantially greater than 10 per cent in

certain priority areas: 14 per cent

and petroleum,

21 per

of the

investment in mining

cent in manufacturing, and 34 per cent in

electric power.

The main objective of

the basis

of the

the Guayana

national economy.

project was

This new

to transform

economy was to be

based on heavy industry and power.

In the context of the resources available in

the Guayana region, and taking the specific

needs of and targets for the Venezuelan economy

set down in the national plan, the planners

designed a heavy industry complex with specific

targets and programs for the production of

steel,

enriched

iron

ore,

sponge iron,

aluminum, chemicals, pulp and paper, metal

fabrications, and electric power. The short

term (1965-1968) and the long term (to 1980)

regional development program was formulated

around this heavy industry complex. From the

beginning the major considerations in project

selection included (1) modern technology that

was related to Guayana's unique resources, (2)

domestic and export demand, (3) economic scale

to achieve competitive output and pricing, (4)

integration

and

complementation

with the

Venezuelan economy as a whole, and (5) linkages, external economies, and transportation factors.(Ganz and Blanco, 1969: 66).

The Guayana industrialization plan

of

iron

ore

to

primary targets.

aluminum

and

established the upgrading

enriched

iron

ore, sponge iron, and steel as

Following

this

would

pulp.

These

latter

coordinated with the development

be

areas,

of

the

development of

however,

electric

power

had

to be

and forest

reserves respectively. Production of ammonia could take advantage

of the availability of

nearby natural

gas. Later

on, the metal

fabricating

industry

could

be

linked

to

iron

and

steel

development.

As we

have noted,

Democratica;

during

the Guayana-CVG

was a

Betancourt's government,

project of Accion

AD started Guayana

City, initiated the steel factory and constructed the bridge over

the Orinoco

river. When the COPEI party came into power in 1968,

their leaders put a freeze on the development project.

Basically,

they reduced the budget of CVG, while at the same time increasing

the budget for all the public enterprises controlled by CVG, such

as EDELCA,

the company in charge of the Caroni river development

(see table 2.1). COPEI created a new platform for the development

of the

Guayana region

from the

Ministry of Public Works (MOP).

This new program was called "La conquista del

of

the

South).

Industrial Plan

The

COPEI

into an

government

Sur"

thus

(the Conquest

converted

infrastructure program

an

AD

for the Guayana

region.

In the

last five years of the period, between 1958-1973, and

during the COPEI government of 1968-1973,

the import substitution

policies originated in 1961 finally exhausted their capabilities.

This

was

evidenced

manufacturing

by

industry.

experienced the first

a

decrease

At

the

in

annual

growth

in

same time, in 1972, oil prices

major increase.

(see GNP table 2.2).

2.3) The period 1973 - 1983: Political Economy of Petrodollars.

TABLE 2.1

:

COPPORACION VENEZOLANA DE GUAYANA

M

BUGET 1965 -

1976

( IN MILLION BOLIVAPS )

% OF TOTAL

NATIONAL

INVESTMENT

INSTITUT

CVG

EDELCA

-----------------------------------------------------------------70.0

86.9

NA

1965

70.0

62.5

NA

1966

90.0

124.9

1,306.0

1967

30.0

124.3

1,:388.7

1960

45.4

122.9

1,494.1

1969

5.0

128.7

1,306.5

1970

33.0

74.0

1,819.2

1971

30.5

70.0

1,494.8

1972

50.0

58.0

1,517.5

1973

INVESTMENT

SIDOR Subtotal FROM THE

INV INSTITUT

103.1

169.5

90.0

90.0

25.0

NA

34.0

40.0

40.0

260.0

:302.0

294.9

234.3

193.3

133.7

141.0

140.5

148.0

NA

19-00%

16.00%

13.00%

10.00%

9.00%

9.00%

10.00%

19.00%

997.2

598.8

130.5

267.9

5,122.0

1974

28.00%

840.0 1,175.1

24.6

310.5

4,248.1

1975

11.00%

400.0

NA

NA

400.0

1976 (Ley) 3,489.7

-------------------------------------------------------------Total

1,777.9

601.9

1,970.3

4,350.1

16.00%(b)

4,787.1

23,186.6 (b)

------------------------------------------------------------Including : "modificacion a la ley de presupuesto".

(a)

Including 1967-1976 period

(b)

SOURCES: Ministerio de Hacienda, Direccion Nacional de Presupuesto.

en: Izaguirre, Maritza. "Cuidad Guayana y la estrategia

de desarrollo polarizado". Ed SIAP-Planteos

Table 36. Pg 90.

