Published in Management Science, (December, 2011) 57, no. 12): 2101-2114.

advertisement

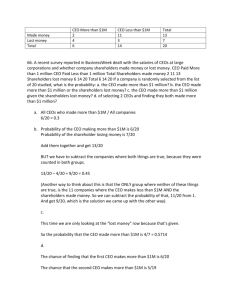

Published in Management Science, (December, 2011) 57, no. 12): 2101-2114. This version is prior to publication How Do Acquirers Retain Successful Target CEOs? The Role of Governance Julie Wulf Harvard Business School Harbir Singh The Wharton School University of Pennsylvania January 2011 Abstract: The resource-based view argues that acquisitions can build competitive advantage partially through retention of valuable human capital of the target firm. However, making commitments to retain and motivate successful top managers is a challenge when contracts are not enforceable. Investigating the conditions under which target CEOs are retained in a sample of mergers in the 1990s, we find greater retention of better-performing and higher-paid CEOs—both measures of valuable human capital. We also show that the performance-retention link is stronger when the acquirer‘s governance provisions support managers and when the acquirer‘s CEO owns more equity. While it is not common for acquirers to retain target CEOs, we argue that they are more likely to do so when their governance environment maintains managerial discretion. Based on a joint analysis of retention and governance, our findings are largely consistent with a managerial human capital explanation of retention. Acknowledgements: For helpful comments, the authors would like to thank Ramon CasadesusMasanell, Russell Coff, Jim Dana, Connie Helfat, Hongyi Li, Matt Rhodes-Kropf, Bill Simpson, Eric Van den Steen, three anonymous referees, an anonymous associate editor, and the department editor, Bruno Cassiman. Errors remain our own. 1 1. Introduction Over the past two decades, the characteristics of mergers and acquisitions have changed dramatically. Transactions during the 1980s were often characterized as hostile takeovers. In contrast, transactions during the 1990s were commonly characterized as friendly mergers that involved negotiations between two willing parties (Andrade, Mitchell and Stafford, 2001). The decade of the 1990s also has witnessed significant changes in governance and higher rates of CEO turnover with an increasing fraction of turnover caused by mergers and acquisitions (Booz & Co., 2006).1 While a number of perspectives on the role of target CEOs in mergers have been discussed in the literature, we develop a managerial human capital explanation which argues that acquisitions can build competitive advantage partially through retention of top managers with value-creating human capital. In contrast to the literature that focuses on the monitoring and disciplining aspects of governance, we argue that the governance of the acquiring firm can play a role in retaining successful target CEOs when contracts are not enforceable. The challenges that target CEOs face in evaluating promises or commitments made by acquiring firms are illustrated by the circumstances around NationsBank‘s acquisition of BankAmerica (1998): According to the SEC filing that described the terms of the merger agreement, NationsBank‘s board of directors had intended for the CEO of the target firm (David Coulter of BankAmerica) to succeed the CEO of the acquiring firm (Hugh McColl of NationsBank) upon his retirement which was expected within 2 years. Instead, the target CEO (Coulter) was forced to resign after the merger was completed.2 1 The decade of the 1990s also has witnessed significant changes in governance including: (i) an increase in shareholder activism leading to greater monitoring and influence over firm decisions by both institutional and block shareholders (Useem, 1993; Daily, Dalton and Rajagopalan, 2003); (ii) a trend toward more independent boards with a higher proportion of outside directors; (iii) an increase in CEO ownership through stock options to align incentives (an indirect measure of internal governance) (e.g., Murphy, 1999 and Holmstrom and Kaplan, 2001); and (iv) increasing recognition that CEOs are heterogeneous in their ability to generate rents for firms (Bertrand and Schoar, 2003 and Wang and Barney, 2006). During this same time period, there has been a more active labor market for CEOs (Himmelberg and Hubbard, 2002) leading to higher turnover rates, lower tenure, and CEOs more commonly being replaced or succeeded by external hires (Huson, Parrino and Starks, 2001). The trend toward friendly, synergistic mergers combined with substantial shifts in corporate governance and fundamental changes in CEO labor markets makes the 1990s an interesting decade in which to explore the role of target CEOs in the governance of the merged entity. 2 ―Mergers of NationsBank BankAmerica and Banc One, First Chicago Unveiled—Huge Deals Could Mark the Beginning of Move to National Banking‖, S. Lipin and G. Fairclough, The Wall Street Journal, 4/14/1998. 2 This is an example of an employment agreement which promised succession to a target CEO, and yet it was not honored.3 And, while succession agreements are not common, it is easy to extend the concept to a more general case in which the acquiring firm promises the target CEO the right to ―be the boss‖, but then fails to keep the commitment. In this paper, we develop a managerial human capital explanation of target management retention in M&A. Target CEOs may represent important ―assets‖ to acquiring firms to the extent that they embody valuable human capital that can enhance firm performance. Acquirers want to retain successful CEOs post-acquisition and, since target CEOs prefer ―being the boss,‖ acquirers make promises about maintaining managerial discretion and providing job security. However, it is difficult for acquirers to credibly commit to promises made to target CEOs. We argue that governance and ownership may differentiate acquiring firms in their ability to credibly commit to managerial discretion for target CEOs and that this in turn affects the likelihood of CEO retention. Using a sample of mergers during the 1990s, we evaluate whether acquiring firms are more likely to retain successful target CEOs and whether the probability of retention varies by certain ownership and governance characteristics. First, we show that target CEOs of better-performing firms and those with higher compensation are more likely to be retained post-merger. That is, acquiring firms retain target CEOs with valuable human capital. Of equal interest, we find that acquiring firms with governance provisions that support managers and acquiring firms with CEOs that are large shareholders are more likely to retain successful target CEOs. These findings are broadly consistent with a managerial human capital explanation of retention. Acquiring firms have the incentive to retain valuable human capital of the target firm and they are more capable of doing so when their governance environment allows them to credibly commit to maintaining managerial discretion. We contribute to the existing research in several ways. First, we re-orient the governance discussion in M&A transactions away from monitoring and dismissal of bad managers toward attraction and 3 Hartzell, Ofek and Yermack (2004) document the existence of explicit succession agreements for target CEOs in only 3% of their sample (9 of 311 mergers) and find that none of these agreements were honored. In contrast, see Wulf (2004) for examples in mergers of equals transactions in which succession agreements were honored. 3 retention of good managers. We extend the managerial human capital view to the context of M&A by developing a theory for why acquirers may want to retain target management and how governance of the acquiring firm may play a role in the target CEO‘s decision to stay. We then jointly analyze retention and governance in a sample of friendly mergers and find results that are broadly consistent with the predictions. To our knowledge, this is the first paper that acknowledges and documents a potential role of the acquirer‘s governance in retaining successful target management. The implications of our analysis suggest that a firm‘s governance choices may help to contribute to the ultimate success of M&A transactions. 2. Prior Literature and Hypothesis Development 2.1 The Acquiring Firm’s Perspective The resource-based view considers acquisitions as a means to improve competitive advantage and perceives target firm executives as part of the critical resources that are acquired. That is, target CEOs can be important ―assets‖ to acquiring firms to the extent that they embody valuable human capital that can enhance performance. 