Intermunicipal IDP Workshop: Greater Cape Town Region City of Cape Town’s Waste Management

advertisement

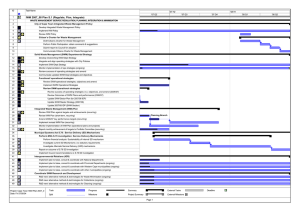

Intermunicipal IDP Workshop: Greater Cape Town Region City of Cape Town’s Waste Management Date: Wednesday, 26 September 2007 City of Cape Town Waste Management i.t.o. Cape Town’s IDP Key Objectives: Waste Management Provision of basic services: cleaning, collection and waste disposal Economy-led infrastructure development Upgrading of existing infrastructure to enable waste minimisation Create new bulk infrastructure: new CT landfill site, more drop-off sites/ mini Material Recovery Facilities Demand management: waste minimisation Recycling: processing is a private sector activity Local initiatives: separation at source – requires public and industry participation: small contractor/ community initiatives CITY OF CAPE TOWN CONTEXT • Metro municipality: • Demarcated area of approx 2 400 km2; • Current population 3.2 mill, growing at about 2% p.a. (70% of WC); • About 80% of WC economic activity; • Waste generated 2.7 mill tonnes (2005); • Waste growth @ ave. 7% p.a. • Recycling about 13-15 % (2003/04): organics (chipping & composting), builder’s rubble, plastics, paper • Council must: • ensure cleaning, collection and waste disposal activities per Constitution, Sched 5B; • regulate services per MSA, S.80; • set policy & by-laws (MSA, S.11); • have an IWM Plan (Nat IP&WM Policy, MSA S.11) • New IWM Policy refocuses traditional waste management services to institutionalise minimisation Waste Management i.t.o. Cape Town’s IDP Sector Plan for Waste Management (statutory plan) Part of the IDP, includes Integrated Waste Management Plan (activity schedule that has a link to the SDBIP’s) Based on 20-year waste, development & infrastructure planning Supported by an IWM Policy (1st for a municipality in SA, adopted in May 2006) Encompasses 16 strategies to deliver on the IWM Plan Waste Minimisation Waste Management Services Logistics Support services Staffing Law enforcement Waste Management for FIFATM2010 World Cup Planning completed and aligned with FIFA Green Goal expectations: Major operating budget shortfall: R61.8 mill additional funds requested Minimise waste Create economic opportunity through waste minimisation during this period Create partnerships: Packaging Industry focus Legacy opportunity: change habits and implement systems utilising a partnership approach Cape Town’s Waste (million tonnes) o on t i t n m e u terv r ann n e i p o ~ 8.0 mil (projected, % th a. (n s t :2 . e p row h with no intervention) g t % w y + tr 7 ro du s h@ ion g n I t t la w & ro 2005/06 sm Po p u te g t s n a o u ri e r T w r f l u il 2.7 mil t actual C f to ffec Lan d e d s e ect ud e Proj E xcl App ly was te m ise) m i n mi in imis a tion to a ch ie ve C ity o f Ca pe Town IW M Po licy Mid -p oi = 2 0% re du nt ta rget: ctio n in w as te generated = 1 0% fu rth e r red u ction in wa ste to lan dfill 2.1 mil 2009/10 2002/03 2008/09 2010/11 2012/13 2018/19 ? 2022/23 Plan for “Zero waste” Effect/ Implications of Waste Minimisation Roll-out/Implementation must: •Create infrastructure; •Educate, make all aware; •Encourage Public/industry participat ion; •Facilitate creation of recycling market through partnerships (industry, NGO’s, CBO’s); •Enable job creation through recycling rather than through clean-ups •Enforce stricter standards Waste Management in future City of Cape Town Create sustainability and opportunity - brief background : Looming problems: increasing population, economic activity and tourism (a focus in the WC economic development programme) = more waste that is filling landfills, and landfill airspace is running out. Growth has a price - with prosperity comes consumption and waste. Unexpected problems: E.g. energy crisis resulted in unexpected waste last year and in the future. Tourism (backbone of ASGISA and WC Econ Dev Plan) – unplanned waste Facts and Figures: 2% Population growth, expected waste growth (net = 5% more than population growth – must be slowed down). Capex requirements for new infrastructure: implications on tariffs and