NEWS ABOUT INSURANCE, RETIREMENT AND WELLNESS PROGRAMS FOR THE UNIVERSITY... CONNECTING WORK + LIFE EMPLOYEE |

advertisement

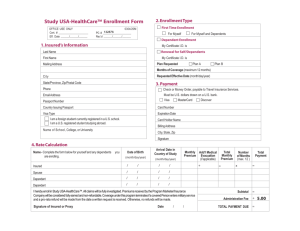

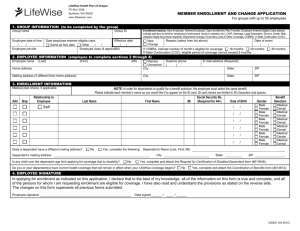

CONNECTING WORK + LIFE EMPLOYEE | July 2015 NEWS ABOUT INSURANCE, RETIREMENT AND WELLNESS PROGRAMS FOR THE UNIVERSITY OF TEXAS SYSTEM EMPLOYEE | July 2015 Special Edition Annual Enrollment & Resource Guide This A Matter of Health newsletter is a special Annual Enrollment (AE) edition providing details on the benefits enrollment process and the uniform benefits plan for UT employees and their qualified dependents. It also contains important information you may wish to refer to throughout the year. IN THIS ISSUE 3 Annual Enrollment Timeline 4 Out-of-Pocket Rates for 2015-2016 5 UT SELECT Medical Plan Changes for 2015-2016 5 Optional Coverage Highlights 20152016 6 Short and Long Term Disability 6 Annual Enrollment: Your Opportunity to Review and Change Vision Benefits 7 Annual Enrollment: Your Opportunity to Review and Change Dental Benefits 8 Living Well Program 8 Voluntary Group Term Life and AD&D Insurance IMPORTANT: AVAILABILITY OF SUMMARY HEALTH INFORMATION 9 Understanding Dependent Eligibility and Documentation Requirements 9 Other Eligibility 10 UT Retirement 10 UT FLEX Program 12 How to Change your Benefits 12 Evidence of Insurability 12 Evidence of Eligibility 13 New UT SELECT Medical ID Cards 13 Changes During the Year 14 2015-2015 UT Benefits Contacts 15 Contact Information Choosing a health coverage option is an important decision. To help you make an informed choice, your plan makes available a Summary of Benefits and Coverage (SBC), which summarizes important information about any health coverage option in a standard format, to help you compare across options. The uniform Summary of Benefits and Coverage (SBC) provision of the Affordable Care Act requires all insurers and group health plans to provide consumers with an SBC to describe key plan features in a mandated format, including limitations and exclusions. The provision also requires that consumers have access to a uniform glossary of terms commonly used in health care coverage. To review an SBC for UT SELECT PPO or Out-of-Area coverage, visit the website www. bcbstx.com/ut. You can view the glossary at www.dol.gov/ebsa/pdf/SBCUniformGlossary. pdf. To request a copy of these documents free of charge, you may call the SBC hotline at (855) 756-4448. UT Benefits for one. Health for UT System. ANNUAL ENROLLMENT TIMELINE PLEASE REVIEW THIS ENTIRE NEWSLETTER Carefully review the 2015-2016 Annual Enrollment Benefits Overview included in this newsletter for information about insurance plan premium rates, plan changes and other AE details. Review what’s changing and consider your insurance needs for the upcoming year. Then, if you don’t want to make any changes, you don’t have to do anything to continue with your current plan selections. MAKE ELECTIONS ANNUAL ENROLLMENT (AE) PERIOD JUL 15 JUL 30 AUG 15 REVIEW FOLLOW UP AE OPTIONS LETTER + AE WEBSITE EOI OR EOE, IF REQUIRED REVIEW MAKE ELECTIONS MAKE INFORMED BENEFITS CHOICES WITH RESOURCES AVAILABLE TO HELP YOU Annual Enrollment Website available by July 15, 2015 Annual Enrollment Meetings (at your institution) Insurance vendors available for planspecific questions (see Contacts at the end of this publication) IN THE NEW (PLAN) YEAR ANNUAL ENROLLMENT PERIOD July 15 – July 31, 2015 UT Benefits Enrollment Options (PIN) letter or email delivered by July 15 Lists current coverage, options for coverage for the next plan year beginning September 1, and instructions for making changes online. July 15, 2015 - July 31, 2015. During this period, you can: • Make changes to your benefits, • Add or remove dependents*, • Enroll in UT FLEX, • Change coverage options for certain plans. Outside of this time period you cannot make any changes unless you have certain life events such as birth, marriage, divorce, death, or gaining or losing other coverage that affect your or your dependents’ need for benefits. This is a good time to update other items if you’ve had changes during the year like: • Contact information, • Tobacco user status, • Beneficiary information. FOLLOW UP COMPLETE EOI OR EOE (IF REQUIRED) Deadline Saturday, August 15, 2015 Evidence of Insurability (EOI) is required to enroll in certain insurance coverage, including: Voluntary Group Term Life and Long Term Care insurance. Evidence of Eligibility (EOE) is required when you enroll your spouse or a dependent in any UT Benefits plan for the first time. *Effective July 1, 2015, same sex spouses are eligible for enrollment in the UT Group Insurance Program. Contact your benefits office for information on adding your spouse to your insurance coverage. SEPTEMBER 1, 2015 ONGOING: KEEP IN TOUCH • Plan changes (including new rates) begin • New Medical ID cards issued for everyone • New ID cards for any plans you changed during Annual Enrollment • Deductibles and limits start over • YOUR ADDRESS | Your address or employment changes? Notify your institution. • NEWSLETTER | Read the UT Office of Employee Benefits monthly newsletter. If you don’t already receive it, subscribe by entering your email address in My UT Benefits. • CONTACT INFO | Keep the Contact Information section of this newsletter to contact insurance vendors for plan information or your institution about your coverage. A Matter of Health | Annual Enrollment Edition for Employees 3 REVIEW OUT-OF-POCKET RATES FOR 2015-2016 PLAN EMPLOYEE EMPLOYEE & CHILD(REN) EMPLOYEE & SPOUSE EMPLOYEE & FAMILY UT SELECT Medical* FULL-TIME $0 $244.10 $17.03 increase p $255.30 $17.81 increase p $480.71 $283.48 $19.78 increase p $676.18 $47.17 increase p $633.86 $44.22 