4 Their expertise may derive from general or firm-specific investments that provide the basis by which the firm can build a long-term competitive advantage (Barney, 1991; Shleifer and Summers, 1988, Castanias and Helfat, 1991).5 Target CEOs with valuable human capital can improve firm performance through various mechanisms—by working harder or in a more productive manner, or by leveraging greater ability or skill. CEO skills can include both general management skills and firmspecific skills.6 Managers can invest in developing knowledge or relationships that are specific to the firm, for example, a deep understanding of a technology or relationships with customers, suppliers and 4 Target executives as valuable assets, not liabilities (Walsh and Ellwood, 1991) is a perspective that is consistent with the notion that firms are comprised of both physical and human capital (Harris and Helfat, 1997; Rajan and Zingales, 1998; and Bailey and Helfat, 2003). 5 Castanias and Helfat (1991, 1992, 2001) develop the notion of ―managerial or earned rents‖ as ―those portions of the firm‘s rents that management creates from its superior management skills‖ that provide incentives for managers to make investments in firm-specific human capital and to perform well. 6 Becker (1962) distinguishes between ―general‖ human capital (which is valued by all potential employers) and ―firm-specific‖ human capital (which involves skills and knowledge that have productive value in only one particular company). More recently, Lazear (2003) has argued that a more informative view of firm-specific human capital is that each job requires a slightly different combination of a multiplicity of general skills and ―firms use the skills in different combinations with different weights attached to them.‖ 4 critical employees. It is these firm-specific skills of managers that ultimately contribute to the superior returns of strong-performing firms. Several early empirical papers on M&A based on transactions during the 1980s, find evidence consistent with the managerial human capital view. For example, Cannella and Hambrick (1993) document that post-acquisition performance and retention of target management is positively correlated. Matsusaka (1993) finds positive event returns when acquirers retain the top management team of the target firm and negative returns when acquirers replace target management. 7 In a very recent paper, Bargeron, Schlingemann, Stulz, and Zutter (2009) find that target CEO retention is positively correlated with firm performance and that target announcement abnormal returns are higher when private bidders retain target CEOs. Broadly consistent with our theory, the authors propose that certain classes of bidders (e.g., private vs. publicly-traded firms) are more likely to retain valuable CEOs. The managerial human capital view recognizes heterogeneity among managers and suggests that acquiring firms should only seek to retain target CEOs that are successful. What constitutes a successful CEO? One direct way to characterize successful CEOs is to identify those that are effective in improving firm performance. While CEOs cannot control many events that determine how well their firm performs, countless studies (especially those analyzing turnover) use firm performance as a measure of a CEO‘s effectiveness or success (e.g., Weisbach, 1988). Certainly, boards of directors must at least consider an executive‘s track record in evaluating their effectiveness. Building on this research, we use measures of pre-acquisition performance of the target firm to characterize successful target CEOs. We expect target firm performance (pre-acquisition) to be positively correlated with target CEO retention. Another way to characterize CEO success is by using compensation of the target CEO prior to the acquisition. Wages are a reasonable proxy for the marginal productivity of labor whether the productivity is a result of greater effort by the employee, greater skill, or a combination of the two. Harris and Helfat (1997) argue that CEO compensation might be one indicator of the value of the human capital that the 7 More recently, Zollo and Singh (2004) show that the capabilities of managers in both the acquiring and target firms are an important factor in determining post-merger performance. 5 CEO brings to the target firm. Firm-specific skills generate rents and firms can choose to share these rents with managers for several reasons—first, in order to retain them, but also to provide an incentive for managers to continue to make investments in these skills. Parsons (1972) models firm and employee investments in firm-specific human capital and resulting implications for turnover. The model predicts that workers who receive a wage-premium for skills (i.e., capturing returns on specific investments) will be less likely to quit. This is broadly consistent with a positive association between pay levels and a higher probability of retention. As a result, we expect CEO compensation (pre-acquisition) to be positively correlated with target CEO retention. Finally, we use tenure in position of the CEO to represent the extent of the CEO‘s firm-specific skills or experience. Some argue that CEOs with extended tenure are more likely to be entrenched or resist change, while others find evidence that more extensive firm-specific experience (longer tenure) has beneficial performance effects (e.g., Kor and Mahoney, 2005). In developing our hypotheses, we adopt the view that CEO experience and tenure contribute to firm-specific human capital and expect tenure in the CEO position (pre-acquisition) to be positively correlated with target CEO retention. We employ all three measures to represent target CEO success or the value of the target CEO‘s human capital. While each measure has drawbacks, by using all three, we hope to mitigate some of the limitations of each. The managerial human capital view suggests that target CEO retention should be positively correlated with target firm performance, CEO compensation, and CEO tenure in the position just prior to the acquisition. Hypothesis 1: Conditional on a merger, the probability of acquiring firms retaining target CEOs will be positively related to the success of the target CEO. Hypothesis 1a: Target CEOs of better-performing firms will be more likely to be retained. Hypothesis 1b: Target CEOs with higher compensation will be more likely to be retained. Hypothesis 1c: Target CEOs with longer tenure in the position will be more likely to be retained. 6 2.2. The Target CEO’s Perspective: The Role of Governance While acquiring firms have the incentive to retain successful target CEOs, retention is a joint decision by both acquiring firms and the target CEOs themselves (Buchholtz, Ribbens, and Houle, 2003). From the target CEO‘s perspective, the attractiveness of the acquiring firm as a potential employer can depend upon a variety of factors. For example, target CEOs may be attracted to future promotion opportunities in the acquiring firms as described in the Booz & Co. study (Lucier, Kocourek, and Habbell, 2006): ―Why do so many former chiefs stay on? There are three reasons. First, being acquired by a larger company may be a passport to greater opportunity, even for executives who are losing their CEO title. … Second, CEOs may stay with the acquiring company because there is a reasonable chance that they could move on to the chief executive role of the larger company in the future. … Third, when a deal takes an acquirer into a new business, that company will often insist that much-needed senior talent remain with the new entity. In this case, the CEO may agree, as part of the deal to remain with the new company, particularly if his or her skill set and leadership are viewed as critical for success.‖ 8 In addition to considering promotion opportunities, if CEOs have made firm-specific investments, they may be concerned about the protection of these investments because the acquirer shareholders may hold them up (Grossman and Hart, 1986 and Hart and Moore, 1990). Whether in honoring a promise regarding promotion or protecting firm specific-investments of the CEO, the governance of the acquirer can be an important factor in the CEO‘s decision to stay. We begin with the notion that target CEOs value the right to make decisions or to ―be the boss.‖9 Why might managers prefer to make decisions without the interference of shareholders? One reason is that managers have different preferences than non-managerial shareholders. For example, CEOs might have a preference for a no layoff policy and want to protect former employees or other assets of the acquired firm.10 Related to this, Aghion and Tirole (1997) show that unless principal and agent 8 A more recent example of the importance in retaining a successful target CEO is when JP Morgan Chase acquired Banc One with the plan to promote its CEO (Jamie Dimon) to the chief executive of the merged entity (see ―Moving the Market: J.P. Morgan‘s Net Jumps Nearly 79%‖, R., Sidel, Wall Street Journal, October 20, 2005.) 9 While we assume that the most important factor to target CEOs is a commitment to decision rights, they also care about other commitments, for example, regarding promotion opportunities and pay. 10 Landier, Nair and Wulf (2009) show that social factors measured by proximity to headquarters can play a role in a CEO‘s decision to layoff divisional employees. Divisions that are located close to headquarters are less likely to experience layoffs especially when headquarters are located in less-populated areas (and play a stronger role in the local community). 