TABLE 2.2 : GROSS DOEsTIC PRODUCT AT MARKET PRICES BY SECTOR 1970-1983

Cbillions of bs st 1968 prices) (1).

1983

1982

1981

1980

1979

1978

1977

1976

1975

1974

1973

1972

1971

1970

~-----------------~--------------- ---------~-----------------------------------------------------------------------------------------------------72.5

76.1

75.6

75.8

7?.4

76.4

74.8

70.1

64.4

60.7

57.3

53.9

52.1

50.7

TOTAL GOP

-4.738

0.66R

-0.26%

-2.07%

1.31%

2.14Z

6.70%

8.85%

6.10%

5.93%

6.312

3.45%

2.762

------------------------------------------------------------------------------------------------- ---------------------------- ---------5.9

6.1

6.6

6.8

7.4

6.9

7

7.2

7.1

9.1

10.3

9.7

10.6

11.2

Petroleuw

-3.28%

-7.582

-2.94%

-8.11%

7.25%

-1.43%

-2.78%

1.41%

-21.982

6.193 -11.652

-8.492

-5.362

---------------------------------------------------------------------------------------------------- ------------------- --------------70

66.6

69

69

70

69.5

67.8

62.9

57.3

51.6

47

44.2

41.5

39.5

Nonpetroleuw

-4.86%

1.45%

0.00%

-1.432

0.72X

2.512

7.79X

9.77%

11.052

9.792

6.33%

6.51%

5.06%

-------------------------------------------------------------------------------------------------------------------------------------------PRIMRRY SECTOR

Agriculture

Crude petroleuw

Mining

SECONDRRY SECTOR

Manufacturing

Petroleum refining

Electricity and mater

Construction

TERCIRRY SECTOR

Comerce

Tranport and cow

Financial inst

Governwnet

Other services

Subtotal

Less imputed

9.8

10.1

10.6

10.9

11.2

10.5

10.5

10.5

10.8

12.2

12.7

12

12.9

-2.97Z

-4.72%

-2.75Z

-2.682

6.67R

0.002

0.00%

-2.78%

5.83% -3.94% -11.48X

-6.98

-2.27%

4.9

4.8

4.7

4.8

4.7

4.5

4.4

4.1

4.2

4

3.7

3.5

3.6

3.5

2.08

2.13%

-2.08%

2.132

4.44%

2.27%

7.32%

5.00% -2.38%

8.11%

5.71F

-2.78%

2.86%

4.5

4.8

5.3

5.5

5.9

5.4

5.5

5.7

5.8

7.3

8.3

7.9

8.7

9.1

-6.252

-9.432

-3.64%

9.26% -6.782

-1.82%

-3.51%

-1.72%

5.062 -12.05% -20.55%

-9.20%

-4.402

0.4

0.5

0.6

0.6

0.6

0.6

0.6

0.7

0.8

0.9

0.7

0.6

0.6

0.6

0.00% -16.67% -20.002

0.00%

0.00%

0.002

-12.50% -14.29

16.67% 28.57% -11.11

0.00%

0.00%

-------------------------------------------------------------------------------------------------------------------------------------------20

20.4

20.1

20.3

20.8

20.7

19.5

17.9

15.8

14.5

13.9

12.8

11.6

11.1

-1.962

1.492

-0.99%

-2.40%

0.482

6.15%

8.94%

13.292

8.972

4.32;

8.592

10.34Z

4.50%

12.3

12

12.5

12.3

11.9

11.4

10.8

10.4

9.3

8.3

7.6

7.2

6.6

6.2

-1.60%

4.172

3.36% -2.44%

4.392

5.56d

3.85a

11.832

12.05%

9.21P

5.562

9.092

6.452

1.4

1.3

1.3

1.4

1.5

1.5

1.5

1.5

1.3

1.8

2

1.8

1.9

2

7.69%

0.00%

-7.14a

0.00% -6.67

0.002

0.00%

15.38%

11.112 -10.00% -27.78Z

-5.26Z

-5.002

2.7

2.5

2.3

2

1.9

1.7

1.7

1.6

1.5

1.3

1

1.1

0.9

0.9

8.00%

8.70%

15.002

5.262

11.76%

0.00%

6.25%

6.67%

15.382

18.18%

10.00%

11.11Z

0.00%

3.6

4.1

4.5

4.6

5.5

6.1

5.5

4.4

3.7

3.1

3.2

2.8

2.2

2

-8.89% -12.202

-2.17%

-9.84% -16.362

10.91%

25.002

18.922

19.352

-3.13N

14.292

27.27%

10.00%

-----------------------------------------------------------------------------------------------------------------------------------48