increase p $1,008.76 $70.38 increase p $32.40 no change $61.51 $67.80 $96.40 no change $55.85 no change $106.06 no change $117.03 no change $166.74 no change no change $16.90 no change $18.68 no change $26.67 no change $5.90 $1.10 reduction q $9.30 $1.70 reduction q $9.52 $1.72 reduction q $15.10 $2.74 reduction q $9.00 $2.00 reduction q $14.08 $3.10 reduction q $15.08 $3.32 reduction q $21.30 $4.70 reduction q $33.54 increase p UT SELECT Medical* PART-TIME UT SELECT Dental no change no change UT SELECT Dental Plus DeltaCare Dental HMO $8.89 Superior Vision Superior Vision Plus *Tobacco Premium $0 to $90 per month based upon tobacco user status Program Basic Coverage package includes medical, prescription, $20K Basic Life and $20K Basic AD&D for employees. Premium rates for Voluntary Group Term Life are not changing for the 2015 - 2016 plan year, but your Voluntary Group Term Life rate may change due to age. See the chart below for the age-banded rates. EMPLOYEE RATE CHART 4 AGE OF SUBSCRIBER ON 9/01/15 RATE PER $1,000 COVERAGE < 35 $0.038 35 - 39 $0.048 40 - 44 $0.065 45 - 49 $0.100 50 - 54 $0.155 55 - 59 $0.240 60 - 64 $0.375 65 - 69 $0.670 70 and over $0.752 A Matter of Health | Annual Enrollment Edition for Employees REVIEW UT SELECT MEDICAL PLAN CHANGES FOR 2015-2016 This year, the UT SELECT Medical plan deductible remains at $350 for individuals and $1,050 for families. The deductible is what you pay for certain services (outpatient and inpatient procedures and services, for example) before the medical plan starts to pay. Once the deductible is met, the plan pays a portion and you pay a portion called coinsurance. In-network coinsurance is 20% of allowed charges. For the 2015 - 2016 plan year, the UT SELECT Medical Plan coinsurance out-of-pocket maximum of $2,150 for individuals and $6,450 for families. This means that you will not pay above that amount in coinsurance for allowed charges. Last year, in accordance with the Affordable Care Act guidelines, UT SELECT Medical introduced an additional out-of-pocket limit that included medical copayments in addition to the deductible and coinsurance. This limit added an extra level of financial protection for you. This year, the broader out-of-pocket maximum of $6,600 for individuals and $13,200 for families includes all member cost share for allowed medical and prescription services covered under the plan: • medical deductible, • medical coinsurance, • medical copayments, • $100 prescription drug deductible, and • prescription drug member responsibility (usually a copayment). The cost for services not covered under the plan including balance billing do not apply to any out-of-pocket limits. Individuals whose primary insurance is Medicare were, in the past, typically unaffected by the out-of-pocket limits because they only applied to medical services which are generally paid in full by OPTIONAL COVERAGE HIGHLIGHTS 2015-2016 LONG TERM CARE This Annual Enrollment is the last opportunity to sign up for the Long Term Care (LTC) plan offered to UT by CNA. If you wish to enroll in LTC, you can find a direct link to the CNA website within My UT Benefits. On that site, you will find instructions describing how to print and mail a form to the insurer for yourself or if you have other eligible family members who wish to enroll. The LTC forms are also available online at www.ltcbenefits.com/uts, or you may request a paper form directly from CNA by calling (888) 825-0353. If you are currently enrolled in a CNA Long Term Care plan through UT, that coverage will continue as usual. There are no changes to rates. VISION - SAME BENEFITS, EVEN LOWER RATES! Last fall the UT System Office of Employee Benefits (OEB) posted Requests for Proposals (RFPs) for the fully insured Vision plans. OEB is extremely pleased with the results of the competitive bid process as we had several companies interested in partnering with us. The contract for Vision Insurance was awarded to Superior Vision. Their network of providers was unmatched by other vendors, none of Medicare and UT SELECT Medical. Beginning September 1, 2015, however, since prescription drug costs are included in the calculations for the larger whole plan out-of-pocket maximum, some individuals with high prescription drug costs may meet that limit at which time all allowed charges will be paid by the plan. COPAYMENTS FOR THERAPY VISITS For those in-area, the in-network benefits for physical, occupational, chiropractic, Airrosti, and speech therapy are changing from deductible/coinsurance to a specialist copayment of $35. CHANGE IN EMERGENCY ROOM BENEFIT Emergency room visit benefit is changing from a flat $150 copayment to $150 copayment plus coinsurance. This applies to in-network and out-of network benefits for the in-area plan. On average, an ER visit costs $1,650, meaning your cost under the new benefit would be $450 consisting of the $150 copayment plus 20% of the remaining allowable cost. ABA THERAPY BENEFIT Applied Behavioral Analysis will be covered for dependent children up to age 19. A $35 copayment applies to in-network services, and out-of-network deductible and coinsurance apply to out-of-network services. Out-of-network providers may balance bill. No network exceptions are allowed and the plan year benefit maximum is $36,000. PRESCRIPTION DRUG FORMULARY CHANGE There are occasional updates to the formulary for the UT SELECT Prescription Drug plan. So, while the plan benefits are not changing, you could see changes in your medication costs. which had all five of the top 5 vision service providers in network. This will enable members to continue to receive uninterrupted services from their current provider, which is a key component of the customer service experience. The new 