.... 1416 52106/11 I

advertisement

REPORT To EXECUTIVE MAYOR.

.... 1416

I

CITY OF CAPE TOWM IISIXEkD SASEKAPA $lAD KAAPSTAD

MC 52106/11

1.

ITEM NUMBER:

2.

FINAL 2011/2012 DIRECTORATE EXECUTIVE SUMMARY OF THE SERVICE

DELIVERY AND BUDGET IMPLEMENTATION PLANS (SDBIP's)

ISISHWANKATHELO

SOKUGQIBELA

SESIGQEBA

SECANDELO

LOLAWULO SONYAKA- MALI KA 2011/2012 SONIKEZELO NGEENKONZO

NESICWANGCISO

SOKUZALISEKISWA

KOHLAHLO

LWABIWO

MALI(SDBIP'S)

DIREKTORAAT

SE

FINALE

BESTUURSOPSOMMING

VAN

DIE

DIENSLEWERINGS EN BEGROTINGSIMPLIMENTERINGSPLAN (SDBIP) VIR

2011/2012

3.

RECOMMENDATION FROM FINANCE PORTFOLIO COMMITIEE:

6 MAY 2011 (FIN 18/05/11)

RECOMMENDED that:

(a)

the Executive Mayor in consultation with the Mayoral Committee approves

the final 201112012 Directorate Executive Summary of the Service

Delivery and Budget Implementation Plan;

(b)

Council notes the final 2011/2012 Directorate Executive Summary of the

Service Delivery and Budget Implementation Plan.

AANBEVELING dat:

(a)

die

Uitvoerende

burgemeester

in

oorlegging

met

die

burgemeesterskomittee die diektoraat se finale beknopte oorsig van die

dienslewerings en begrotingsimplementeringsplan

vir 2011/2012

goedkeur;

(b)

die Raad kennis neem van direktoraat se finale beknopte oorsig van

dienslewerings en begrotingsimplementeringsplan vir 2011/2012.

ISINDULULO

•

1417

(a)

Ukuba uSodolophu wesigqeba ecebisana neKomiti yoLawulo yakhe

makaphumeze isiShwankathelo sokugqibela sesiGqeba kwiCandelo

loLawulo sokuNikezelwa kweNkonzo nesiCwangciso sokuZalisekiswa

koHlahlo Iwabiwo mali kowama 2011/2012;

(b)

ukuba IBhunga maliqwalasele isiShwankathelo sokugqibela sesiGqeba

seCandelo loLawulo nesiCwangciso zokuZalisekiswa koHlahlo Iwabiwo

mali kowama 2011/2012.

Lc 36b1

REPORT To

FINANCE PORTFOLIO COMMITTEE

MAYCO

COUNCIL

1.

ITEM NUMBER:

2.

SUBJECT

•• " .- t._

1118

CITY OF CAPE tOWN IISIXEXO SASEKAPA ! STAD KAAPSTAD

I

FIN 18/05/11

(LSUB0934)

FINAL 2011/2012 DIRECTORATE EXECUTIVE SUMMARY OF THE SERVICE

DELIVERY AND BUDGET IMPLEMENTATION PLAN (SDBIP)

2.

ISIHLOKO

ISISHWWANKATHELO

SOKUGQIBELA

SESIGQEBA

SECANDELO

LOLAWULO ESIJOLISWE KUNIKEZELO LWENKONZO KOWAMA-2011/2012

NAKWISICWANGCISO SOKUZALISEKISWA KOHLAHLO-LWABIWO-MALI

(SDBIP)

2.

ONDERWERP

DIREKTORAAT SE FINALE BEKNOPTE OORSIG VAN DIE

DIENSLEWERINGS-EN-BEGROTINGSIMPLEMENTERINGSPLAN (SDBIP)

VIR 2011/2012

3.

PURPOSE

The purpose of this report is to submit to the Portfolio Committee for their

consideration and recommendation to the Executive Mayor, the final 2011/2012

Finance Directorate Executive Summary including the SDBIP.

These documents underpin the 2011/2012 Corporate SDBIP that will be

submitted to the Executive Mayor for approval in terms of section 53 (1)(c)(ii) and

69(3)(a) of Act No. 56 of 2003: Local Government: Municipal Finance

Management Act (MFMA).

4.

FOR DECISION BY

The Executive Mayor in consultation with the Mayoral Committee.

Page 1 of 5

1112 Directorate ExeSum mary Report. 7AprIl

[September 20091

.

·','.' ,

..

5.

~

"'.- .

14L9

EXECUTIVE SUMMARY

In terms of the MFMA: Municipal Budget and Reporting Regulations, a

Directorate Executive Summary must be completed for each Directorate SDBIP.

The final 2011/2012 Finance Directorate Executive Summary contains inter alia a

brief description of financial information on the capital and operating budget as

required by the Regulations. It also contains a brief description of the directorate's

structure, the services provided and the customer groups, as well as how the

directorate's objectives and indicators relate to the Integrated Development Plan.

The final Finance Directorate Executive Summary is attached as Annexure A.

The purpose of this report is to submit the final 2011/2012 Finance Directorate

Executive Summary of the SDBIP to the Portfolio Committee for consideration

and recommendation to the Executive Mayor.

The 2011/2012 Directorate Executive Summary and SDBIP will be submitted to

National and Provincial Treasury and the electronic versions will be placed on the

city website at www.capetown.gov.za/idp after noting by Council.

6.

6.