46.1

48.3

46.9

48.3

48.3

47.4

43.6

39.3

34.7

31.1

29.4

27.3

25.7

-3.96R

-0.62%

2.992

-2.90%

0.00%

1.902

8.72%

10.942

13.26Z

11.58%

5.78%

7.692

6.23Z

6.8

6.9

6.7

6.9

8.2

8.7

8.7

8.3

7.4

6.4

5.9

5.7

5.5

5.4

-1.45%

2.99%

-2.90%

-5.?5% -15.859

0.002

4.82%

12.16v

15.63X

8.47P

3.51%

3.642

1.85%

8.8

10.5

10.2

9.8

9.9

10.4

9.6

8.7

7.7

7

6.3

6.1

5.5

5.2

2.942 -16.192

4.082

-1.012

-4.81%

8.332

10.34M

12.992

10.00%

11.11%

3.28%

10.91M

5.77%

15

14.6

15.1

14

14.5

14.3

14.2

13.1

11.7

9

10

8.3

7.7

7.2

2.742

-3.312

7.862

-3.45%

2.112

-0.702

9.16a

11.972

17.00%

8.43% 11.11%

7.792

6.942

10.4

10.6

10.6

10.5

10.1

9.4

9.3

8.6

7.9

7.2

6.2

6

5.5

5.1

-1.89%

0.002

0.952

3.962

7.45%

1.08%

8.142

8.862

9.72%

16.131

3.332

9.09%

7.84%

5.1

5.4

5.7

5.7

5.6

5.6

5.5

4.9

4.6

4.1

3.7

3.3

3.1

2.8

-5.562

-5.26%

0.002

1.792

0.002

1.822

12.249

6.52%

12.20%

10.81P

12.12%

6.45

10.712

13.2

50

1

bank charges

51.8

3.602

1

0.00%

54.2

4.63%

1.3

30.00%

57.7

6.46%

1.6

23.082

61.4

6.41P

2

25.00%

65.9

7.332

3.3

65.00%

72

9.26%

3.8

15.15%

77.4

7.50%

4.7

23.68M

79.5

2.712

4.8

2.132

1.?

2.1

2

1.9

1

1.5

1.1

1.3

5.00% -19.05%

5.26X

26.672

50.002

-9.09V

-13.332 -15.382

------------------------------ ------------------------------------------------------------------------ -------14,071

13,590

13,119

12,665

11,632

Population (2).

3.54%

3.59X

3.582

8.882

--------------------------------------- ---------------------------------- ------------------------------(1) Source: Scott-Venezuela 1986 adapted frow Banco Central de Venezuela

(2) Source: Minister9 of Energy and Mines.

Plus custows duties

1.5

80.3

1.01%

5.2

8.33%

78.1

-2.742

4.8

-7.692

79

1.15%

5.7

18.752

78.5

-0.63%

4.9

-14.04Z

75.9

-3.31%

4.8

-2.042

1.3

2.3

2.3

2.6

2.4

0.002 -43.482

8.33X -11.54%

41.18%

-------------- -----------------------------16,394

15,940

15,485

15,024

14,562

2.852

2.942

3.07X

3.24X

3.42%

---------------------------------------

brought into power someone with the will to

of 1973

in December

to the Presidency

of AD

The election of Carlos Andres Perez

government, thanks to

innovate, delegate and spend. The now-rich

the rising oil prices of the early 70's, purchased the iron mines

also provided

Venezuela's

concessions. It

the oil

from their foreign owners, and likewise

for a vastly expanded effort to develop

the funds

resource-based

industries

("La

Gran

Venezuela",

launched by Perez), all through state-owned corporations.

on the Venezuelan economy in

an impact

bonanza had

The oil

two waves, 1974 and 1980, which should be differentiated one from

the other.