2015-2016 premium rates will also be significantly lower than current rates; good news for enrollees in both the Regular Vision plan and the Vision Plus plan. DENTAL PPO PLAN EXCLUSION CHANGE UT SELECT Dental PPO plans will no longer exclude the initial installation of a fixed bridge or partial denture made necessary by the absence of natural teeth occurring before the Primary Enrollee was enrolled in dental coverage under The University of Texas System. Removing this exclusion, commonly referred to as the “missing tooth clause” should help expedite treatment for many UT SELECT Dental participants and improve the patient experience. SHORT AND LONG TERM DISABILITY No Evidence of Insurability (EOI) required during this year’s Annual Enrollment. A Matter of Health | Annual Enrollment Edition for Employees 5 REVIEW SHORT TERM AND LONG TERM DISABILITY ANNUAL ENROLLMENT: YOUR OPPORTUNITY TO REVIEW AND CHANGE VISION BENEFITS As announced in May and promoted in June, enrolling in Disability Insurance can make a tremendous difference in maintaining an income stream should you suffer an illness, injury or accident that will keep you out of work. With the new Short and Long Term Disability contract in place for the upcoming plan year, the new contract not only offers slightly decreased rates, it also offers a great opportunity to enroll in disability insurance during Annual Enrollment in July without having to complete Evidence of Insurability. This opportunity is generally only allowed for new employees or for employees who are adding coverage due to a change of status such as marriage or the birth or adoption of a child. Normally during Annual Enrollment, applicants would need to answer health questions that could lead them to be turned down for coverage. If you are not currently enrolled in coverage, this is a prime time to consider adding it. DISABILITY INSURANCE MONTHLY PREMIUM RATES Short Term Disability $0.28 per $100 of monthly income $0.022 reduction q Long Term Disability $0.38 per $100 of monthly income $0.017 reduction q VISION PLAN OPTIONS For additional information about each of the current UT vision plans briefly described below, please visit the OEB website. Plan limitations and exclusions do apply for each of these plans. Contact Superior Vision customer service for specific details about plan benefits and coverage at (800) 507-3800. SUPERIOR VISION PLAN (STANDARD PLAN) We are pleased to announce that the contract for Vision Insurance was awarded to Superior Vision. The network of providers will remain the same, which translates to uninterrupted services. The new 2015-2016 premium rates will also be significantly lower than current rates; good news for enrollees in both the Regular Vision plan and the Vision Plus plan. SUPERIOR VISION PLUS PLAN (ENHANCED PLAN) In addition to the standard Superior Vision plan, there is also the enhanced Superior Vision Plus plan. For a higher premium, you receive higher benefit allowances than the standard plan. See below for additional details. VISION PLAN DESIGN FEATURES 2015-2016 PLAN DESIGN FEATURES Superior ANNUAL EXAM FRAME PROGRESSIVE LENS COVERED LENS NETWORK CO-PAYMENT ALLOWANCE ALLOWANCE OPTIONS OF PROVIDERS $35 COPAY $140 Vision Member pays Options are provided at a 20% New Contract provides difference between discount uninterrupted service. lined trifocals and Best value provided when progressive retail visiting a contracted cost Superior Vision provider. Please contact Superior Superior Vision Plus $35 COPAY $150 $120 Polycarbonates, dependents to Vision customer service age 25 before you receive services (standard plan does not cover) to confirm if your provider Scratch coat covered in full is in-network. (standard plan does not cover) Ultraviolet coat covered in full (standard plan does not cover) 6 A Matter of Health | Annual Enrollment Edition for Employees REVIEW ANNUAL ENROLLMENT: YOUR OPPORTUNITY TO REVIEW AND CHANGE DENTAL BENEFITS DENTAL PLAN OPTIONS UT System will continue to offer two self-funded UT SELECT Dental PPO plan options: UT SELECT Dental and UT SELECT Dental Plus. There will be no premium changes to either of the PPO plans and we are happy to announce that the Missing Tooth Exclusion clause will no longer apply as of September 1, 2015. The UT SELECT Dental and UT SELECT Dental Plus plans are both administered by Delta Dental Insurance Company. As self-funded plans, all claims are paid by UT System through premiums collected from participants. While both PPO plans cover most of the same types of services and provisions, the premiums are different and the benefits are higher in the UT SELECT Dental Plus plan. Compare the benefits closely in order to select the plan that best meets your or your family’s particular needs. PLAN DESIGN FEATURES PLAN DEDUCTIBLE ANNUAL PLAN BENEFIT ORTHODONTICS ALLOWANCE NETWORK OPTIONS UT SELECT $25 $1,250 ANNUAL Separate Freedom to choose any licensed dentist. For maximum Dental PPO DEDUCTIBLE BENEFIT MAXIMUM $1,250 lifetime savings, choose from the Dental Preferred Organization orthodontic (DPO). If you choose a provider outside of the DPO maximum network, you may be subject to balance billing. Contact Delta Dental customer service to confirm the status of your dental provider. UT SELECT PLAN PAYS $3,000 ANNUAL Separate Freedom to choose any licensed dentist. For maximum Dental Plus PPO DEDUCTIBLE BENEFIT MAXIMUM $3,000 lifetime savings, choose from the Dental Preferred Organization orthodontic benefit (DPO). If you choose a provider outside of the DPO maximum network, you may be subject to balance billing. Contact Delta Dental customer service to confirm the status of your dental provider. BENEFITS AND COVERED SERVICES PLAN DIAGNOSTIC & BASIC MAJOR ORTHODONTIC PREVENTIVE