RECOMMENDATIONS

6.1

That the Portfolio Committee makes recommendation to the Executive

Mayor on the contents of the final 2011/2012 Directorate Executive

Summary of the Service Delivery and Budget Implementation Plan

6.2

That the Executive Mayor in consultation with the Mayoral Committee

approves the final 2011/2012 Directorate Executive Summary of the

Service Delivery and Budget Implementation Plan

6.3

That Council notes the final 2011/2012 Directorate Executive Summary of

the Service Delivery and Budget Implementation Plan

ISINDULULO

6.1

Ukuba iKomiti yeMicimbvi yeSebe mayenze isindululo kuSodolophu

wesiGqeba ngokujoliswe kokuqulathwe kwisiShwankathelo sokugqibela

seCandelo 10Lawulo ngokumalunga noNikezelo IweNkonzo kowama2011/2012 nesiCwangciso sokuZalisekiswa koHlahlo-lwabiwo-mali.

6.2

Ukuba uSodolophu wesigqeba ecebisana neKomiti yoLawulo yakhe

makaphumeze isiShwankathelo sokugqibela sesiGqeba kwiCandelo

10Lawulo sokuNikezelwa kweNkonzo nesiCwangciso sokuZalisekiswa

koHlahlo-lwabiwo-mali kowama-2011/2012.

1112 Directorate ExeSummary Report} Apr11

ISeptember 2009J

Page 2 of 5

,

1420

....

...

.

6.3

6.

7.

Ukuba iBhunga maliqwalasele isiShwankathelo sokugqibela sesiGqeba

seCandelo loLawulo nesiCwangciso sokuZalisekiswa koHlahlo-lwabiwomali kowama-2011/2012.

AANBEVELING

6.1

Dat die portefeuljekomitee aanbevelings maak by die uitvoerende

burgemeester oor die inhoud van die direktoraat se finale beknopte oorsig

van die dienslewerings-en-begrotingsimplementeringsplan vir 2011/2012.

6.2

Dat die uitvoerende burgemeester in oorlegpleging met die

burgemeesterskomitee die direktoraat se finale beknopte oorsig van die

dienslewerings-en-begrotingsimplementeringsplan

vir

2011/2012

goedkeur.

6.3

Dat die Raad kennis neem van direktoraat se finale beknopte oorsig van

die dienslewerings-en-begrotingsimplementeringsplan vir 2011/2012.

DISCUSSION/CONTENTS

a.

Constitutional and Policy Implications

This process is driven by legislation.

b.

Environmental implications

Does your report have any

environmental implications:

c.

No

~

Yes

D

Legal Implications

The process of preparing a Service Delivery and Budget Implementation

Plan must inter alia comply with:

Section 53(1 )(c)(ii) and 69(3)(a) of Act No. 56 of 2003: Local Govemment:

Municipal Finance Management Act as well as the Municipal Budget and

Reporting Regulations (Schedule A, Part 2, Sections 22, 23 & 24).

In terms of the MFMA: Municipal Budget and Reporting Regulations a

Directorate Executive Summary must be completed for each Directorate

SDBIP.

1112 Directorate ExeSummary.Report.7Apr11

[September 2009J

Page 3 015

• t

d.

Staff

~

•

1(Zl

"",Ii a

nons

Does your report impact on staff resources, budget, grading, remuneration, allowances,

designation, job description, location or your organisational structure?

No

[8J

0

Yes

e.

Risk Implications

Does this report and/or its recommendations expose the City to any risk?

No.

f.

Other Services Consulted

All relevant Directorates were consulted.

ANNEXURES

Annexure A:

Final 2011/2012 Finance Directorate Executive Summary of the

Service Delivery and Budget Implementation Plan

FOR FURTHER DETAILS CONTACT:

NAME

CONTACT NUMBERS

E-MAIL ADDRESS

DIRECTORA TE

SIGNA TURE : DIRECTOR

Maria Hargrave

021-400-2359

Maria. harcrraveifD.caoetown. crov. za

F,i.nance

.I,A\... T

./

,

0

REPORT COMPLIANT WITH THE PROVISIONS OF

COUNCIL'S DELEGATIONS, POLICIES, BY-LAWS

AND ALL LEGISLATION RELATING TO THE MATTER

UNDER CONSIDERATION.

0

NON-COMPLIANT

~~

I

LEG

./.

'r./-..y

PLiANCE

NAME

Comment:

TEL

Oertified as leg a II com lIant:

DATE

Based on the contents of the report.

1112 Directorate ExeSummary.Report.7Apr11

INovember 20091

Page 4 of 5

.....11ZZ

'"

Comment:

EXECUTIVE DIRECTOR

Mike Richardson

DATE

('1/'1/'1

I

(Author to obtain all signatures before submission to Executive Support)

Page 5 of 5

1112 Directorate ExeSummary.Report.7Apr11

[November 2009]

•

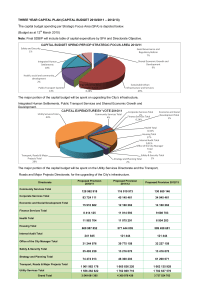

FINANCE DIRECTORATE

EXECUTIVE SUMMARY

OF THE SERVICE DELIVERY AND BUDGET IMPLEMENTATION PLAN

-

2011/2012

"

~

~

Executive Director: Mike Richardson

Website: www.capetown.gov.za

e..:Il>

2

2

m

><

C

::a

m

l>

Page 1 of 8

2011/12 Finance Directorate Executive Summary.13 April 2011.Final

1.

EXECUTIVE SUMMARY

1.1

Vision

To provide sound financial services which are sustained via corporate governance procedures for the City of Cape Town.

