Measurement of Interest Problem Set

advertisement

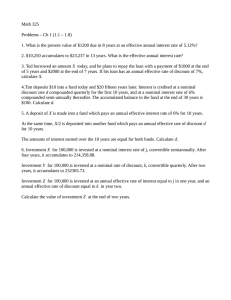

Math 420 Measurement of Interest Problem Set 1 1. Money accumulates in a fund at an effective annual interest rate of i during the first 5 years, and at an effective annual interest rate of 2i thereafter. A deposit of 1 is made into the fund at time 0. It accumulates to 3.09 at the end of 10 years and to 13.62 at the end of 20 years. What is the value of the deposit at the end of 7 years? 2. Ted invests 100 in Fund A and 100 in Fund B. Fund B earns a compound interest of j and Fund A earns a compound interest of 1.05j. Amount in Fund A is equal to the amount in Fund B at the end of 2 years. Calculate the amount in Fund B at the end of 10 years. 3. You make an investment where you pay 6,000 now and get 7,000 back in 5 years. What nominal interest convertible quarterly did you earn? 4. Ted borrows 1,000 from Rob at an annual effective rate of interest i. He agrees to pay back 1,000 at the end of 6 years and 1,366.87 after another 6 years. Three years after his first payment, Ted repays the outstanding balance. What is the amount of Ted's second payment? 5. Chris deposits 20 into a fund and 30 fifteen years later. Interest is credited at a nominal rate of discount d compounded quarterly for the first 10 years and at a nominal interest rate of 8% compounded semiannually thereafter. The accumulated balance in the fund at the end 30 years is 150. Calculate d. 6. Rob deposits 100 into an account at time 0. Ted deposits 50 into his at the same time. Each account earns an annual effective discount rate of d. The amount of interest earned in Rob's account during the 11th year is equal to the amount of interest earned in Ted's account during the 17th year, and each is equal to X. Calculate X. 7. At time 0, Tim deposits 1000 into a fund which credits interest at a nominal interest rate of 10% compounded semiannually. At the same time, he deposits P into a different fund which credits interest at a nominal discount rate of 6% compounded monthly. At time t = 20, the amounts in each fund are equal. What is the annual effective interest rate earned on the total deposits, 1000 + P, over the 20-year period. 8. At time t = 0, 1 is deposited into each of Fund X and Fund Y. Fund X accumulates at a force of interest dt= t 2 / k. Fund Y accumulates at a nominal rate of discount of 8% per annum convertible semiannually. At time t = 5, the accumulated value of Fund X equals the accumulated value of Fund Y. Determine k. 9. At a force of interest dt= 0.1 / (1 + 0.1t), 0 t 14, the following payments have the same present value: i) X at the end of 5 years plus 2X at the end of 10 years. ii) Y at the end of 14 years. Calculate Y/X. 1 Math 420 Measurement of Interest Problem Set 1 10. Matt takes out a loan over a 4-year period. The loan is charged an effective rate of discount of 6% for the 1st year, a nominal rate of discount of 5% compounded every 2 years for the second year, a nominal rate of interest of 5% compounded semiannually for the third year, and a force of interest of 5% for fourth year. Calculate the annual effective rate of interest for the 4-year period. 11. If an investment of 1 will be tripled in 175.778 years at a constant force of interest d, in how many years will an investment of 1 be doubled at a nominal rate of interest numerically equivalent to d and convertible once every four years. 12. The force of interest dt=0.02t, where t is the number of years from Jan 1, 2001. If 1 is invested on Jan 1, 2003, how much is in the fund on Jan 1, 2008? 13. A bank offers a nominal rate of 12% compounded monthly. a) What is the equivalent annual effective rate of interest? b) What is the equivalent nominal annual interest rate compounded quarterly? c) What is the equivalent nominal annual discount rate compounded semiannually? 2