Annual Report 2007 TILEC Mailing address

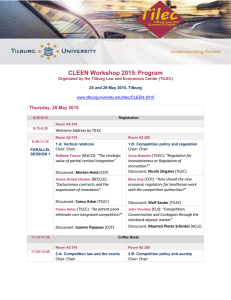

advertisement