1.2

Mission

To create a sound financial environrnent, enabling the City to provide effective, efficient and affordable services to its citizens,

thereby achieving the City's strategic objectives

1.3

Our vision and mission will be achieved mainly through:The rnaintenance of accurate and cornplete financial records to enhance decision-rnaking

Cornpilation and Irnplernentation of affordable balanced operating and capital budgets aligned to the lOP

The sustaining of confidence in the financial records of the City

Managing the City's banking, investrnents, borrowings and cash flow in the rnost effective, econornical and efficient rnanner; : ....;

Ernbedding a culture of Risk Managernent in the City to ensure the optirnal use of scarce resources

~

Billing and collecting rnonies and funds due to the City

"'"

~

Monitoring and controlling all expenditure in order to ern bed sound financial discipline and ensuring accountability for the use of

public funds

Fair property valuations in order to equitably levy rates on all properties for the provision of non-tariff funded services

Irnplernentation of sound supply chain rnanagernent policies and procedures

The expansion of external funding provisions and allocations for the upgrade and developrnent of inforrnal settlernents and

housing areas

Developrnent and reviewing of financial and finance-related policies

Ensuring cornpliance to relevant legislation, and the irnplernentation and rnaintenance of good governance

Page 2 of 8

2011/12 Finance Directorate Executive Summary. 13 April 2011.Final

Modelling the impact of the Total Municipal Account (TMA) on residents to ensure a fair distribution of the burden

1.4

The Directorate's Core Functions

DEPARTMENT

OBJECTIVE

Budgets

To give financial affect to the strategic focus of the City in the form of a medium term

financial plan which is affordable, credible, viable and sustainable.

Expenditure

To ensure financial compliance by performing accurate and timeous payments to the City's

suppliers, councillors, officials and third parties, conducting payroll reconciliation, and

providing support services to the Finance Directorate

Inter-Services Liaison

Assisting departments experiencing difficulties with processes, tariffs or financial viability,

especially where more than one department has a role to play, as well as the provision of

financial control and administrative support for grants-in-aid and central improvement

districts. Managing the rates policy development, tariff setting and impact on all residents.

Modelling the TMA distribution to ensure a fair distribution of all billed municipal charges

;

and the collectability thereof.

•

Integrated Risk Management

To contribute to the achievement of the City's overall strategic objectives by'managing the

governance issues and risks that could detract from achieving its strategic objectives.

Housing Finance and Leases

The provision of a comprehensive financial service, aligned to specific Housing and

Financial Legislation and National Housing and other National Infrastructure Funding

Programs, to all facets of the various City suites of housing development (including housing

subsidies, MIG, NDPG), informal settlement upgrades, hOUSing debtor management and

operational funding programs of the City

Revenue

Providing accountable revenue services and informing citizens through council structures

as to their responsibility in creating a solvent and prosperous City.

Shareholding Management

Managing the legislated relationship between the City and the Municipal Entities; ensuring

good governance and protecting the integrity of the City's shareholding investment.

Supply Chain Management

To provide a cost effective, efficient and sustainable service, in terms of Supply Chain

Page 3 of 8

2011/12 Finance Directorate Executive Summary.13 April2011.Final

,.

Management processes, to customers, adding measurable value to the City of Cape

Town's strategic objectives.

2

Treasury

Ensure compliance to relevant legislation by reporting timeously and safeguarding assets in

order to achieve the strategic and operational objectives of the Department in an efficient,

effective and economic manner.

Valuations

To continuously improve processes, systems and the capacity of staff to enable the City of

Cape Town to sustain a just and accurate valuation roll, thereby supporting the City's vision

of a sustainable and well-governed municipality.

PURPOSE AND SERVICE MANDATE OF DIRECTORATE

The Finance Directorate ensures sound financial management of the City's financial resources, in compliance with the Municipal

Finance Management Act, together with other related legislation, policies and procedures.

STAKEHOLDERS AND CUSTOMERS

Finance Directorate customers are both internal and external:

NEEDS

CUSTOMERS

External Customers:

-

Members of the Public

-

Government Departments (National/Provincial/Local)

-

Business Sector

-

Municipal Entities

-

Regulatory and ad hoc stakeholders

-

Private Sector

-

Institutions e.g. IMFO, SALGA, NGO's, etc.

Information, responses, service delivery, consultation, payments,

legislative procedures and advice

Commercial banks/Investors

Service Providers

Page 4 of 8

2011/12 Finance Directorate Executive Summary.13 April 2011.Final

•

-

Vendors/Suppliers

Internal Customers:

-

3.

Line Departments (Officials)

Councillors

Service delivery, information, processes, systems, financial

advice and expertise and policies

Unions

Audit Committee

RISKCO

SENIOR MANAGEMENT ORGANOGRAM

CHIEF FINANCE OFFICER

MIKE RICHAROSON

(2)

"

,

••

· .-

.

.

~

~

-.l

DIRECTOR:

DIRECTOR:

DIRECTOR:

DIRECTOR:

BUDGETS

EXPENDITURE

JOHAN STEYL

HOUSING FINANCE

AND LEASES

NOTHEMBA

LEPHEANA

INTEGRATED

RISK

MANAGEMENT

(25)

(106)

DIRECTOR:

DIRECTOR:

DIRECTOR:

REVENUE

SHAREHOLDER

SUPPLY CHAIN

MANAGEMENT

MANAGEMENT

lOUISE

MULLER

LEONARD

SHNAPS

(5)

(298)

LIAISON

TREVOR BLAKE

GEORGE VAN

WAYNE MULLER

LUDWIG

(42)

DIRECTOR:

INTER-SERVICE

GELDENHUYS(9)

SCHALKWYK

(814)

(8)

Page 5 of 8

DIRECTOR:

TREASURY

DIRECTOR:

VALUATIONS

DAVID

VALENTINE

CHRISTOPHER

GAVOR

(69)

(142)

2011/12 Finance Directorate Executive Summary.13 April 2011.Final

4.