7 preferences are perfectly aligned, the agent strictly prefers to have control over decisions. Another reason is that managers may believe that they are better equipped to make decisions in comparison to shareholders either because they have better information, more relevant expertise, or because of differing beliefs or priors (e.g., Van den Steen, 2010). In the case of differing priors, managers may have a strong vision for what direction the firm should take, and this is at odds with the shareholders‘ view about the best course of action (e.g., Boot, Gopalan, and Thakor, 2006). The literature on differing priors is more closely akin to research in strategy in which managers have skills and capabilities that lead to better decisions (Finkelstein and Hambrick, 1989). Note that even though target CEOs may have different preferences or beliefs from the shareholders, the shareholders may still find it valuable to retain the target CEO because of firm-specific human capital that will be lost if s/he leaves. Regardless of the reason for valuing discretion—whether it be because of different preferences or differing priors between managers and shareholders—CEOs will prefer environments that maintain managerial discretion. Since it is difficult to write a contract that unambiguously protects decision rights in all contingencies, the acquiring firm may opportunistically renege on any promises made (Williamson, 1973). Because of this, target CEOs prefer firms that can make credible commitments. What types of firms are able to credibly commit to maintaining managerial discretion? We consider and discuss two types of governance environments of acquirers: firms with governance provisions that shift the balance of power from shareholders to managers and firms with CEOs that have large equity holdings. While much of the finance literature focuses on the role of governance in protecting investors, in this paper we focus on the protection of managers. To the extent that governance provisions make it difficult for shareholders to overrule management and they are costly to change, such provisions will limit shareholder interference in the running of the company by top management. For example, executive severance agreements provide compensation to senior executives upon an event such as termination, demotion, or resignation. They restrict shareholder rights since they limit the ability of a controlling shareholder to fire management without incurring an additional cost (Gompers, Ishii, and Metrick, 2003). Golden parachutes are another example of a costly 8 provision to shareholders in the event of a change in control.11 Classified (or ―staggered‖) boards place directors into different classes that serve overlapping terms, making it more difficult for large shareholders to gain control of the board. Target CEOs should be less concerned about interference from shareholders in acquiring firms that offer severance agreements, golden parachutes, or have classified boards. We expect that acquiring firms with governance provisions that protect managerial rights will be more able to credibly commit to maintaining managerial discretion.12 In addition to governance provisions, acquiring firms with CEOs that hold large equity stakes also may be able to make credible commitments. In deciding whether to stay, the target CEO may seek commitments from those parties in the acquiring firm who hold control rights (i.e., the shareholders). Since the acquiring CEO is generally a key player in the negotiations between the acquirer and target, commitments may often be made and communicated by the acquiring CEO. An acquiring CEO would have a strong reputational incentive not to renege on any promise made personally to the target CEO, and with large equity holdings, s/he also has the control rights needed to make the commitment credible. In addition to being more involved in negotiations, an acquirer CEO may have preferences and beliefs that are more congruent with those of the target CEO in comparison to other parties with control rights (nonCEO shareholders). For example, CEOs may highly value relationships with other managers and employees, while non-CEO shareholders may place little value on such relationships. We expect, as Aghion and Tirole (1997) and Baker, Gibbons and Murphy (1999) show, that any commitment to delegate decision-making authority (i.e., ―real‖ authority) to the target CEO will be more credible when 11 More broadly, golden parachutes can be thought of as payments to target CEOs in exchange for firm-specific human capital investments (Castanias and Helfat, 1991). As such, they align incentives of target CEOs with shareholders thereby leading to efficient transactions and transfer of control to acquiring firms (Lambert and Larcker, 1985; Knoeber, 1986; Singh and Harianto, 1989). 12 While much of the finance literature assumes that managerial supportive provisions lead to ―entrenchment‖ and ultimately destroy shareholder value, there are clearly costs and benefits of governance provisions. Fisman, Khurana, and Rhodes-Kropf (2005) adopt a more balanced view by analyzing trade-offs of different governance environments and find evidence that provisions that support managers can be beneficial in certain circumstances. 9 the holders of ―formal‖ authority have similar preferences to the target CEO. This is more likely when one of the major shareholders is the acquirer CEO.13 Our human capital view posits that certain governance and ownership structures enhance the ability of the acquiring firm to credibly commit to maintaining target CEO discretion post-merger. Specifically, a credible commitment to managerial discretion is more likely in acquiring firms with governance provisions that limit shareholder intervention and acquiring firms with CEOs with large equity holdings that have similar preferences to target CEOs. As such, we would expect a higher probability of retaining successful target CEOs when the acquiring firm‘s governance is characterized by: (i) governance provisions that are more likely to maintain managerial discretion, or (ii) a higher fraction of stock held by the acquiring CEO. Hypothesis 2: Acquiring firms that are more able to credibly commit to maintaining managerial discretion are more likely to retain successful target CEOs. Hypothesis 2a: The greater the use of governance provisions by the acquiring firm that protect managerial discretion, the more positive the relationship between target pre-acquisition performance and CEO retention. Hypothesis 2b: The higher the fraction of stock held by the acquiring CEO, the greater the ability to credibly commit to maintaining target CEO decision rights, and the more positive the relationship between target pre-acquisition performance and CEO retention. 3. Data and Econometric Specification 3.1. Sample: The data in this paper come from a variety of sources. Data on merger transactions come from Securities Data Company (SDC). Information on ownership and target CEO retention comes from Securities and Exchange Commission (SEC) filings surrounding the merger announcement and completion dates. CEO characteristics come from proxy statements and ExecuComp. Firm financials come from Compustat. Corporate governance provisions come from Investor Responsibility Research 13 This line of reasoning contributes to the literature which analyzes the effect of ownership structure on managerial discretion (e.g., Demsetz, 1983; Burkart, Gromb and Panunzi, 1997). Burkart, et. al. develop a theoretical model of the trade-off between gains from monitoring and those from managerial discretion in which they argue ―that a firm‘s ownership structure can act as a commitment device to delegate a certain degree of control to management.‖(pg. 694). They focus on dispersed shareholders, while we focus on ownership by existing managers. 10 Center (IRRC) as reported by Gompers, Ishii, and Metrick (2003). We also use the Directory of Corporate Affiliations and Dun and Bradstreet Million Dollar Directory to verify target CEO post-merger status as SEC filings only cover the top-five highest paid executives in the firm. Finally, we analyze merger announcements through Lexis/Nexis to verify dates and to document announced plans for target CEO retention. The initial sample of mergers includes all U.S. mergers listed by SDC with announcement dates between 1/1/1994 and 12/31/1998 that meet the following criteria: (i) the merger is not classified as a share repurchase, a self-tender, or a sale of a minority interest; (ii) the method of financing is classified as either a stock swap or a tender offer transaction; (iii) both acquirer and target firms are publicly traded and listed on the CRSP database, and (iv) the market capitalization of target firms is greater than $50 million. A key feature of this study distinct from earlier empirical work is that we focus on select characteristics of both the acquirer and the target firms. As such, we require the firms to have proxy data on both acquirer and target for the study period and for them to be covered by ExecuComp. This results in a sample of 220 transactions comprised of 188 completed and 32 uncompleted mergers. In this paper, since we are focused on target CEO retention, we analyze only completed mergers. 