SERVICES SERVICES SERVICES SERVICES UT SELECT Dental PPO 100% 80% 50% 50% UT SELECT Dental Plus PPO 100% 100% 80% 80% DENTAL HMO – DELTACARE USA The DeltaCare USA dental HMO plan has set copayments and no annual deductibles or maximums for covered benefits. There are no premium changes and the benefits will remain the same for plan year 2015-2016. DELTACARE USA PLAN DESIGN FEATURES • Set copayments. • No annual deductibles and no maximums for covered benefits. • Low out-of-pocket costs for many diagnostic and preventive services (such as professional cleanings and regular dental exams). • Upon enrollment into the DeltaCare USA plan, you must select a new dentist in My UT Benefits during Annual Enrollment or one will be selected for you based on your address. You may call Delta Dental at (800) 893-3582 to find out if your current dentist is in the DeltaCare network. Do not make any appointments until you are certain that DeltaCare has confirmed a dentist for you and/or for each of your covered dependents. If you visit a dentist other than the one listed as your primary dental provider, your services may not be covered. Plan limitations and exclusions do apply for each of these plans. Contact Delta Dental customer service for specific details about plan benefits and coverage at (800) 893-3582. For additional information about the three dental plans briefly described above, please visit the OEB website. A Matter of Health | Annual Enrollment Edition for Employees 7 REVIEW VOLUNTARY GROUP TERM LIFE AND AD&D INSURANCE Voluntary Group Term Life (VGTL) insurance can help ensure financial security for your family and loved ones upon your death. UT System, through the vendor Dearborn National, provides eligible employees the opportunity to purchase additional life Insurance coverage at group rates in addition to the $20,000 basic GTL included in the basic coverage package. During annual enrollment employees can elect up to a maximum of six times their annual salary with approval of Evidence of insurability (EOI). Additionally, spouses of employees who have VGTL are eligible for up to $50,000 in VGTL with EOI. Benefits-eligible active employees enrolled in UT SELECT Medical are automatically enrolled in the Accidental Death and Dismemberment (AD&D) plan with $20,000 as part of the basic coverage package. Active employees may also enroll themselves and their eligible dependents in optional Voluntary AD&D insurance in amounts of coverage up to ten times their annual salary, with spouse coverage of up to 50% of the employee’s election. All amounts of AD&D coverage are guaranteed issue. No EOI is required for any increases in AD&D benefits during annual enrollment or during the plan year following a qualified change in status event. YOU MAY ADD OR INCREASE VOLUNTARY GROUP TERM LIFE INSURANCE DURING ANNUAL ENROLLMENT * Evidence of Insurability is required to add or increase Voluntary Group Term Life Insurance. LIVING WELL PROGRAM WELLNESS. FIND YOUR WAY. ONSITE FLU SHOTS The University of Texas System Living Well: Make it a Priority Worksite Health & Wellness program was established to encourage all employees, retirees, and dependents to reach their potential and maintain the productivity necessary to meet the challenges of work and life. Our Living Well program goal is to enable you to take charge of your health by developing your own personal wellness program, using resources available through the Office of Employee Benefits and your UT institution. For more details please visit our website at www.livingwell.utsystem.edu or email us at livingwell@utsystem. edu. Flu Shots may be available at your institution at no cost to you. Details will be sent in our “A Matter of Health” newsletter in fall of 2015. CONDITION MANAGEMENT PROGRAM Members with chronic conditions, such as diabetes, asthma, high blood pressure, and many more, can get personalized professional support in managing the disease. To learn more about this voluntary health improvement plan by BCBSTX, call 1-800-462-3275. 24/7 NURSELINE Get answers to your health care questions with the BCBSTX 24/7 Nurseline. Experienced registered nurses are available 24/7 to help you with questions you have about major medical issues, chronic illness, and lifestyle changes. Call toll-free: 1-888-315-9473. ONSITE HEALTH CHECKUPS The checkup, similar to what you might receive at your doctor’s office, is designed to identify issues that may affect your health and help you get them under control before they become serious. Participating institutions will communicate the dates via email and posters. Checkups include a quick health evaluation; including finger stick blood test, blood pressure, and body composition, followed up by a private health consultation with a licensed Nurse Practitioner. 8 A Matter of Health | Annual Enrollment Edition for Employees EXPERT PHARMACIST HELP If you have been diagnosed with high cholesterol, diabetes, or any other condition, pharmacist specialists from the Express Scripts Therapeutic Resource Center can provide you with vital information about your condition and treatment, including potential risks and side effects of medications. Learn more by calling 1-800-818-0155. PHYSICAL ACTIVITY CHALLENGE Each spring, team up with your institution for the UT System Physical Activity Challenge. You’ll receive a weekly goal and work with those who are registered towards earning individual rewards and institution recognition. The following Institutions were awarded the 2015 Traveling Trophies: nn2015 UT Activity Challenge Small Institution Champion: UT System Administration nn2015 UT Activity Challenge Medium-sized Institution Champion: UTHealth nn2015 UT Activity Challenge Large Institution Champion: UTMB Galveston