Guayana

The first

program

investments),

(see

and

in

and the SIDOR steel

decade. The

and decisive

graph

owned bauxite

indicating

the

jump

in CVG

consequence the hydro-electrical Guri dam

plant were

aluminum smelter

to 250,000 tons. New projects

million ton

2.1

wave was channelled into the

brought forward

by more

than a

of Venalum was raised from 100,000

were

announced,

among

them

a 1

state-owned alumina plant and a 3 million ton statemine. Investments

in pulp,

diesel motors, cement

and gold were discussed. The original 1965 projection for 1980 of

transforming the Guayana complex,

substituting imports

during

those

only

into

years

become

were

a

reality.

alumina,

as

center for

well

as

The decisions

based on projected exports of 3

million tons of steel, 200,000 tons of aluminum

of

a

of key industrial products, but also into a

major export center could now

made

not

and 350,000 tons

many other products. Cement was to be

20

GRAPH 2.1

-5-197 i'

CV G 19

BUDGETS

$1 .200

$1.100

$1.900

$o.aoa

$0.700

$o.ano

$B13MI0

.40. 0

$$0.;50a

-

$0.210

~V4

*

1.2513

1.9890

4-

CvG

-9Eddan

9-now

1.872

1.97

A Sidar

I

-'

1.874

X

1.078

subintal

TOTAL INVESTMENT AND CVG

SHARE OF TOT4L-

(19.".-1976)

C/G

D.CvD

dd to-tal

1871

1

int invearmtitn

4

1G75

Tat d I n - CvX

provided for the construction of the Guri dam

light the

whole central

area of

and electricity to

the country. The main question

which arises from these projects and projections is, what has the

return

of

these

been,

investments

and

what

is their actual

contribution to exports today?

2.4) The period 1983 - 1987: Crisis and devaluation.

took place

at this

three major

due to

This period is significant

Venezuela: the first devaluation of

time in

elections in December

the Bolivar in February 1983, presidential

1983

(which

were

won

by

events which

AD), and a second devaluation of the

bolivar in December 1986, when additional

exchange controls were

introduced.

The Venezuelan

economy during this period remained stagnant,

as the GNP did not grow

announced that

year). The

after

the non-oil

crisis

of

this

1980

(in

December

1986

it was

sector grew 3.5 per cent during that

period

is

partially

explained by

reduced private investment and flight of capital, consequences of

a lack of confidence in the

economy, higher

interest in foreign

capital markets (1980-82) and the overvaluation of the Venezuelan

currency (until December 1986).

Venezuelan unemployment is now

(the Central

Bank puts

the

highest

in

forty years

the figure at 12 per cent and the unions

argue that it is around 20 per cent), and inflation

is also into

double

digits.

These

figures

are

surprising after the annual

growth experienced from the early 50's

Venezuela was

until the

seen as one of the few economic success stories in

Latin America. This state of affairs is not

of

the

involves

economic

the

recession

very

development both

responsible

mid-70's, when

it

viability

only serious because

entails,

but

of

country's

the

also

because it

scheme

of

political and economic. Venezuela's leaders are

for

having

set

over-ambitious

targets

and

miscalculated their implementation, and it is the Guayana project

which cast a shadow over these figures.

The drop in oil

prices

Venezuela's economic

earlier,

economy,

rather

than

actually

appears

to

as the

the second oil price

to

a

large

extent to

crisis, but this crisis appears to have had

its origins much

referred to

contributed

oil

have

involving

alone.

begun

most

if

not

Paradoxically,

in

1978,

all

the

during

of the

decline

the period

"oil bonanza", and to have continued despite

rise;

the

fall

of

oil

prices

has only

accelerated the process.

It is

important to

note the

the period prior to 1973, when

strong economic performance in

non-oil growth

was 6.5

per cent

per year in comparison to the period 1973-84, when it grew only 3

per cent. Examining these figures since 1978, we

have a

1.1 per

cent annual

growth. It

income grew

more than 3 per cent prior to 1973, and rose briefly

is important

22

to note

as well that real

upwards from 1973 to 1977, only to sink in 1985 to lower than the

1973 levels. Private

between 1977

sector

and 1982.

investment

went

off

75

per cent

The creation of jobs, which had averaged

about 150,000 per year in the 70's, fell

sharply in

1978 and by

1983 was negative.

The private sector, with a utilized capacity of around 60 per

cent, since the first evaluation was

to overcome

the crisis.

strategy. These

groups

demanding changes

Some private

asserted

in order

groups had proposed a new

that

if

Venezuela

wished to

regain its forward momentum, the government would have to abandon

its strategy

of import

substitution based

on the

State as the

engine of growth, in favor of a strategy which relied more on the

private sector, to achieve a more

diversified group

of exports,

notably manufactured exports. These initiatives are embodied in a

book, Proposal to the Nation (E. Quintero and

others, 1985): the

proposed initiatives were to be supported by a sharp devaluation,

as well as reduction

in protection

industry,

a

"to

open

way

for

and control

the

creation

competitive activities in manufacturing"

The recent

January 1986),

debt,

and

deterioration

the efforts

the

preferential rate

high

of

for

of new, export-

(Scott, 1986).

prices

made since

demand

of 7.50

oil

of the domestic

(especially since

1983 to

foreign

pay off foreign

currency

at

the

Bolivars per US dollar established in

1983, combined to put enough pressure on the

balance of payments

to motivate

a new

economic strategy and a second devaluation of

the Bolivar in December 1986. A

per

US

dollar

was

established

goods and services, with

remains

unchanged

new exchange

all

Bs. 14.50

for all imports and exports of

some exceptions.

for

rate of

imports

(The Bs.

