Document 10546577

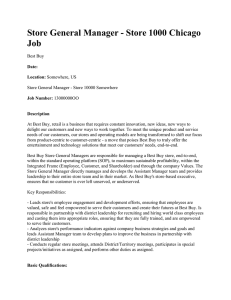

advertisement