REVIEW UNDERSTANDING DEPENDENT ELIGIBILITY AND DOCUMENTATION REQUIREMENTS With Annual Enrollment this month, it’s important to be aware of the dependent eligibility rules for the UT Benefits program and the requirement to provide documentation verifying that your dependents are eligible to participate. Here is a brief review of the dependent eligibility requirements as well as information about providing required supporting documentation. ELIGIBILITY Eligibility to participate in certain UT Benefits coverage as a dependent is determined by law. Eligible dependents are: nnYour spouse*; nnYour children, including stepchildren and adopted children, who are: • under age 26 regardless of marital status for the UT SELECT Medical plan (due to federal eligibility rules), • unmarried and under age 25 for other UT Benefits (Dental, Vision, and Life insurance); nnChildren for whom you are named a legal guardian or who are the subject of a medical support order requiring such coverage; nnYour unmarried grandchildren under age 25, provided they qualify and you claim them as your dependent for federal tax purposes; and, nnCertain children over age 25 (over age 26 for the UT SELECT Medical plan based on federal eligibility rules) who are determined by OEB to be medically incapacitated and are unable to provide their own support. OTHER ELIGIBILITY SURVIVING DEPENDENTS INCAPACITATED DEPENDENTS IF YOU CURRENTLY COVER A DEPENDENT who is also receiving premium sharing for coverage through a a plan with Texas A&M or Employees Retirement System of Texas, please choose to have that person covered under only one plan and make the appropriate enrollment changes at this time. *Effective July 1, 2015, same sex spouses are eligible for enrollment in the UT Group Insurance Program. Contact your benefits office for information on adding your spouse to your insurance coverage. SURVIVING DEPENDENTS OVERAGE INCAPACITATED DEPENDENTS The surviving spouse or other benefits-eligible dependent of an employee or retired employee who, on the date of the employee’s death, had at least five (5) years of Teacher Retirement System of Texas (TRS) or Texas Optional Retirement Program (ORP) creditable service, including at least three (3) years with UT as a benefitseligible employee at the time of death, is eligible for benefits as a surviving dependent if the dependent had been participating in UT Benefits at the time of the employee or retired employee’s death. A surviving spouse may continue UT Benefits coverage for the remainder of the surviving spouse’s life. A dependent child may continue until the child loses his or her status as a dependent child. The dependent of an individual who has not met the service requirements at the time of death may elect COBRA coverage for a period not to exceed 36 months. Enrolled children may remain eligible for UT Benefits as an incapacitated dependent if they are determined to be medically incapacitated at the time they age out of eligibility for coverage as a child under the program (either at age 25 or 26, depending on coverage type). An older dependent child who is determined to be medically incapacitated at the time a subscriber first becomes benefits eligible may be enrolled in the plan if the child was covered by the subscriber’s previous health plan with no break in coverage. Please contact your institution’s Human Resources or Benefits Office for additional information about covering incapacitated dependent children. IMPORTANT Misrepresentation of dependent eligibility constitutes a policy violation that could result in consequences ranging from a reprimand to dismissal. Misrepresentation may also require that you reimburse benefits paid on behalf of an ineligible individual. Deliberate misrepresentation may constitute criminal fraud and could result in a referral to law enforcement. A Matter of Health | Annual Enrollment Edition for Employees 9 REVIEW UT RETIREMENT: ANNUAL ENROLLMENT AND YOUR RETIREMENT SAVINGS OPPORTUNITIES With Annual Enrollment fast approaching and decisions to be made regarding your health care options, there is no better time to consider your financial health as well. UT FLEX: CONVENIENT, EASY SAVINGS AND NO MORE ADMINISTRATIVE FEE Participating in the UT FLEX flexible spending account program is convenient, easy, and best of all, saves you money! Through your UT FLEX account, you can pay for eligible health care and dependent day care expenses using pre-tax dollars, which means you don’t pay federal income or Social Security taxes on this money. In addition to a suite of health insurance options to take care of you and your family, the University of Texas System also offers two voluntary retirement savings plans that all you to plan for the financial future for yourself and your family. While you can enroll or increase your contribution in the UTSaver TSA or UTSaver DCP at any time, annual enrollment is a great time to think about your total future retirement needs. Contributions can be as little as $15 per month or as much as $18,000.00 a year. In some cases, you may even be able to contribute more. All contributions are conveniently deducted from your paycheck before taxes, which means your taxable income decreases. If you prefer to make your contributions after taxes have been deducted, that option is there for you too. NEED HELP INVESTING YOUR CONTRIBUTIONS? The UTRetirement Programs partner with our providers to ensure you have the resources you need. There are dozens of financial representatives in your area who will be glad to sit down with you and help you determine your best course of action. After making your annual enrollment elections, make sure to go back and click on the link to the UT System Retirement Programs website at