14 To collect detailed information on both acquirer and target firms, CEO characteristics, and ownership, we use three SEC filings: (i) the proxy statement, Form 10-K, or similar document containing ownership data in advance of the last annual meeting before the acquisition announcement; (ii) the proxy statement, Form S-4, Form DEF 14, or other document filed in connection with the transaction; and (iii) the first and second proxy statement of the acquiring company filed after the merger becomes effective. 14 One important issue in the use of our sample selection criteria is how representative our sample is of merger transactions during this time-frame.By using the above screens, do we systematically bias the sample in such a way that the study results are not representative of a larger sample of transactions? To address this, we conduct some comparisons between the study sample and a sample of more than 1000 mergers covered by SDC during a similar timeframe. This larger sample of transactions is based on the first three screens for the study sample, but we do not impose that the market capitalization is greater than $50 million. We then exclude the study sample transactions from this larger sample. We compare the means and medians of transaction characteristics, and both acquirer and target firm characteristics for both the study sample and the broader sample of transactions and find that summary statistics are generally qualitatively similar between the two samples. Another selection issue that is not possible to address with our data is that we don‘t observe those CEOs that are offered a position by the acquiring firm, but choose not to stay. 11 3.2. Econometric Specification: To explore the determinants of target CEO retention rates, we estimate the following probit model conditional on the firm being a target in transaction i at time t: Pr(CEORET / t arg et ) it1 (1it1 2 it1 3Tit1 * X it1 4 it1 5 it1 ) it (1) where CEORET is a dummy variable equal to one if the target CEO is retained by the acquiring firm in the year after the merger (t+1) and zero otherwise; T, X, and Z represent target firm characteristics, acquirer governance characteristics, target CEO characteristics, and transaction characteristics, respectively, in the year prior to the merger (t-1). Target firm characteristics include size and return on assets, while target CEO characteristics include compensation paid and tenure in position in the year prior to the acquisition. Acquirer governance characteristics include the governance index, CEO ownership, and block shareholdings. We include interaction terms between pre-acquisition performance and select governance measures as appropriate to evaluate support for each hypothesis. Transaction characteristics include whether the acquisition is a tender offer or merger, the relative size of the target to the acquirer, and the number of days from announcement to merger completion. all models use mean-centered variables (or deviations from the mean) for interaction terms and the respective main effects. We include year indicators and report heteroskedastic-robust standard errors in all specifications. Dependent Variables: Data collection on CEO retention begins with both announcement and completion dates of the merger as reported by SDC (and verified using Lexis/Nexis). The fiscal year of the target firm prior to the year of announcement is considered to be year (–1). Year (+1) is the fiscal year of the merged firm following completion of the merger. For each target firm in the fiscal year prior to the announcement date (–1), the individual occupying the position of CEO is identified using the proxy statement filed with the SEC. In the first year following the completion of the merger (+1), the acquirer‘s proxy statement is analyzed to determine retention rates of target CEOs. The definition of retention is whether the target CEO is reported in any capacity (i.e., as an officer or director of the merged firm) in the acquirer‘s proxy statement in the year following merger 12 completion and is represented by an indicator variable. An additional retention measure includes retention as an officer in the second year following the merger (+2). Independent Variables: In this paper, we use three measures to represent the value of the target CEO to the acquirer: target firm performance, target CEO compensation, and target CEO tenure in position (all in the year prior to the acquisition, t-1). To represent target firm performance in the years prior to the merger, we use an industry-adjusted accounting measure from Compustat. The measure is return on assets (ROA) and is defined as operating income divided by assets in t-1. This measure is deviated from industry medians. For completeness and to avoid misclassifying performance due to outliers, we also calculate three-year averages of this measure (based on t-3, t-2 and t-1). Turning to CEO pay, we measure compensation as total compensation as reported in ExecuComp (which includes salary, bonus and the value of stock options, restricted stock and other forms of long-term incentives). Finally, we use tenure or the number of years in position as CEO as a proxy for the target CEO‘s firm-specific human capital. In this paper, we use two measures of the acquiring firm‘s governance: (i) broad governance provisions represented by a governance index or the G-index (Gompers, Ishii, and Metrick, 2003, or GIM) and (ii) the fraction of stock held by the acquiring CEO. The G-index characterizes the degree to which the firm‘s governance provisions support owners versus managers or ―the balance of power between shareholders and managers‖ (GIM, 2003). As mentioned earlier, to the extent that the G-index proxies for provisions that make it difficult for shareholders to "punish" or overrule management, and if they are costly to change, such provisions limit shareholder interference in top management discretion. This index considers 24 different provisions in 5 categories—tactics for delaying hostile bidders, voting rights, director/officer protection, other takeover defenses, and state laws (refer to Table A1 for details by group). The index, G, is formed by adding one point if the firm has a specific defensive provision in place and zero otherwise, leading to values between 0 and 24. Larger values of G represent more restrictions on 13 owners and in turn more support for managerial discretion.15 Because this index is the simple sum of various governance measures, it is relatively common in the corporate governance literature to use quartiles of the index (e.g., Cremers and Nair, 2005). Moreover, since our focus is on the interaction term between the governance index and firm performance and the effect on retention, and not the level effect of the governance index on retention, we construct an indicator variable equal to one if G is in the top quartile of the index (i.e., greater than 12) and classify these acquirers as firms that commit to maintaining managerial discretion. Or, said another way, firms with G greater than 12 are firms with provisions that increase the ability of the acquiring firm to credibly commit to managerial discretion for the target CEO. Our second measure of the acquiring firm‘s governance is CEO ownership calculated as the fraction of the firm owned by the acquirer CEO. We use the number of shares listed in SEC proxy statements in year (t-1) and divide that by the total number of shares outstanding as reported directly in SEC filings. Acquiring CEOs with large stockholdings are important since they have substantial voting control and, when they have similar preferences to target CEOs, they are more effective in maintaining managerial discretion. We control for a number of variables that are important to merger outcomes including characteristics specific to the transaction and the target firm. First, we include a set of control variables related to the transaction. When the size of the target firm is large relative to the acquiring firm, the challenge of postmerger integration may be more difficult (Zollo and Singh, 2004). We might expect the likelihood of target CEO retention to be higher, so we control for the size of the target firm relative to the size of the acquiring firm. To measure relative size, we calculate the ratio of the target firm assets to that of the sum of assets for the acquirer and target firm in the year prior to the merger. When acquirers operate in different industries than the target firm, the industry-specific skills of target CEOs should be of greater 15 As described in GIM: ‗We divide the rules into five thematic groups and then construct a ―Governance Index‖ as a proxy for the balance of power between shareholders and managers. Our index construction is straightforward: for every firm we add one point for every provision that reduces shareholder rights. This reduction of rights is obvious in most cases; the few ambiguous cases are discussed. Firms in the highest decile of the index are placed in the ―Dictatorship Portfolio‖ and are referred to as having the ―highest management power‖ or the ―weakest shareholder rights‖; firms in the lowest decile of the index are placed in the ―Democracy Portfolio‖ and are described as having the ―lowest management power‖ or the ―strongest shareholder rights.