7.50/$ rate

and exports of the oil and

iron-ore industries).

This new exchange rate was

order

to

reduce

its

supported

by

other

measures in

effect on national investment, mainly the

foreign investment regulations which had been relaxed in order to

promote

future

foreign

exchange

investors clear-cut

guidelines on

accorded

investments

to

their

contracts.

The new laws gave

the exchange

and

treatment to be

the remission of dividends

abroad.

At the same time, in order to stimulate domestic investments,

the

Venezuelan

Development

Fund

Venezuela")

had announced that

investment

projects

through

it

("El

Fondo de Inversiones de

would

finance certain private

shareholder participation in mixed

enterprises, and open overall lines of

and

development

agriculture,

of

specific

industry,

and

of

most

credit for

high-priority

construction

the financing

sectors

of

such

as

tourist

infrastructure.

The

effects

implementation

of

the

some

recent

measures

devaluation

which

were

and

the

announced

simultaneously

are

a

source

of current debate. Pedro Palma, a

Venezuelan economist, gave a presentation to the Mason Fellows at

Harvard

University

(Kennedy School

1987 about the short term effects

In

his

opinion,

exporters and

the

reduce

of such

devaluation

those

of

of Government) on March 14

a second devaluation.

would "generate earnings for

importers".

In

Venezuela, the

principal exporter by far is the public sector, while the private

sector is

basically a

that the

net importer.

recent measures

Palma's estimate indicates

would add approximately Bs. 35 billion

to the Central Government (principally originating

profits).

The

situation, the

from

private

private

sector

new exchange

exports

and

would

face

rate reducing

increasing

a

from exchange

more

difficult

the bolivar earnings

the

cost of imports and

foreign debt service.

In Palma's national accounts, he forecasts a positive balance

of 9,896

billion bolivars

for the

balance for the private sector of

public sector and a negative

35,295 billion

bolivars. Even

if the government is capable of returning a large portion of this

transfer

to

government

the

has

private

at

its

sector,

disposal

while

only

estimating

of Bs.

25 billion.

In order

loss of

income on

to continue stimulating

public spending in the internal economy at the levels of

previous years

sector,

the

the

9.9 billion bolivars to

invest, the private sector will undergo a net

the order

that

the two

and to compensate for the transfers to the public

Government

must

provide

some

additional

Bs. 20

billion or more. Such resources will have to come from new credit

sources in an amount equivalent to

the country's

pnlblic foreign

debt service outlays.

It

is

national

in

this

role

to

administration

of

perspective

play.

CVG,

The

Guayana

is being

investment and reactivation of

in attracting

that the Guayana project has a

foreign capital.

offered

the national

region,

as

a

under

the

channel

for

economy, especially

In chapter 3 we will observe why

these required new investments tend to keep going to Guayana, and

in chapter

4 we will see how CVG is facilitating these transfers

to the region.

3) THE OUTCOME OF THE INDUSTRIALIZATION PROCESS:

As we have seen in the preceding chapter, it has become clear

that

important

time, and new

economic

changes

are

strategies

growth.

consideration

must

These

the

taking

new

relative

government, state-owned

labor force. The study

Guayana Development

be

place in Venezuela at this

provided

strategies

positions

of

enterprises, the

of

in

the

order

must

the

to spur

take

main

into

players:

private sector and the

industries

associated

with the

Corporation can't be separated from analysis

of the role of the other players.

In this

Venezuelan

chapter I

have made

industrialization

a special

from

political point of view.

This would

economic

more

variables

are

main players

in the

economic

help us

important

Venezuelan industrialization and to

of the

an

effort to reexamine

rather

to determine which

for

weigh the

the

analysis

of

relative position

economic arena. Understanding which

are the more important economic variables will help

the relative

than a

us to define

position of the players and will allow us to make a

better assessment of this case.