LINKAGE TO THE IDP and changes to the indicators and targets

Due to the nature of the business, most of the objectives are directly linked to Strategic Focus (SFA) 8 "Good Governance and

Regulatory Reform", while others are linked to SFA 1 (Shared Economic Growth and Development), and SFA 2 (Sustainable

urban infrastructure and services).

Various amendments have been made to the Finance Directorate's SDBIP for 2011/12, in order that the objectives, indicators and

targets are aligned to the amendments made to the City's Corporate Scorecard.

The 2011112 Finance Directorate SDBIP is

attached as Appendix 1.

5.

PERFORMANCE PROGRESS AND IMPACT

Finance Directorate has achieved various accolades and these can be summarised as follows:

Unqualified Audit Report from Auditor General (seven consecutive years)

Best performance rating nationally for audit outcomes for the past 3 years

Unqualified audit reports for Municipal Entities for the past 2 years

Received a high investment grade credit rating from Moody's Investor Services for the fifth consecutive year.

_...

~

CO

Improved Capital Budget Spending

Sustainable Revenue collection despite the economic recession and high electricity tariff increases

Continued Improved Supply Chain Processes & Procedures in collaboration with line departments

Maintaining the ISO standard accreditation for SCM

Successful Bond Issue

South African Housing Foundation Award for the City's Public/Private Sector Programmes for the development of affordable

housing

Received award during the year for Best Reporting from SA Statistics

Page 6 of 8

2011/12 Finance Directorate Executive Summary.13 April 2011.Final

Sound financial policies approved by Council and utilised by other Local Authorities as the basis for developing their own

policies

Leading the implementation of the Municipal Property Rates Act, providing training and guidance to other Councils and driving

the amendments required by Local Government to improve aspects of the Act

IRMSA 2010 Industry Specific Award in the category Public Sector Risk Initiative

6.

FINANCIAL INFORMATION

6.1

Summary of revenue by source -INFORMA TlON NOT PROVIDED.

Subject to budget approval and formulation of spending programmes.

6.2

Summary of operating expenditure by type -INFORMATION NOT PROVIDED.

...

Subject to budget approval and formulation of spending programmes.

6.3

Summary of capital expenditure by Department -INFORMA TlON NOT PROVIDED

Subject to budget approval and formulation of spending programmes.

6.4

A description of discretionary and non discretionary expenditure.

Funds are utilised for discretionary expenditure whilst also noting that fund management programmes incorporate significant

quantum of targeted external funds

6.5

Any risks to achieving revenue projections, any expected major shifts in revenue patterns and planned alternative

sources of revenue

The effects of the economic down-turn, influence of systemic risks, past experience (history), high electricity increases and

changes in legislation were considered in projecting anticipated revenue levels.

Page 7 of 8

2011/12 Finance Directorate Executive Summary.13 April 2011.Final

6.6

On the directorate capital programme in the context of the overall capital programme of the municipality

Not applicable

7.

OBJECTIVES AND INDICATORS OF THE DIRECTORATE SERVICE DELIVERY AND BUDGET IMPLEMENTATION PLAN

(SDBIP) - are contained in the Finance Directorate 2011112 SDBIP- attached as APPENDIX 1.

8.

AUTHORISATION

The undersigned do hereby indicate their agreement with the contents of this document, together with all appendices.

Name

Executive Director

Mike Richardson

Mayco Member

Ian Neilson

Signature

9.

/

~

./

('1/ 1/

tJJd~1

I {

•,

APPENDICES:

Appendix 1:

#

~

LL:

../

f~

...Q.

~"~

Date

.'

FINANCE DIRECTORATE 2011/2012 SDBIP

Page 8 of 8

2011/12 Finance Directorate Executive Summary. 13 April2011.Final

I-

,

0

c

e

0

F

G

J

N

R

Z

V

"

2011/2012 FINANCE DIRECTORATE SDBIP

,

r'-3

,

,

H

RATING KEY

ALIGNMENT TO lOP

=

~ meets or exceeds target;

~•

E

Corporate

Scorecard

Direetorete

Indicator No.

Objective

and Lead

No.

Directorate

5

SFA 1

Shared

Economic

Growth and

Developme

[

~

Objective

~

Legot/a Top 20

Objective

.~

Indicator

ITe Include unil of

measure)

Baseline

(201012011)

Annual

Target

2.011/2012

!