‖‘ 14 value to the acquiring firm. We expect lower retention rates of target CEO when the acquiring and target firms operate in the same industry (Walsh, 1989; Buchholtz, Ribbens, and Houle, 2003). We create an indicator variable equal to one if the acquirer and target firms operate in the same 3-digit SIC industry and zero otherwise. The time it takes to complete a merger can be a function of the complexity of merger negotiations between the acquiring and target firms. This might be larger when negotiations involve retention of valuable human capital. We include the number of days until completion (i.e., the number of days between announcement and completion of the merger) as reported by SDC. Also, we control for target firm characteristics. Larger and more complex firms may require managers with unique skills and may allow managers more opportunities to create value (Finkelstein and Hambrick, 1989). To control for firm size, we include the logarithm of target assets in the year prior to the merger. Finally, in the regressions that include governance measures, we control for the presence of blockholders in the acquiring firm (i.e., the fraction of shares held by investors with greater than or equal to 5% of the shares, excluding the CEO). Due to their significant control rights, blockholders can be very influential in decisions around M&A including the decision to retain the target CEO. 4. Results In Table 1, we report summary statistics for all the variables in our analysis. The average retention rate between years (–1) and (+1) for target CEOs in any capacity (i.e., as either an officer of the merged company or director of its board) is 50%. The comparable retention rate as an officer of the merged firm is 22% between years (–1) to (+2). These percentages imply turnover rates that are much higher in comparison to the approximate figure of 10% found in other studies analyzing firms without a change in control (e.g., Martin & McConnell (1991)). However, it is not surprising that target CEOs are either forced to leave or voluntarily choose to after their firm has been acquired. Other notable statistics are the industry-adjusted performance measures for target firms. On average, target firms have higher ROA relative to industry peers (positive ROA), but lower revenue growth (negative sales growth). In Table 2, we report means for the key variables split into deals in which the acquiring firm retained the target CEO and deals in which the target CEO was not retained. The deals are different in a 15 comparison of means of several key variables and these differences are generally consistent with our predictions. The total compensation of the target CEO prior to the acquisition is larger in deals in which the target CEO is retained (approximately $3.1 million vs. $1.8 million). The target firms in deals in which the target CEO is retained are more profitable (higher ROA). The relative size of the target firm to the acquiring firm is much larger in deals in which the target CEO is retained (0.38 vs. 0.21). In Table 3, we include a correlation matrix of all of the variables used in the analysis. We can see positive and statistically significant correlations between target CEO retention and target performance and CEO compensation, but no relationship to tenure. Another notable positive and statistically significant correlation is that between CEO pay and both measures of target size: the absolute size (i.e., the logarithm of target assets—correlation 0.44) and the relative size to the acquiring firm (i.e., the ratio of target assets to the sum of acquirer and target assets—correlation 0.22). Since pay is highly correlated with target firm size, we initially exclude size in the regressions that include pay, but then include all measures in the fully-specified model. The probit regressions analyzing the relation between target CEO retention and measures of the value of the CEO are shown in Table 4 columns 1 through 8. All regressions include year dummies and heteroskedastic-robust standard errors. The Wald Chi-sq. tests evaluate the joint significance of the variables that represent the value of the CEO by comparing the restricted model (1) to the more fullyspecified models reported in each column. We designate the target CEO as being retained if s/he remains as an officer or director in the merged firm in the year following the merger (+1). In this table, we are evaluating the relationship between the probability of target CEO retention and measures of target firm performance, target CEO pay, and target CEO tenure in position (i.e., Hypothesis 1). In column 2, we evaluate the relationship between target CEO retention and the measure of pre-acquisition performance (ROA) and find that they are positively correlated and statistically significant at the 1% level. Betterperforming target CEOs are more likely to be retained by acquiring firms.16 In columns 3 and 4, we 16 An alternative explanation is that good target CEOs may simply prefer to stay with acquiring firms that are betterperforming. However, the data do not support this simple explanation. In a regression of target CEO retention on 16 evaluate the relationship between retention and pay. In column 3, we find that the coefficient on target CEO compensation is positive and statistically significant. (Note the number of observations decline due to missing data in ExecuComp on target CEO pay.) However, when we include both the logarithm of target assets and relative target size in column 4, the magnitude of the coefficient on pay declines and it is no longer statistically significant. As mentioned earlier and as seen in the correlation matrix (Table 3), both measures of target size are correlated with target CEO pay, especially the logarithm of target assets (correlation is 0.44).17 Since the pay result is sensitive to controlling for target size, we conclude that our evidence is suggestive that higher paid target CEOs are more likely to be retained. In column 5, we evaluate the tenure of the target CEO and find no relationship between tenure in position and the probability of retention.18 Finally, in columns 6 and 7, we include performance, pay and tenure. We find a strong positive relationship between retention and performance, some suggestive evidence of a positive relationship with pay, but no relationship with tenure. The p-values of the Wald tests for joint significance are generally statistically significant in the regressions that introduce the performance and pay variables, but insignificant in those introducing tenure. The positive and significant coefficients on target firm performance and target CEO compensation in the year prior to the merger support Hypothesis 1a and 1b. The evidence of a link between retention and performance is much stronger than that with pay. However, we find no support for Hypothesis 1c (tenure). Several other findings are worth noting. Target CEOs are more likely to be retained in deals with relatively larger target firms and in deals that take longer to complete suggesting that CEOs are retained in more complex transactions. It is also possible that deals in which the target CEOs are retained acquiring and target firm performance measures (ROA) and the interactions between acquiring and target performance, we find no evidence that better-performing acquiring firms are more likely to retain good target CEOs. Moreover, there is no evidence that the performance of the acquiring firm is positively correlated with the governance measures in our sample. In regressions of acquirer performance (ROA) on the governance indicator and CEO ownership, all coefficients on the governance/ownership measures are statistically insignificant (unreported). 17 When we use CEO pay and target assets in place of their logarithmic transformations, the coefficient on CEO pay is positive and statistically significant at the 5% level in all specifications (unreported). This could suggest that high quality CEOs are at the top of the pay distribution. 