rates unsustainable – lends itself to MSP’s Challenges: to turn around manufacturing and waste management models in industry, waste management practices and consumer habits that will reduce waste, but also create economic opportunity Waste is valuable! Future legislation: Waste Management Bill (Act), National Waste Management Strategy, possible Treasury legislation on environmental fiscal reform, City’s IWM Bylaw Minimal control over private sector: maximise opportunities, but Regulate activities: control of waste management activities to prevent degradation of environment and reduce resource impacts Waste Minimisation Approach and Rationale 80/20 on waste types: “low hanging fruit” Rationale: higher volumes, reasonable markets Successes already evident Recycling: a private sector/CBO/NGO activity 1st Economy focus: to establish a sustainable market for low hanging fruits” (processors & manufacturers: tins, glass, paper, cardboard, demolition waste, garden waste, etc) If market demand is firm, it should stabilise effects on the 2nd Economy (create stable jobs and income, shared growth) This end of the process requires high capex/opex and expertise 80/20 focus of an implementation mechanism: target areas/facilities where high concentrations of people gather, trade, enjoy their leisure Improve efficiencies and recovery volumes through economies of scale Mutual Benefits (reduce resource, landfill & infrastructure pressures, create economic opportunities for all: true Triple Bottom Line approach) CT Waste Minimisation Summit: Issues raised Land availability: Council or other suitable for recycling activities Infrastructure and facilities Temporary storage: permitting Security and public safety Grants and funding vs. concessions (MSA S.78 requirements) Can drop-offs be converted to become buy-back centres (is it desirable, sustainable) Red Tape: EIA’s, zoning, plans approval, permits for waste management activities (speed of approval, standard procedures, etc: streamlining and cutting red tape) Possible partnerships: Formalised (MSP/PPP), non-formalised Service levels by private sector: collection frequencies, etc Implications on the status quo: current contracts need to be amended Incentives, disincentives Job creation, training in waste management Clearer definition of responsibilities, roles: Municipality vs. private sector/ CBO’s/ NGO’s/ residents Communication, education and training: the role of schools Information: reporting and information sharing Regulation and law enforcement Recycling Materials Producer/ Manufacturer 80/20 approach: Low hanging fruit & specific initiatives Waste Management Service Providers (Store, Recover, Recycle) E-Waste Garden Greens Construction/ Demolition Recycle Recover, Collect: Divert waste from landfill Reuse, Reduce Producer, Manufacturer Wholesaler/ Retailer/ Prop Manager Avoid User/ Consumer Waste Management Service Providers (Clean, Collect & Dispose) Importer Virgin Material Producer 80/20 approach: Areas/ Places of high public concentration Municipality (Waste Regulator) Raw Material Waste Proposed approach to increase Waste Recovery Volumes and Recycling Activities in Cape Town Key questions What should all municipalities in the region be doing to facilitate more recycling? How can effective value chains and practical mechanisms be created to enable recycling that will effectively divert larger volumes of valuable waste from landfills? What can be done to enable/ improve/ facilitate new investments (i.e. formal or 1st Economy) that will stimulate job growth in both the formal and informal economies (1st and 2nd Economies). Need for a regional waste management/ infrastructure working group? Regional context Impact on CT’s landfills: cross-boundary economy Synergies that can be explored Bulk infrastructure: Landfill – however, new landfill is only designed for CT’s waste (30 year life) Logistics and transport: cost reduction, alternatives Communication, education: common problem Investment in the City Extensive work required to determine “new” budget arrangement, Service Level Agreements, etc Conclusion Let us work together for a better city