,!•

•

0

General Comments

30 Sept 2.011

Target

31 De" 2011

Target

31 March 2.012Target

subject to

subject to

subject to

budget

approval and

budget

approval and

budget

approval and

formulation of

spending

formulation of

spending

formulation of

spending

programmes

programmes

programmes

30 June 2012

Target

Evidence

i

subject to

'"

"'OriQinal target to be amended

TARGETS vs ACTUALS

t

SFA &

~ information not available or worK on hold;

'l Currently does not meet target;

t

•

"'

tA Create an

enabling environment

MUniCipal mvestment

for the economy to

mto the economy

grow and become

globally competitive

lA,1 Capital Budget

Spend lor the City

Achievement as

at 30 June 2011

budget

approval and

formulation

of spending

f

~

0

programmes

The 4 quarterly targets are subject to change upon adoplion of the 3·year

2011112-2013114 Budget which IS still In draft lormat

sUbject to budget

approval and

formulation of

spending

programmes

SAP Repon

Director Budgets

The quarter 4 target amount represents 95% of Ihe approved capital

budget

Capital Expenditure monitored on an on-going basis by EMT and Mayco

via the FMR

6

The annual target IS subjecl to change, as the budget is still In draft

format

SFA 2

$!Jstemable

Urban

Inlrastructur

e and

Services

2C,'

i

2C Effectively

manage the City's

Inlrastructure and

Resources

Manage

memtenance 01 City

mfrastructure

2C 1 Amount spent 011

repairs and

maintenance for the

City

subject to

budget

Achievement as

at 30 June 2011

approval and

formulation

subject to

subject to

budget

approval and

budget

approval and

formulation of

formulation of

subject to

budget

approval and

formulation of

of spending

spending

spending

spending

programmes

programmes

programmes

programmes

subject to budget

approval and

formulation of

spending

SAP Repon

Director, Budgets

programmes

This indicator measures the amounl of Ihe operallng budget spent on

repairs and maintenance The objective is to improve the maintenance 0

the city's Infrastructure. Spending on repairs and maintenace IS assumed

10 Increase the lifespan of Ihe asset

,

SFA 8

Good

Governanc

e and

Regulatory

Reform

883

i•

8B Management 01

key financial and

governance areas,

such as income

control, cash flow,

indigent sup pOri,

altemative income

opporiunities, asset

and risk management

..b;.

.....

-

The 4 quarterly largets are subjeclto change as Ihe budgel is still In draft

format

Create eSSets for

public benelil

8B 3 Percentage

spend of capital

budget for the City

AchieVement as

at 30 June 2011

95%

Quanerly

subject to

subject to

subject to

budget

approval and

budget

approval and

formulation of

budget

approval and

formulation of

formulation of

spending

programmes

spending

programmes

spending

programmes

subject to budget

approval and

formulation of

spending

SAP Repon

Director Budgets

Capital Expenditure monitored on an on-going baSIS

via the FMR

.

EMT an{MayCO

;...;

programmes

8

The 4 quarteriy targets are subject to change as the budget IS still In dr~

SFA 8

Good

Governanc

e and

Regulatory

Reform

88

$•

8B Management of

key financial and

governance areas

such as income

cofltrol, cash fiow,

Indigent support.

alternative income

opporiunities, asset

and risk management

""

Percentage spend 01

operating budget for

the City

Achievement as

at 30 June 2011

Quanerly

95%

subject to

,ubject to

budget

approval and

budget

<lpproval and

formulation of

spending

formulation of

approval and

formul<ltion of

spending

programmes

spending

programmes

programmes

subject to

budget

subject to budget

approval and

formulation of

spending

Operating Expenditure monitored on an on-going baSIS by EMT and Mayco via

FMR

SAP Repon

Diredor Budgets

Total actual to dete es a percentage of the total budget including secondary

expenditure

»

"'tJ

programmes

,

9

SFA 8

Good

Govemanc

e and

Regulatory

Reform

8B

!

8B Management of

key financial and

governance areas.

such as Income

control. cash flow,

indigent support,

alternative income

0pp0riunities, asset

and nsk msnagementl

""

Affordable balanced

Operating and Capital

Budget for the City

aligned to the lOP

adopted by 31 May

2011

Achievement as

at 30 June 2011

Affordable

balanced

Operating

and Capital

Budget for

the City

aligned to

the IDP

adopted by

31 May 2012

Annual

,I,

,I,

,"

Affordable

balanced

CounClI Repon Operating and

Agenda and Minutes

Capital Budget

'DP

for tile City

D1fector Budgets, and

aligned to the lOP

Director, lOP

adopted by 31

May 2012

Alignment 01 budget to MTREF and lOP Processes

2 Review MTREF Model

3 Revise finanCial/budget policies

"'tJ

m

Z

C

"

1112 SDBIP Finance Diredorate 13Apr11 FINAL

Page 1

A

,

C

D

~

SFA &

Directorate

Objectiw.

No.

Corporale

8

Scorecard

Indicator No

and Lead

~

Directorate

5

e and

Regulatory

Reform

•

Indicator

(To include unit of

G

Baseline

(201012011)

measure)

H

I

Annual

1,•

Target

201112012

,•

"

0

0

"

N

R

V

31 Dec 2011

Target

31 Man:;h 2012

30 June 2012

Target

"

i

"

,

~

~

6B

>

••

,

~

f

"

Z

M

General Comments

30 Sept 2011

Target

Target

Evidence

I

~

"

SFA 8

Good

Governanc

e and

Regulatory

Reform

Legotls Top 20

Objective

C

Due to the current economic climate 11 wOUld be unrealistic to expect a higher

cOllection rate

86 Management of

key flnane'al and

governance areas,

SFA 8

Good

Govem8m;

Objective

E

such as "'come

control. cash now,

imligenl support

""

Revenue collected as

a percentage 01 billed

amount

Monthly Payment

Ratio report to

Achl<wemenl as

at 30 June 2011

95%

Annual

95%

95%

95%

95%

altemative income

opportunihes, asset

am! risk management

89 Manegement of

key financial and

govemance areas

such as irlcome

comrol, cash flow,

Indlgem suppon,

alternative Income

opponunilies, asset

end risk management

""