18 We also experimented with specifications that allow for non-linear relationships between retention and tenure by including squared-terms of tenure, but find no robust results. We did the same with target CEO age (or proximity to retirement), but found no consistent patterns. 17 take longer precisely because of the challenges involved in clarifying job responsibilities and making commitments to the target CEO. Interestingly, target CEOs are less likely to be retained in transactions that are tender offers. Much of the earlier finance research which supports the disciplinary motives of the market for corporate control are based on samples of tender offer transactions. Since tender offers tend to be hostile transactions, not retaining the CEO is more likely. To evaluate whether the inclusion of tender offers in our sample materially affects our results, we repeat the fully-specified model in column 7 of Table 4 on a restricted sample that excludes tender offer transactions. These results, shown in column 8, are very similar to those found in the complete sample, despite the reduction in sample size. Overall, we find support for a managerial human capital explanation. Target CEOs are more likely to be retained as either an officer or director in the merged firm when the target firm is better-performing measured by industry-adjusted ROA. While previous studies in finance of hostile takeovers have shown that poorer-performing target CEOs are more likely to be fired (also consistent with our findings), we show that the performance-retention link holds in a sample of friendly mergers. Another interesting finding is that higher paid target CEOs appear more likely to be retained. We know of no other study that has documented this relationship, but we also caution that the evidence supporting this is only suggestive. Importantly, while the positive coefficient on performance is also consistent with the agency explanation that poor-performing target CEOs are dismissed, the positive coefficient on pay seems to be at odds with this explanation. If CEOs are paid more because they are ―entrenched‖, then we would expect pay and retention to be negatively correlated—i.e., higher paid CEOs would be less likely to be retained. The fact that we find suggestive evidence of the opposite seems to be more consistent with a managerial human capital explanation. Finally, the weak results on tenure are generally consistent with other studies (e.g., Buchholtz, Ribbens, and Houle, 2003) that find no evidence of any linear relationship between target CEO departure and tenure. 18 4.1. Role of Governance: Let us now analyze the relationship between the retention of the target CEO and firm performance and how that varies with the acquiring firm‘s governance environment. In Table 5, we again report probit regression results based on the whole sample (column 1) and the sample that excludes tender offer transactions (column 2). In both regressions, we include our two measures of governance for the acquiring firm: the governance indicator representing managerial discretion (i.e., if G is in the top quartile of the index, G>12); and the fraction of shares owned by the CEO. We include the two measures directly and also include interaction terms between each governance measure and target ROA (all variables are mean-centered).19 Since powerful shareholders of the acquiring firm might influence the decision to retain target management, we also include the fraction of shares held by blockholders (excluding the CEO) as a control variable. In both models, the coefficient on target ROA is positive and statistically significant. Of greater interest, the coefficient on the interaction between the governance indicator and target ROA is positive and significant. This finding is consistent with H2a. Better-performing target CEOs are more likely to be retained when the acquiring firm has governance provisions that support managers. Moreover, the coefficient on the interaction between the acquirer CEO ownership and target ROA is positive and significant, a finding that is consistent with H2b. Better-performing target CEOs are more likely to be retained when the CEO of the acquiring firm owns a higher fraction of the firm‘s stock. Note this latter result is also consistent with the simple agency explanation in that acquirer CEOs with larger equity stakes are more likely to dismiss poor-performing target CEOs. However, the stronger retention- performance link in firms with governance provisions that support managers is at odds with this explanation. The agency explanation suggests that the retention-performance link should be stronger in firms with governance that supports shareholders, yet we find the opposite.20 19 In order to address criticisms raised by Ai and Norton (2003) regarding interaction effects in non-linear models, we created figures that show the marginal effects as calculated by the ―inteff‖ program and procedure (STATA) (not included in paper). The interaction marginal effects are consistent with the sign of the coefficients on the interaction terms (governance and CEO ownership interaction effects) for both samples. 20 To evaluate the robustness of the effect of governance on the retention of successful target CEOs, we conduct additional analyses (unreported). First, we analyze all quartiles of the G-Index governance measure and find that 19 There are a couple of other notable points in Table 5 to highlight. First, the p-values of the Wald Chisq. tests show that the joint significance of the performance and governance variables is statistically significant in both columns (1) and (2). Second, the coefficient on days until completion is positive and significant in both specifications. The fact that mergers that retain target CEOs take longer to complete is consistent with our theory and the idea that getting promises or commitments from influential shareholders may extend the negotiations and lead to longer completion times. Finally, the coefficient on the fraction of shares owned by blockholders in the acquiring firm is negative and significant suggesting that powerful (non-CEO) shareholders are less likely to retain target CEOs. Overall, the findings in Table 5 support a managerial human capital explanation. Better-performing target CEOs are more likely to be retained when acquiring firms have governance provisions that support managers and when acquiring firms have CEOs with large equity holdings. We argue that both of these findings are consistent with the explanation that acquiring firms that are more able to credibly commit to maintaining managerial discretion are more likely to retain successful target CEOs. That is, target CEOs that prefer ―to be the boss‖ will be more likely to stay with an acquiring firm when governance provisions maintain managerial discretion and acquirer CEOs (with similar preferences to target CEOs) have greater control. 5. Discussion and Conclusion In contrast to physical capital or assets, human capital cannot be ―owned.‖ As such, one of the most significant challenges facing acquiring firms is how to retain the valuable human capital of the firm that they are buying. We develop a managerial human capital view in the context of M&A that recognizes the importance of retaining successful target management and the role of the acquiring firm‘s governance structure in doing so. In a joint analysis of retention and governance, we explore the conditions under indeed, the effect only holds for the firms in the top quartile. That is, the coefficients on the interaction terms between the lower quartile dummies and ROA are small and not statistically significant. Second, we use another common governance index (the E- index of Bebchuk, Cohen and Ferrell, 2008) that is based on 6 governance provisions that have been shown to limit shareholder power. They include staggered board, limitation on amending bylaws, limitation on amending the charter, supermajority to approve a merger, golden parachute, and poison pill). The positive effect of governance on retention of better-performing CEOs is robust to using the top quartile of this alternative governance measure. 