www.utretirement.utsystem.edu to learn more about the TSA or DCP plans, or to read about the services each provide makes available to you at no cost. You can even schedule an appointment with a financial advisor at your convenience. Take the opportunity to ensure that your financial health is just as robust as your physical health! HOW MUCH MIGHT YOU SAVE? WITH AN FSA WITHOUT AN FSA ANNUAL SALARY $40,000 $40,000 HEALTH CARE FSA CONTRIBUTION (PRE-TAX) ($1,500) ($0) DEPENDENT CARE FSA CONTRIBUTION(PRE-TAX) ($4,000) ($0) TAXABLE INCOME AFTER CONTRIBUTION AMOUNT $34,500 $40,000 ESTIMATED TAXES WITHHELD (22.65%)* ($7,814) ($9,060) POST-TAX INCOME $26,686 $30,940 MONEY SPENT AFTER TAX ON HEALTH CARE AND DEPENDENT DAY CARE EXPENSES ($0) ($5,476) TAKE HOME PAY $26,686 $25,464 SAVINGS $1,222 $0 *Based on 7.65% FICA and 15% tax bracket. Note: Please be advised that this example is for illustrative purposes only. These projections are only estimates of tax information and should not be assumed to be tax advice. Be sure to consult a tax advisor to determine the appropriate tax advice for your situation. 10 A Matter of Health | Annual Enrollment Edition for Employees REVIEW PHYSICIAN EXERCISE REFERRAL Individuals with medical conditions that can be improved by physical activity (such as diabetes, hypertension, depression, and more) are able to receive reimbursement from their healthcare flexible spending account to pay for some exercise expenses. A Letter of Medical Necessity is needed from the physician advising the exercise. Details can be found at www.utsystem.edu/offices/employeebenefits/ut-flex-active-employee UT FLEX HEALTH CARE REIMBURSEMENT ACCOUNT (HCRA) Important: In response to the Internal Revenue Service (IRS) increasing the annual maximum election, effective plan year 20152016 (September 1, 2015) the new annual maximum election per employee for HCRA accounts is $2,550 (an increase of $50). With a UT FLEX HCRA, you can set aside up to $2,550 per year in pre-tax dollars to pay for eligible health care expenses, including these common expenses: UT FLEX DEPENDENT DAY CARE REIMBURSEMENT ACCOUNT (DCRA) You can set aside pre-tax dollars (up to $5,000 per family per calendar year) to pay for eligible expenses for dependent day care that allows you (and, if married, your spouse) to work, look for work, or go to school full time. Eligible expenses for care of qualified dependents include costs for: nnBefore/after school care, nnDeductibles, copayments, and coinsurance; nnPreschool or nursery school (for pre-kindergarten aged dependents), and nnPrescription drugs, insulin, and syringes; nnSummer day camp. nnDental exams, x-rays, fillings, crowns, and orthodontia; nnEye exams, prescription eyeglasses, and prescription sunglasses; nnContact lenses and cleaning solutions; and nnHearing aids. You can find additional details about eligible HCRA expenses online at www.utflex.com. NO ADMINISTRATIVE FEES FOR PARTICIPATION OR DEBIT CARD Starting September 1, 2015, participants in the UT FLEX program will no longer have to pay the $12 annual fee per UT FLEX account. The PayFlex Debit Card will continue to be free for HCRA participants as well. You can find complete details about qualified dependents and eligible DCRA expenses online at www.utflex.com. NEED HELP DETERMINING HOW MUCH TO ELECT? Use the savings calculator online at www.utflex.com to help you estimate your eligible expenses by itemizing your unreimbursed health and dependent day care costs. To use the calculator on the UT FLEX website, click on the Savings Calculator tab and enter your annual estimated costs in each category. Once complete, you’ll have an estimate for an annual election and you can also see your estimated tax savings! Using the PayFlex Debit Card gives you several advantages, including: nnImproving your cash flow throughout the plan year by allowing you to directly access your account for eligible expenses rather than paying out of pocket and filing for reimbursement. You have direct access to your entire annual election amount beginning on the first day of the plan year (9/1/2015); nnEliminating the need for you to complete claim forms or any other paperwork for most expenses;* and, nnEnsuring that eligible purchases are automatically deducted from your available UT FLEX HCRA balance so you always know how much you have remaining in your account. IMPORTANT REMINDERS Don’t forget – to participate in UT FLEX for 2015-2016, you must make your election through the My UT Benefits online enrollment system during this year’s Annual Enrollment period – even if you are a current UT FLEX participant. nnSave all of your receipts and especially those for dental and vision services which will likely require documentation to prove the service was medically necessary. Important: If you currently have a PayFlex Debit Card, do NOT discard it. As long as you make a UT FLEX HCRA election for 20152016, your Debit Card will continue to work. Expiring cards will be replaced as necessary, similar to most credit and debit cards. A Matter of Health | Annual Enrollment Edition for Employees 11 MAKE ELECTIONS HOW TO CHANGE YOUR BENEFITS All of your changes can be made using the My UT Benefits online system at www.utsystem.edu/myutbenefits. LOGIN TO MY UT BENEFITS Login using one of the options provided. Your PIN will be sent to you in the email or letter titled “Your UT Benefits Enrollment Options” by July 15th. BEFORE MAKING YOUR ELECTIONS, YOU MUST DECLARE OR UPDATE YOUR TOBACCO USER STATUS The Tobacco Premium Program (TPP) is an out-of-pocket premium of $30 per month. It applies to subscribers and dependents aged 16 and over who are enrolled in the UT SELECT Medical plan and use tobacco products. Before making election changes via My