Obtain an optimum

ratrng from National

Treasury With regards

to tM embedding of

Risk Management in

the City

Finance Panlolio

Commit1ee

Filed in Office of

DHector- Revenue

The achievement of a level 4 rating is dependent on Nahonal Treasury's

developmant of ratmg cntena for levels 4 - 6 (currently only rahng criteria for

levels 1 - J 9 has been developed)

Achievement as

at 30 June 2011

,

Annual

""

,

""

,

""

National Treasury

Maturity survey results

obtainable from the

IRM department

This irldicator measureS good governance and accounting praclices and

will be euatuated and considered by the Auditor Generalm determining

his opinion An unqualified audit opinion refers to the position where the

SFA 8

Good

Govemanc

e and

Regulatory

Reform

88 ,

i:

!

r

88 Management of

key financial and

governance areas,

such as income

oontrol. cash flow,

An unqualified aud,t

indigent support,

altemative income

opponunilies, asset

and riSk management

auditor hauing completed his audit has no reservation as to the fairness

of presentation of financial statements and conform no material errors or

88 1 Opinion of

Auditor-General

Achievemant as

at 30 June 2011

Unqualified

Audit Repon

Annual

Audit still in

progress

Audit

concluded and

unqualified

audit opinion

received

misstatement and conform With General Recognised ACCOunting

Practices This is referred to as "clean opinion"

Unqualified

Audit Opinion

received

Unqualified Audit

Opinion received

Annual Repon

Obtainable from

Dlrector- Treasury

Alternatively in relation to a qualified audit opinion the auditor would

Issue this opinIOn In whole, or In pan, over the financial statements if

these are not prepared in accordance With General Recognised

Accounting Practices or could not audit one or more areas of the

financial statements

I

;ndlcator standardlNormfBem::;hmark

Benchmark - 2007

n

SFA 8

Good

Govemanc

e and

Regulatory

Reform

882

i:

!

r

89 Management of

key financial and

govamance areas,

such as inoome

control, cash flow,

mdigent support,

alternative Income

0PP0riUrlilies, asset

and risk marlagement

I~ report Which reflects cred,t wonhlness of an institutIOn to l'epay long

term and shon-term liabilities Credit rating IS an analySIS

the City's

key financial data performed by an independent agency to:assess its

ability to meet short· and long·term financial obligations

.....

d

Mamtam tire City's

Credit Ratmg

892 Opinion of

independent ratmg

agency

Achievement as

at 30 June 2011

A1 + (short

term)

AA· (long

term)

Annual

""

""

""~

Al + (shon term)

AA- (long term)

Credit Reting Report·

Treasury websltel

Indi cator standardlNormfBenc hmark

Oirector- Tteasury

8enchmark - 2007

A1 + (short term)

AA- (long term)

"

~

W

N

Reflects the percentage of assets annually verified by audit pU'lloses

SFA 8

Good

Governanc

e and

Regulatory

Reform

"

,,•,

r

89 Management Of

key financ,al and

govemanca areas,

such as Income

oontrol, cash flOw,

indigent suppon.

alternative Income

opportunities, asset

and nsk management

"I,

Percentage annual

asset venfiestion

process completed for

City

Achiavement as

at 30 June 2011

100%

veriflcaMn

Annual

""

""

""

100% verification

Owix report· Office of

Manager, Accounting

& Assets

"

1112 S091P Finance Directorate 13Apr11_FINAL

Page 2

-

,

,

c

0

Corporate

SFA &

SClllrecard

Diredlllrate

Indicatll>r No.

Objective

and Leed

No

Directorate

5

SFA 8

Good

Governanc

e and

Regulatory

Reform

~

~

Objective

Legot/e Top 20

Objective

.~

,

G

,

~

Indicator

(To include unit of

measure)

Baseline

(201012011)

Annual

Target

201112012

~

,•,i•

"

N

R

V

Z

30 Sept 2011

Target

31 Oec2011

31 March 2012

Target

Target

30 June 2012

Target

Evidence

AA

General Comments

~

,,

<

'"

E

>

~

c

88 Management of

key financial and

governance areas,

sucl1 as Income

control, cash flow,

'nd'gent support,

alternative inCOme

opportun,tles, asset

and risk management

"/.

Net Debtors to Annual

Income (Ratio of

outstanding serv,ce

debtors to revenue

actually rece,ved for

services)

Achievement as

at 30 June 2011

Calcutation

from

approved

budget

Annuel

"'"

"'"

",_

Calculat'on from

approved budget

SAP Report

Director: Treasury

Perform CalculallOn

Net Current debtors IS the balance of debtors that are classified as current for

financ'al statement purposes, but excluding the short-term port,on of long-term

debtors_ The provision for bed debts is deducted from the current debtors'

balances Provision for bad debts- Is the amount set aSide as a prOvision 'n the

accounting records to take Into account the possible non-payment by debtors

Total Annual Operating Income' Income from all sources thet will be credited 10

the income statement for financial statement purposes in accordance with

prescribed finanoal statement formats but excluding conditional grants for cap,tal

expenditure housing receipts attributable to the HOUSing Devellllpment Fund,

new hOUSing subs,dy scheme receipts, publ,c contnbuliOns and gains on the

disposal of property, plant and eqUipment The m'd-year calculations for

operating income are based on the actuals up to the current period plus the

budget for the remaining period

16

SFA 8

Good

Governanc

e and

Regulatory

Reform

'"

/:

c!

88 Management of

key financial and

governance arees,

sucl1 as income

contrOl, cash flow,

indigent support,

altematlve income

opportunities, asset

and risk management

"/.