20 which target CEOs are retained by acquiring firms. We find evidence that is broadly consistent with a managerial human capital view. First, acquiring firms retain ―successful‖ target CEOs, i.e., those that come from better-performing firms and are higher paid. Moreover, they are more likely to do so with governance provisions and ownership structures that allow acquiring firms to credibly commit to maintaining managerial discretion. Specifically, the retention-performance link is stronger when the acquiring firm‘s governance supports managers (as measured by the G-index) and the acquirer CEO has control rights (i.e., holds a higher fraction of firm stock). Taking our findings together as a whole, they suggest a more nuanced view of the role of governance in retaining valuable human capital in the governing body of the post-merger entity. We conclude that acquirers appear to be making optimal decisions to retain valuable CEOs in the presence of governance structures that are simultaneously beneficial to both managers and owners. Managers and owners may not necessarily be at odds. Much of the early research that supports the disciplinary view of takeovers is based primarily on tender offer transactions occurring in hostile settings where managerial interests clearly conflict with those of shareholders (e.g., Martin & McConnell, 1991). In contrast to this literature, we use a sample of primarily friendly mergers during the 1990s that typically involve negotiations between the CEOs of both the acquiring and target firms. Negotiated mergers are interesting to study because, it is exactly these settings in which target managers may be valuable assets to acquiring firms, and the governance environment may affect the acquirer‘s ability to retain valuable human capital. Clearly, there are several limitations with this study. First, our measure of retention is based on archival sources, and as a result, we cannot determine how much discretion is given to the target CEO that stays with the merged firm. Another limitation is that our results are based on a governance index that is comprehensive and includes a broad set of provisions (yet is robust to a narrower list). Future research may employ finer-grained measures that identify the most effective corporate governance provisions. Despite these limitations, we believe that our results identify the conditions under which successful target CEOs are retained by acquiring firms. One advantage of focusing on retention around mergers, rather than retention in general, is that we are able to isolate a specific corporate event in which decision-makers 21 of both the acquiring and target firms make a decision that potentially has important implications for the success of the merger. Our tests address the marginal impact of governance provisions and ownership structure that lead to the retention of valuable human capital in the post-merger firm. The evidence presented in this paper provides a new and interesting insight into the relationship between managers and owners in M&A and the role that governance may play in the retention of valuable human capital of the target firm. The traditional view of the market for corporate control and efficiency arguments typically consider target managers as ―liabilities‖ and emphasize the monitoring and disciplining of managers by owners. In contrast, this paper considers managers as ―assets‖ and presents evidence suggesting the objectives of owners and managers are not necessarily at odds. Owners of acquiring firms can benefit from retaining human capital of target firms as they may be valuable resources central to the firm‘s long-term competitive advantage. Acquiring firms retain these valuable resources when the ownership structure and governance environment provide credible commitments to maintaining managerial discretion. Our findings suggest that a human capital explanation might be more consistent with the characteristics of the friendly, negotiated mergers during the 1990s. Perhaps increased ownership by CEOs has contributed to a more nuanced approach to retention of the human capital of target firms. Acquiring firms may have developed enhanced skills in identifying valuable human capital and recognizing the role of their governance environment in retaining successful managers. Our theoretical and empirical contributions shed light on changes in how the market for corporate control operates while providing some direction for future research. 22 References Aghion, P., J. Triole. 1997. Formal and Real Authority in Organizations. Journal of Political Economy, 105: 1-29. Ai, C. and E.C. Norton, 2003. Interaction Terms in Logit and Probit Models. Economic Letters, 80 (1): 123-129. Andrade, G., M. Mitchell, E. Stafford. 2001. New Evidence and Perspectives on Mergers. Journal of Economic Perspectives, 15: 103-120. Bailey, E., C. Helfat. 2003. Management Succession, Human Capital, and Firm Performance: An Integrative Analysis. Managerial and Decision Economics, 24: 347-369. Baker, G.P., R. Gibbons, K.J. Murphy. 1999. Informal Authority in Organizations. Journal of Law, Economics & Organization, 15: 56-76. Bargeron, L.L., F.P. Schlingemann, R. Stulz, and C.J. Zutter. 2009. Do Target CEOs Sell Out their Shareholders to Keep their Job in a Merger? NBER Working Paper, no. 14724. Barney, J. B. 1991. Firm Resources and Sustained Competitive Advantage. Journal of Management, 17: 99-120. Bebchuk, L.A., A. Cohen, and A. Ferrell. (2009). ―What Matters in Corporate Governance?‖ Review of Financial Studies, 22(2); 783-827. Becker, G.S. 1962. Investment in Human Capital: A Theoretical Analysis, Journal of Political Economy, 70: 1-14. Bertrand, M., A. Schoar. 2003. Managing With Style: The Effect of Managers on Firm Policies. Quarterly Journal of Economics, 118: 1169-1208. Boot, A.W., R. Gopalan. A.V. Thakor. 2006. The Entrepreneur's Choice between Private and Public Ownership. Journal of Finance, 61: 803-836. Booz & Co. (Lucier, C., P. Kocourek, and R. Habbell) 2006. CEO Succession 2005: The Crest of the Wave. Booz & Co. Magazine. Strategy+Business, 43, summer, reprint 06210. Buchholtz, A.K., B.A. Ribbens, I.T. Houle. 2003. The Role of Human Capital in Postacquisition CEO Departure. Academy of Management Journal, 46: 506-514. Burkart, M., D. Gromb, F. Panunzi. 1997. Large Shareholders, Monitoring and the Value of the Firm. The Quarterly Journal of Economics, 112(3): 693-728. Cannella, A. A., D.C. Hambrick. 1993. Effects of Executive Departures on the Performance of Acquired Firms. Strategic Management Journal, 14: 137-152. Castanias, R.P., C.E. Helfat. 1991. Managerial Resources and Rents. Journal of Management, 17: 155171. __________ 1992. Managerial and Windfall Rents in the Market for Corporate Control. Journal of Economic Behavior and Organization, 18:153-184. __________ 2001. The Managerial Rents Model: Theory and Empirical Analysis. Journal of Management, 17: 155-171. 23 Cremers, M. K. J., V.B. Nair. 2005. Governance Mechanisms and Equity Prices. The Journal of Finance, 60(6): 2859. Daily, C. M., D.R. Dalton, N. Rajagopalan. 2003. Governance Through Ownership: Centuries of Practice, Decades of Research. Academy of Management Journal, 46(2): 151-158. Demsetz, H. 1983. The Structure of Ownership and the Theory of the Firm. Journal of Law and Economics, 26: 375-390. Finkelstein, S., D.C. Hambrick. 1989. Chief Executive Compensation: A Study of the Intersection of Markets and Political Processes. Strategic Management Journal, 10: 121-134. Fisman, R., Khurana, R., M. Rhodes-Kropf. 2005. Governance and CEO Turnover: Do Something or Do the Right Thing? Harvard Business School Working Paper No. 05-066. Gompers, P.A., J. L. Ishii, and A. Metrick. 2003. Corporate Governance and Equity Prices. Quarterly Journal of Economics, 108:1, 107-155. Grossman, S.J., O.D. Hart. 1986. The Cost and Benefits of Ownership: A theory of Vertical and Lateral Integration. Journal of Political Economy, 94: 691-719. Hart, O., J. Moore. 1990. Property Rights and the Nature of the Firm. Journal of Political Economy, 98: 1119- 1158. Hartzell, J.C., E. Ofek, D. Yermack. 2004. What‘s In It for Me? CEOs Whose Firms Are Acquired. Review of Financial Studies, 17: 37-61. Harris, D., C. Helfat. 1997. Specificity of CEO Human Capital and Compensation. Strategic Management Journal, 18: 895-920. Himmelberg, C., G. Hubbard. 2001. Incentive Pay and the Market for CEOs: An Analysis of Pay-forPerformance Sensitivity. Mimeo, Columbia University. Holmstrom, B., S.N. Kaplan. 2001. Corporate Governance and Merger Activity in the United States: Making Sense of the 1980s and 1990s. Journal of Economics Perspectives, 15: 121-144. Huson, M., R. Parrino, L. Starks. 2001. Internal Monitoring Mechanisms and CEO Turnover: A Long Term Perspective. Journal of Finance, 56: 2265-2297. Knoeber, C. 1986. Golden Parachutes, Shark Repellents, and Hostile Tender Offers. The American Economic Review, 76(1): 155-167. Kor, Y. Y. and J. T. Mahoney, 2005. How Dynamics, Management, and Governance of Resource Deployments Influence Firm-Level Performance. Strategic Management Journal, 26: 489-496. Lambert, R., D. Larcker. 1985. Golden Parachutes, Executive Decision-Making, and Shareholder Wealth. Journal of Accounting and Economics, 7(1-3): 179-203. Landier, A., V. Nair and J. Wulf. ―Tradeoffs in Staying Close: Corporate Decision-Making and Geographic Dispersion.‖ The Review of Financial Studies, 2009, Vol. 22, No. 3, pp. 1119-1148. Lazear, E.P., 2003, ―Firm-Specific Human Capital: A Skill-Weights Approach,‖ mimeo, Stanford University. Martin, K.J., J.J. McConnell. 1991. Corporate Performance, Corporate Takeovers, and Management Turnover. Journal of Finance, 46: 671-687. 24 Matsusaka, J.G. 1993. Takeover Motives During the Conglomerate Merger Wave. The Rand Journal of Economics, 24(3): 357. Murphy, K.J. 1999. Executive Compensation. O. Ashenfelter, D. Card, eds. Handbook of Labor Economics, 3(38): 2485-2563. Parsons, D. O. 1972. Specific Human Capital: An Application to Quit Rates and Layoff Rates. Journal of Political Economy, 80(6): 1120-43. Rajan, R.G., L. Zingales. 