We can easily recognize that

exporter since

the beginning

Venezuela

has

been

of the century (table 2.2 provides

information for 1970-83). Today, as it was 25 years ago

industrialization

process

and

a primary

when the

the Guayana project started,

the

economy is still

Venezuela been

highly

dependent

unable to

on

oil

exports.

reduce its dependence on oil revenues?

countries which

How has Venezuela performed in relation to other

were primary

Why has

exporters 25 years ago? How has Venezuela performed

in relation to other oil-exporters in the last decade?

Studying the experience

help

us

of

other

the

understand

industrialization process.

developing

deficiencies

For the

countries may

of

Venezuela's

"different

developing world,

factors seem to suggest a balanced investment in heavy as well as

light industry and a reduced share of manufactured imports in the

gross national product".

Venezuela, as

(Chenery,

we noted

industrialization

under

pg 2,

1986).

in Chapter

the

2, began

influence

of

its process of

specific

economic

theories. During the decade of the 50's Presbisch and Singer were

advocating industrialization

disadvantages

of

in

specialization

associated secular deterioration

order

in

in

to

offset

the supposed

primary production and the

the

terms

of

trade. This

ideology was based on two fundamental points: The clearly limited

world demand for

domestic demand

a

general

exports

of

primary

products

and

the rising

for manufactured goods. These realities promoted

import

substitution

strategy

among

Latin American

countries that called for a balanced growth of the industrial and

primary sectors.

Venezuela, like other Latin American countries,

import substitution

would

conflict

practiced an

policy. It can be argued that such a policy

the

with

neoclassical

concept

of comparative

advantages, which suggests that Venezuelan advantages were in the

oil industry (World Bank

industries

as

suggested

report

of

after

the

1961)

or

appraisal

region. This economic concept

of comparative

progressive appraisal

natural resource

Guayana region has

of the

been

in

tremendously

iron related

of

the Guayana

advantages and the

endowment of the

influential

among policy

makers during the entire democratic period.

Referring

again

to

economic

industrial process must

take

into

natural

resources

available,

capital

resources

in

manufactured

goods,

order

but

or

to

also

theory,

any evaluation of an

consideration

the

not

allocation

exploit

them

or

only the

of human and

to

produce

the global changes in demand and

supply as ways of guaranteeing transfers of modern technology.

In addition, trade policies

factor of

economic growth

have proved

among the

to be

more successful developing

countries. Venezuela can't escape the temptation

these successful

have

have

arisen

of referring to

countries to reexamine its industrial strategy.

What Venezuela must keep in

economies

an important

faced

from

international economy

a

mind

is

that

these trade-oriented

completely different world economy and

different

historical

those countries

29

backgrounds.

dealt with

The

in the period

1950-70 was a world

of expansive

international trade. Venezuela

today faces a radically altered world, one where restrictions and

protectionism are the order

years the

US and

of the

Spain have

day. For

example, in recent

imposed a voluntary steel quota on

Venezuela.

The argument

for

shifting

from

an

inward-oriented

to an

outward-oriented strategy has been strengthened by the success of

a small group of

by the

"newly industrialized

four East

Asian economies

economies", particularly

in this group: Hong Kong, the

Republic of Korea, Singapore, and Taiwan.

Although

these

successful

outward-oriented

policies

have

received great attention in recent years, they have been only one

of

several

Japan for

ingredients

example has

in

Venezuela

because it

development strategies.

been more

notable for

attaining a great

than

having

particularly open

increase in productivity

economy (the

successful

for

a

"microchips-war" in March 1987 is

is

different

owns this

from

these

a clear example).

successful super-exporters

natural resource

endowment which includes

oil, iron ore, cheap energy, gas and others. The general tendency

of

countries

such

endowments

and

strategies

of

as

primarydelayed

Venezuela,

exporter

which

have

large

economies,

industrialization,

where,

start, manufacturing increases rapidly in response

of domestic

demand. It

is important

is

resource

to

follow

after a late

to the growth

to notice that at the same

time Venezuela has the

resources.

The

power

timing

to

and

decide

scale

when

of

to

such

developments would be a fundamental issue in the

general development

in the hands of

develop such

resource

base

analysis of the

and industrialization of Venezuela. What was

international corporations

two decades

ago, is

today in hands of many independent producers such as Venezuela.

In addition

to natural

important factors such as

resource endowments and trade, other

the role

of the

Government and human

resources have also to be considered in evaluating the actual and

future capabilities of the Venezuelan economy.

We would expect Venezuela, like any other developing economy,

to

experience

process

of

evaluating

relative

structural

changes