Debt coverage by own

billed revenue

Ach,evement as

at 30 June 2011

Calculation

from

approved

budget

Annual

"'"

"'"

"'"

Calculation from

approved budget

SAP Report

Treasury

~rector

"

SFA 8

Good

Govemanc

e and

Regulatory

Reform

<

'"

~

c

8B Management of

key financ,al and

governance areas,

such as Income

control, cash flow,

,ndigent support,

alternative income

opportunit,es, asset

and risk management

"'"

Ratio of cost covefage

ma'nta'ned

Ach,evement as

at 30 June 2011

Calculallon

from

approved

budget

Annual

",.

"'"

"'"

Calculation from

approved budget

SAP Report

o.rector, Treasury

Perform calculation

Own b,lIed revenue to loans outstanding Total own b,lIed Income' Income from

all sources that woll be credited to the income stetement for financial statement

purposes in accordance with prescribed fInancial statement formats Total debt

Aggregate 01 long-term liabilities, short-term liabllilles ,ncluding bank overdrefts,

hire purcl1ase liabilities and finance lease I,abillties but excluding trade creditors,

consumer depos,ts, payments In advance from consumers and provisions, debt

related to sinking fund investments is reduced by the investment The mid-year

Calculations for own billed revenue are based on the actuals up to the current

period plus the budget for the remaining period

Perform calculation

Total cash and Investments (short term) to monthly operat<ng expenditure Cash

and cash equivalents refer to the short term Investments and cash available as at

the period ending

Operat'ng expenditure Includes all expenditure that Will be debited to the income

statement for financial statement purposes ,n accordance with preSCribed

f,nancial statement formats It excludes capital expenditure The m,d-year

calCulations for expenditure are based on the aduals up the to the current penod

plus the bUdget for the rema'nlng penod

.

'.

16

"

SFA 1

Shared

Economic

Growth and

Developme

"

•w

U

"'

lA Create an

enabling envirooment

for the economy to

grow and become

globally competit,ve

"'"

Percentage of the

Rand value of

purchase orders

allocated to

SMMEIHDI

suppl,ersiservice

providers

AcI1'evement as

at 30 June 2011

Annual

55%

55%

55%

55%

55%

SFA 8

Good

Governanc

e end

Regulatory

Reform

8A

•

U

W

8A Ensuring

enhanced service

delivery With effic'ent

Institutional

arrangements

"/.

~

W

"

Improved average

turnaround time of

tender procurement

processes In

accordance w'th

procurement plan

(weeks)

....-

AChievement as

at 30 June 2011

There are 2 measures to be taken into account'

(1) Tenders are believed to be completed In 6 weeks from the clOSing to award.

this IS the norm

(2) Orders are based on a norm 01 not having any unprocessed requlsilions

calculated on a 22·day working month

7 weeks

Monthly

7 weeks

7 weeks

7 weeks

7 weeks

ZO

SFA 8

Good

Govemanc

e and

RegUlatory

Reform

8A

•w

U

8A Ensuring

enhanced service

delivery With effiCient

institutional

arrangements

"/.

Development and

Implementation of

Contractor

Performance

Management S~tem .

Phase 2

The Contrador Performance Management System is ,nillally 'mplemented as a

P,lot ProleCt and thereafter will, over a penod of time, be rolled out to all

Departments Within the City

Achievement as

at 30 June 2011

Implemented

Documentation

Quarterly

as per plan

completed

Submitted to

EMTfor

approval

Pilot Project

Implemented as

per Plan

"

1112 SDBIP F'nance Dlrectorate.13Aprll FINAL

Page 3

A

SFA &

8

Corporal!:!

Scorecard

Directorate

Indicator No.

Obj",ctive

Is

N.

and Lead

Directorate

SFA 8

Gaad

Gavo:orn<lnc

e <lnd

8A

C

~

•~

Obj",ct;ve

G

Legctla Top 20

Objo:octlve

Indicator

(To include Unit of

measure)

H

Annu<l1

S"seline

(2010/2011)

r"rget

201112012

~

,

N

R

V

31 Oec2011

r<lrtlet

31 March 2012

30 June 2012

Target

Target

31-Oct-It

29-Feb-12

31-May-12

g

,•

•

AA

G'm'H<1I Comments

30 So:opi 2011

Target

Ellidance

~

,

~

~

Regulatary

Refarm

D

8A Ensuring

o:onh"nco:od so:orv'Co:>

delivo:!1Y with ",flle"""1

institution,,'

",

Signed Suppjo:omentary

V"lu<ltian Ralls

submiUo:od 10 tho:> City

Achlevemo:ont as

at 30 Juno:> 2011

M"nager

<lrr<lngo:omo:onts

310el2011

29 F",b 2012 On-9 a;n9

31 May 2012

"',

Capy al I",U"" ta City

M"n<lger

Obt";n<lbl,,, fram

Directa,' V"iual,ans

22

SFA 8

Goad

Gavam"nc

a and

Ro:>gulatary

Reform

8A

j

~

8A Ensuring

enhanco:>d sarvlco:>

do:>IIvo:>ry with o:>fficienl

institutional

arrango:>mo:>nls

30 Nail 2011

"~

Valu"tlan Ralls

publlsho:>d '" tho:> press

31 M"rch

2012

30 Juno:>

2012

Achievemo:>nl "s

at 30 Juna 2011

On-gaing

""

30-Noll_l1

31-Mar-12

Financial

repartlng by all

municipal

o:>nlitio:>s an"

monthty basis

Financial

raparting by all

municip,,1

entitio:>s an a

monthly basis

Financial

reporting by all

municipal

o:>nlitio:>s an"

monlhly basis

30-Jun-12

Extr"ct of

advertiso:>mo:>nl in Iho:>

prass

Obl"inabto:> from

Oirector Valuatians

23

!

f1i

SFA 8

Gaad

Govo:>rn"nc

0:> a~d

88

Ro:>gulatory

Refarm

!