1998. Power in a Theory of the Firm. The Quarterly Journal of Economics, 113(2): 387. Shleifer, A., L.H. Summers. 1988. Breach of Trust in Hostile Takeovers. A. J. Auerbach, ed. Corporate Takeovers: Causes and Consequences. University of Chicago Press, Chicago, IL, 33-56. Singh, H., F. Harianto. 1989. Management Board Relationships, Takeover Risk, and the Adoption of Golden Parachutes. Academy of Management Journal, 32: 7 24. Useem, M. 1993. Executive Defense: Shareholder Power and Corporate Reorganization. Cambridge, MA: Harvard University Press. Van den Steen, E.J. 2010. Disagreement and the Allocation of Control. Journal of Law, Economics, and Organization, 26: 385-426. Walsh, J.P. 1989. Doing a Deal: Merger and Acquisition Negotiations and Their Impact Upon Target Company Top Management Turnover. Strategic Management Journal, 10: 307-322. Walsh J.P., J.W. Ellwood. 1991. Mergers, Acquisitions and the Pruning of Managerial Deadwood. Strategic Management Journal, 12(3): 201-217. Wang, H.C., J.C. Barney. 2006. Employee Incentives to Make Firm-Specific Investments: Implications for Resource-Based Theories of Corporate Diversification. Academy of Management Review, 31(2): 466-476. Weisbach M.S. 1988. Outside Directors and CEO Turnover. Journal of Financial Economics 20: 431460. Wiersema, M., H. Bowen. 2009. The Use of Limited Dependent Variable Techniques in Strategy Research: Issues and Methods. Strategic Management Journal, 30: 679-692. Williamson, O.E. 1973. Markets and Hierarchies: Some Elementary Considerations. The American Economic Review, Papers and Proceedings of the Eighty-fifth Annual Meeting of the American Economic Association, 63: 316-325. Wulf, J. 2004. Do CEOs in Mergers Trade Power for Premium? Evidence from Mergers of Equals. Journal of Law, Economics and Organization, 20(1): 60-101 Zollo, M., H. Singh. 2004. Deliberate Learning in Corporate Acquisitions: Post-Acquisition Strategies and Integration Capability in U.S. Bank Mergers. Strategic Management Journal, 25: 1233-1256. 25 Table 1: Summary Statistics Target CEO Target Firm Acquirer CEO Acquirer Firm Transaction Variable Retention in any capacity (t+1) Retention as officer (t+2) Tenure in CEO position (years) Total Compensation ($000's) Log (Total Compensation) Assets ($M) ROA (Industry-adjusted) Sales growth (Industry-adjusted) Ownership (%) Assets ($M) Governance Index Managerial Discretion (top quartile of G-index, G>12) Block Shareholdings (excluding CEO) Related Merger (Same 3-digit SIC) Target Relative Size # Days b/n announcement & completion/100 Tender Offer transaction Obs 187 179 175 157 156 188 182 175 185 188 179 Mean 0.50 0.22 6.55 2438.22 7.30 10135.79 0.02 -0.12 2.13 18149.09 9.73 Std. Dev. 0.50 0.42 5.65 4105.50 0.92 37553.34 0.06 0.58 4.26 45743.76 2.73 Min 0.00 0.00 0.00 0.00 5.12 61.86 -0.13 -2.94 0.00 97.50 4.00 Max 1.00 1.00 31.00 41484.55 10.63 310897.00 0.24 1.67 31.20 386555.00 17.00 179 183 188 188 188 188 0.16 17.72 0.58 0.30 1.54 0.18 0.37 15.45 0.49 0.20 1.13 0.38 0.00 0 0.00 0.00 0.30 0.00 1.00 83.70 1.00 0.83 8.93 1.00 Notes: The fiscal year of the target firm prior to the year of announcement is year (–1). Year (+1) is the fiscal year of the merged firm following completion of the merger, while year (+2) is the second fiscal year post-merger. The governance index is based on Gompers, Ishii and Metrick (2003). Target relative size is defined as target assets/ (target + acquirer assets). 26 Table 2: Means of Sub-samples: Target CEO Retained vs. Not Retained Variable Target CEO tenure in position (years) Target CEO Total Compensation ($000's) Log (Target CEO Total Compensation) Target Assets ($ M) Target ROA (Industry-adjusted) Target Relative Size Target CEO Retained Mean 6.20 3052.48 7.46 12481.56 0.03 0.38 Target CEO Not Retained Mean 6.88 1831.11 7.13 5155.15 0.01 0.21 p-value (difference) 0.4295 0.0632 0.0242 0.1278 0.0403 0.0000 27 Table 3: Correlation Matrix Mean SD (1) 0.50 0.50 1.00 0.22 0.42 0.53* 1.00 6.55 5.65 -0.06 0.02 1.00 7.30 0.92 0.18* 0.19* 0.13 1.00 5. Target ROA 6. Acquirer CEO Ownership (%) 7. Acquirer Governance Index 8. Acquirer Managerial Discretion (top quartile) 9. Related Merger (same 3digit SIC) 10. Log Target Assets 11. Target Relative Size 12. Days Until Completion/100 0.02 0.06 0.02* 0.02 0.15 -0.09 1.00 2.13 4.26 0.08 -0.01 0.02 0.00 0.14 1.00 9.73 2.73 0.06 0.03 -0.10 -0.02 -0.09 -0.21* 1.00 0.16 0.37 -0.01 -0.09 -0.03 -0.03 -0.02 -0.11 0.65* 1.00 0.58 0.49 0.11 0.05 -0.05 0.02 -0.13 -0.10 0.0 -0.01 1.00 7.18 1.76 0.29* 0.24* -0.10 0.44* -0.28* -0.24* 0.1 -0.05 0.14 1.00 0.30 0.20 0.43* 0.30* -0.13 0.22* -0.07 0.15* -0.15* -0.06 0.31* 0.42* 1.00 1.54 1.13 0.24* 0.18* -0.05 0.01 -0.17* -0.15* 0.1 -0.01 0.04 0.31* 0.12 1.00 13. Tender Offer 0.18 0.38 -0.38* -0.22* 0.00 -0.09 -0.08 -0.04 0.1 0.16* 0.00 -0.27* -0.28* -0.26* 1. Target CEO Retained as Officer or Director (t+1) 2. Target CEO Retained as Officer (t+2) 3. Target CEO Tenure in Position 4. Log Target CEO Pay (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) * Represents significance at the 5 % level. 28 (13) 1.00 Table 4 (H1): Target CEO Retention Target Firm Performance, CEO Pay and Tenure (1) Target ROA (2) (3) (4) 6.523 (2.029)*** Log Target CEO Pay 0.271 (0.117)** 0.179 (0.143) Target CEO Tenure Position Log Target Assets Target Relative Size in Assets Related-3 digit Days Until Completion/100 Tender Offer Constant Year Dummies Observations Pseudo R-squared Wald Chi-Sq. Deg. of Freedom/p-value (5) 0.058 (0.071) 2.358 (0.754)*** -0.006 (0.248) 0.188 (0.092)** -1.476 (0.429)*** -0.585 (0.657) Yes 175 0.24 (6) (7) 7.177 (2.186)*** 0.284 (0.130)** -0.01 (0.022) 2.201 (0.939)** 0.201 (0.275) 0.368 (0.127)*** -1.465 (0.479)*** -2.699 (1.058)** Yes 7.677 (2.273)*** 0.193 (0.126) -0.006 (0.022) 0.126 (0.092) 2.104 (0.920)** 0.166 (0.279) 0.288 (0.133)** -1.428 (0.482)*** -2.771 (1.088)** Yes (8) ‗ Excludes Wd‘ foffers Tender Offers Sdfg‘ Serrl‘ser;k[pw 7.678 erk[ptka24kpta (2.349)*** wm[pehm,[pkl er=q2 0.239 (0.158) -0.01 (0.024) dsdfa 0.11 (0.097) 2.002 (0.990)** 0.273 (0.296) 0.336 (0.146)** 0.286 (0.230) 0.187 (0.106)* -1.327 (0.354)*** -1.872 (0.933)** Yes 0.044 (0.085) 2.368 (0.753)*** -0.028 (0.255) 0.165 (0.126) -1.123 (0.376)*** -1.966 (1.051)* Yes 0.002 (0.019) 0.023 (0.071) 2.707 (0.719)*** -0.002 (0.245) 0.186 (0.092)** -1.414 (0.403)*** -0.775 (0.662) Yes 175 0.29 154 0.17 154 0.23 174 0.25 154 0.29 154 0.29 -2.571 (1.130)** Yes 125 0.22 10.34 1/0.0013 5.39 1/0.0203 1.57 1/0.2098 0.01 1/0.9246 13.60 3/0.0035 12.90 3/0.0049 12.50 3/0.0058 0.11 (0.076) 2.578 (0.790)*** 0.191 (0.247) 0.249 (0.095)*** -1.448 (0.447)*** -1.581 (0.702)** Yes Probit regression models where ***, **, * represent significance at the 1%, 5%, 10% level, respectively; heteroskedastic-robust standard errors reported in parentheses. Wald tests compare restricted model (1) (without performance, CEO pay, and tenure) to the more fullyspecified models. 29 Table 5 (H2): Target CEO Retention, Target Performance, and Acquirer Governance Target ROA Acquirer Managerial Discretion X Target ROA Acquirer Managerial Discretion Acquirer CEO Ownership X Target ROA Acquirer CEO Ownership Related-3 digit Log Target Assets Target Relative Size in Assets Days Until Completion/100 Target CEO Tenure in Position Acquirer Block Shareholdings (excl. CEO) Tender Offer Constant Year Dummies Observations Pseudo R-squared Whole Sample (1) Excludes Tender Offers (2) 17.877 (5.001)*** 63.01 (28.445)** 2.122 (0.689)*** 1.199 (0.557)** 0.081 (0.037)** 0.383 (0.287) 0.143 (0.091) 2.742 (1.005)*** 0.279 (0.107)*** -0.008 (-0.024) -0.024 (-0.011)** -4.569 (-1.916)** -0.975 (-0.913) Yes 175 0.40 44.129 (15.167)*** 224.325 (92.500)** 6.634 (2.634)** 1.082 (0.543)** 0.085 (0.037)** 0.375 (0.292) 0.107 (0.094) 2.65 (0.997)*** 0.356 (0.129)*** -0.01 (-0.025) -0.029 -(0.012)** -0.048 (-1.115) Yes 141 0.29 Wald Chi-Sq. 30.58 29.17 Deg. of Freedom/p-value 5/0.0000 5/0.0000 Probit regressions where ***, **, * represent significance at the 1%, 5%, 10% level, respectively; heteroskedastic-robust standard errors reported in parentheses; interaction terms and respective main effects are based on mean-centered variables. Wald tests compare restricted models (without ROA and governance variables) to the fully-specified models in this Table. 30 Table A1: Governance Provisions of Gompers, Ishii, Metrick (2003) (Table I, pg. 112) Delay Blank check Classified board Special meeting Written consent Protection Compensation plans Contracts Golden parachutes Indemnification Liability Severance Voting Bylaws Charter Cumulative voting Secret Ballot Supermajority Unequal voting Other Antigreenmail Directors‘ duties Fair price Pension parachutes Poison pill Silver parachutes State Antigreenmail law Business combination law Cash-out law Directors‘ duties law Fair price law Control share acquisition laws 31