UT Benefits, you will be prompted to confirm tobacco user status for yourself and eligible dependents. EVIDENCE OF INSURABILITY/EVIDENCE OF ELIGIBILITY Evidence of Insurability (EOI) application (for adding or increasing Voluntary Group Term Life or Long Term Care), you must follow through by providing this information. If you do not, your requested changes will not be implemented. REVIEW YOUR CHANGES Login using one of the options provided. Your PIN will be sent to you in the letter or email titled “Your UT Benefits Enrollment Options” by July 15th. BE AWARE THAT CHANGES MADE DURING AE WILL TAKE EFFECT ON SEPTEMBER 1 EXCEPTION: If EOI is required and has not been approved by September 1, changes will take effect on the approval date for Life Insurance or the first of the month following approval for Long Term Care. If you make a coverage election that requires documentation of relationship (for adding a dependent) or for you to submit an FOLLOW UP EVIDENCE OF INSURABILITY DEADLINE FOR SUBMISSION IS AUGUST 15 During this year’s Annual Enrollment (AE) period, Evidence of Insurability (EOI) will be required to enroll in or increase Voluntary Group Term Life and Long Term Care (LTC) insurance. EOI is not required for UT SELECT Medical. In addition, no EOI is required to enroll in short- or longterm disability during AE period. Important Notes: LONG TERM CARE EOI nnEOI is not required for enrollment in the UT SELECT Medical Plan Employees and their spouses as well as any other eligible family members will need to complete and pass EOI in order to enroll in Long Term Care. nnThe deadline for submitting electronic EOI or mailing a paper EOI form is August 15th. LIFE EOI The My UT Benefits online system will automatically direct you to complete EOI electronically if you enroll online. Otherwise, you may complete a paper form and submit it to the insurer. You can view and print the life EOI form online at www.dearbornnational.com/ut/ pdf/employees/gtl/ut_eoi.pdf. You can also request a form from your institution’s HR or Benefits Office. EVIDENCE OF ELIGIBILITY DEADLINE FOR SUBMISSION IS AUGUST 15 12 If you wish to enroll in LTC, you can find a direct link to the CNA website within My UT Benefits. On that site, you will find instructions describing how to print and mail a form to the insurer for yourself or if you have other eligible family members who wish to enroll. The LTC forms are also available online at www.ltcbenefits.com/uts, or you may request a paper form directly from CNA by calling (888) 825-0353. DOCUMENTATION – EVIDENCE OF ELIGIBILITY When requesting to add a dependent to your UT Benefits coverage, you must provide appropriate supporting documentation demonstrating Evidence of Eligibility (EOE). You should be prepared to provide copies of relevant documents. Depending on the relationship and circumstances, appropriate documentation may include items such as a marriage certificate, a birth certificate, completed adoption paperwork, or other legal documents. A Matter of Health | Annual Enrollment Edition for Employees The My UT Benefits online system offers the convenience of submitting documents electronically when adding NEW dependents to your benefits coverage during Annual Enrollment. To do this, you simply upload clear, legible digital images (scanned documents or photographs) of required documents directly through My UT Benefits as evidence of your dependent’s eligibility. Additional information will be available when you log into My UT Benefits, including FAQs about the documentation upload process. There is a separate tab for dependent information to help you more easily find details that you may need. NEW UT SELECT MEDICAL ID CARDS New UT SELECT Medical ID cards from Blue Cross and Blue Shield of Texas (BCBSTX) will be issued to all UT SELECT Medical enrollees before September 1, 2015. The new Medical ID Card will feature the same information you are accustomed to seeing on your current ID card plus new language about the Emergency Room benefit and therapy benefit copayments for physical, occupational and speech therapy. See the article on UT SELECT Medical Plan Design Changes elsewhere in this newsletter for more details about these changes. Please do not discard your current UT SELECT Medical ID card until you receive your replacement ID cards. You can still access your benefits with the old ID card. After you receive your new Medical ID card in the mail, you can contact BCBSTX Customer Service at (866) 882-2034 to request additional ID cards for your covered dependents, if needed. CHANGES DURING THE YEAR Because there are no changes to key benefits information for the Prescription Drug Plan with Express Scripts, UT SELECT Dental plans, the Delta Dental HMO, or Superior Vision plans for the upcoming 2015-2016 Plan Year, new ID Cards will not be issued this year to continuing participants in these plans. If you enroll in a new insurance plan type during Annual Enrollment or you change the plan you are currently enrolled in (such as from Vision to Vision Plus), you will receive a new insurance ID card prior to the start of the 2015-2016 plan year. Outside of Annual Enrollment, you may not make changes to your benefits unless you have certain qualified change of status events including: nnmarriage, divorce, annulment, or spouse’s death; An employee nnbirth, adoption, medical child-support order, or dependent’s death; nnwhose dependent loses insurance coverage under the Medicaid or CHIP program as a result of loss of eligibility of either the employee or the dependent; or nnsignificant change in residence if the change affects you or your dependents’ current plan eligibility; nnchange of job status affecting eligiblity; nnchange in dependent’s eligibility (e.g., reaching age 26 for UT SELECT Medical, marriage or reaching age 25 for all coverage other than UT SELECT Medical, or gaining or losing eligibility for any other reason); or nnsignificant change in coverage or cost of other benefit plans available to you and your family. nnwhose dependent becomes eligible for a premium assistance subsidy under Medicaid or CHIP may enroll this dependent in the basic coverage under UT Benefits, as long as the dependent meets all other UT eligibility requirements and is enrolled within 60 days from the date of the applicable event. If enrollment of the dependent is conditioned on enrollment of the retired employee, the retired employee will also be eligible to enroll. You may enroll in or make changes to benefits by contacting your institution HR/Benefits office within 31 days of one of these change of status events. ONGOING: KEEP IN TOUCH If your address or employment changes, it could affect your benefits. Notify your institution if you have one of these changes. Monthly Newsletter | Read the UT Office of Employee Benefit montly newsletter. If you don’t already receive it, subscribe by entering your email address in My UT Benefits. Contact Us | Keep the “Contacts” section of this newsletter to contact insurance vendors for plan information or your institution about your coverage. WHAT DO WE DO & HOW CAN YOU FIND HELP? INSTITUTION UT BENEFITS VENDORS Address Change Life Events / Change of Status Eligibility Rates Monthly Newsletters Legal Notices Plan Guides Annual Enrollment Plan Details ID Cards Value Added Benefits Claim Issues Customer Service A Matter of Health | Annual Enrollment Edition for Employees 13 2015-2016 UT BENEFITS CONTACTS | EMPLOYEES UT ARLINGTON Office of Human Resources (817) 272- 5554 Fax: (817) 272-5798 benefits@uta.edu (512) 471-4772 or Toll Free: (800) 687-4178 Fax: (512) 232-3524 HRSC@austin.utexas.edu UT BROWNSVILLE Human Resources (956) 882-8205 Fax: (956) 882-6599 benefits@utb.edu UT DALLAS Office of Human Resources (972) 883-2221 Fax: (972) 883-2156 benefits@utdallas.edu UT EL PASO Human Resources (915) 747-5202 Fax: (915) 747-5815 benefits@utep.edu UT HEALTH SCIENCE CENTER HOUSTON Employee Benefit Services (713) 500-3935 Fax: (713) 500-0342 benefits@uth.tmc.edu UT HEALTH SCIENCE CENTER SAN ANTONIO Office of Human Resources (210) 567-2600 Fax: (210) 567-6791 ben-admin@UTHSCSA.EDU A Matter of Health | Annual Enrollment Edition for Employees UT RIO GRANDE VALLEY Office of Human Resources Brownsville Human Resources (903) 877-7784 Fax: (903) 877-5394 benefits@uthct.edu (956) 882-8205 Fax: (956) 882-6599 hr@utrgv.edu Edinburg Human Resources UT AUSTIN Human Resource Services 14 UT HEALTH SCIENCE CENTER TYLER UT MD ANDERSON CANCER CENTER Human Resources Benefits (956) 665-2451 Fax: (956) 665-3289 hr@utrgv.edu (713) 745-6947 Fax: (713) 745-7160 hrbenefits@mdanderson.org UT SAN ANTONIO Physicians Referral Service (PRS) (713) 792-7600 Fax: (713) 794-4812 prsfacbensrvs@mdanderson.org (210) 458-4250 Fax: (210) 458-7890 benefits@utsa.edu UT MEDICAL BRANCH AT GALVESTON Human Resources UT SOUTHWESTERN MEDICAL CENTER Employee Benefits Services Human Resources/Employee Benefits Division (409) 772-2630, Option “0” Toll Free: (866) 996-8862 Fax: (409) 772-2754 benefits.services@utmb.edu (214) 648-9830 Fax: (214) 648-9881 benefits@utsouthwestern.edu UT SYSTEM ADMINISTRATION UT PAN AMERICAN Office of Employee Services Human Resources (512) 499-4660 Fax: (512) 499-4380 esc@utsystem.edu (956) 665-2451 Fax: (956) 665-3289 hrbenefits@utpa.edu UT TYLER UT PERMIAN BASIN Office of Human Resources Human Resources (903) 566-7480 Fax: (903) 565-5690 aclem@uttyler.edu (432) 552-2751 Fax: (432) 552-3747 CONTACT INFORMATION INSURANCE PLAN ADMINISTRATORS RETIREMENT PROVIDERS UT SELECT MEDICAL DELTACARE USA DENTAL HMO FIDELITY INVESTMENTS (Blue Cross and Blue Shield of Texas) Group: 71778 (Delta Dental) Group: 6690 (866) 882-2034 M-F 8:00 AM-6:00 PM CT www.bcbstx.com/ut (800) 893-3582 M-F 7:00 AM-8:00 PM CT www.deltadentalins.com/ universityoftexas (800) 343-0860 M-F 7:00 AM-11:00 PM CT www.netbenefits.com/ut UT SELECT PRESCRIPTION (Express Scripts) Group: UTSYSRX SUPERIOR VISION (800) 818-0155 24hrs a day 7 days a week www.express-scripts.com/ut (800) 507-3800 M-F 7:00 AM-8:00 PM CT Sat 10:00 AM-3:30 PM CT www.superiorvision.com/ut UT FLEX (PayFlex) (866) 887-3539 M-F 7:00 AM-7:00 PM CT Sat 9:00 AM-2:00 PM CT www.utflex.com Group: 26856 GROUP TERM LIFE, AD&D, AND DISABILITY (Dearborn National) Group: GFZ71778 LIVING WELL HEALTH PROGRAM (866) 628-2606 M-F 7:00 AM-7:00 PM CT www.dearbornnational.com/ut livingwell@utsystem.edu. www.livingwell.utsystem.edu LONG-TERM CARE UT SELECT DENTAL and UT SELECT DENTAL PLUS (Delta Dental) Group: 5968 VOYA FINANCIAL (formerly ING) (866) 506-2199 M-F 7:00 AM-9:00 PM CT Sat 7:00 AM-3:00 PM CT https://utexas.prepare4myfuture.com LINCOLN FINANCIAL GROUP (800) 454-6265 * 8 M-F 7:00 AM-7:00 PM CT www.lfg.com/ut TIAA-CREF (800) 842-2776 TDD (800) 842-2755 M-F 7:00 AM-9:00 PM Sat 8:00 AM-5:00 PM CT www.tiaa-cref.org/utexas VALIC (CNA) Group: 0010025IS (888) 825-0353 M-F 7:00 AM-5:00 PM CT www.ltcbenefits.com/uts (800) 448-2542 M-F 8:00 AM-7:00 PM CT www.valic.com/utexasorp (800) 893-3582 M-F 6:15 AM-6:30 PM CT www.deltadentalins.com/ universityoftexas A Matter of Health | Annual Enrollment Edition for Employees 15 OFFICE OF EMPLOYEE BENEFITS 210 W. 6TH STREET SUITE B.140E Presorted Standard Mail U.S. Postage Paid Austin, Texas Permit No. 391 AUSTIN, TEXAS 78701 Annual Enrollment is July 15 - July 31 Important News About Your UT Benefits and Annual Enrollment is Enclosed. For detailed plan information, scan the QR code with your Smartphone or visit our website at www.utsystem.edu/offices/employee-benefits