~

~

!

~

88 Man"go:>mo:>nt al

key fin"nci,,1 and

gavernance "ro:>as,

such as incama

control, cash flaw,

indigent support,

altem"live Incamo:>

appartUJlltjo:>s, "ssel

a~d risk man"go:>mo:>nt

"~

Campli"nce, as lar "s

is W1th", tho:> Oty's

i~fluenti,,1 ability. with

the financial reporting

raquirements "s

autlined In current and

any new municipal

leglslatlan

Fi~anClal

financI,,1

complianco:>

by all entltio:>s

In no:>w

formal or

exemption in

placo:>

Achievemenl "s

"t 30 Juno:> 2011

Manlhly

Camphance

with

do:>adlino:>s on

budgeting

"nd financi,,1

reporting

rIIparting by "II

mUnicipalo:>ntilies

an a monthly

basis, setting

upper limils al

Monthly fin"ncial

raparts: Council

Submissions

s"l"rio:>s far

o:>nlillO:>s

Primary Oo:>adllno:>s. AFS complo:>lian 2 months ,,11o:>r ye"r-o:>nd. wllh cansalldatian

p"cks following. Annual Ro:>parts to bo:> subm,tto:>d ta tho:> City by o:>nd Oo:>cambo:>r

Assist with "ny

"nd

I"bled in Council In Ja~u"ry, Entity 8udgo:>t ta bo:> "ppravo:>d by Ba"rd 30 d"ys

Enlity budgo:>ls to

Financial

consalid"lion

Copies of Annual

befare implemo:>nl"lian, Manthly ro:>porting with", Iho:> so:>ctlan 87(11) timo:>lrames

h"ve bo:>en

st"lo:>mo:>nls al

quanes "nd

Ro:>parts "nd Cauncil "nd ro:>part format

Enlity Annu,,1

"pproved by

o:>nlitias la be

respond to

Submlssians: Capio:>s

Reports ta have Boards by tho:> end

campleted and Auditor-General

af Budgo:>1

beo:>n lablo:>d by

al41h quarter,

submitted ta

quenes on

submissians and

o:>nd January

Cilyappraved

Iho:> AuditarAfSI

relato:>d

allocalions, who:>ro:>

Go:>nerai

Cansalidated

carro:>spondenco:>

necess"ry

~

......

ACO

c....:l

25

~

KEY OPERA TtONAL INDICATORS (KOls!:

26

Oata Saureo:>' SAP & SAP People are the City's masl valuab.,!tSSet Wh~sl ~ IS acknowledge thaI all slall performrng al

acceplable levals I~ the arga~isatia~ ale valuable. "rc$pectove ollt>e~ profession, specific

I~tcrvenlions and strategio:>s ~eed la bo:> applied 10 retai~ hfgh palenllal indiVIduals I~ SCarce

Data cxtraebo~ will be

skills professlone ThiS IS mo:>asured by a % attritian af stall in thcse calegorles over a 12

fac;,tated by Corporate

month peood agalnsl an ac.::eptable benchmark % tumover of 12%

Services

E.!mm!liJ.i. Totallermonabons as % of stall compiemo:>nt each month, as measUfed OVer a

Training for data

precedmg 12 monlh pe~od (I 0:> 12 month ro~Ing average). This win be l,mOOd 10 the follOWing

< 12% within

extraC\lon Will be

occupational "alego"",. Le9'~alors & se~Ior ma~agers, ProfeSSionals, Technicians a~d other

Skilled calo:>gories ladlftared by Corporale

prolessio~als

"

~

SFA 8

Good

GOvo:>rn"nc

0:> "nd

Regul"IOry

Ro:>form

M

~

~

~

8A Ensunng

o:>nhanco:>d SO:>rvlCO:>

do:>llvery W1lh o:>ffic,o:>nt

institu,"on,,1

anango:>ments

"I,

Ratention 01 scarce

Skills as mo:>"sured by

st,,11 lumover lor

Fin"nco:> Diractorato:>

Achlo:>vo:>menl as

al 30 Juno:> 2011

<:

12% within

skilled

Qu"rto:>rly

calo:>gono:>s

< 12% within

sklllo:>d

c"to:>gorio:>s

<:

12% wilhin

skilled

calagorio:>s

<:

12% wrthin

skilled

calo:>gorio:>s

Se~ces

Targel Ihe stall !i.ltnover % must be $t2% thrsughout the finaneral year

0

0

A Iral~ing manual IS

availablo:> to assist WIth the

extractio~ of the report

27

1112 SD81P Fln,,~ce Diro:odo",lo:> 13Apr11 FINAL

Page d

A

,

C

D

,

G

[

SFA &

Directerate

Objective

No.

Corporate

Scorecard

Indicator Ne.

and Lead

Directorate

~

Objective

i

Legatls Top 2Q

Objective

Indicator

Basel;ne

(To include unit at

measure)

(201012011)

H

Annual

Target

2011/2012

,,••

"

i:

N

R

30 Sept 2011

31 Dec 2011

31 March 2012

30 June 2012

Target

Target

Target

Target

g

Z

AA

General Comments

Evidence

~

Dala SOlKC ..

Repert-PT6~

'"

(absenlee,sm rale)

SFA B

Good

Gouemanc

e and

Regulatory

Relorm

,i

eA

~

~

•

A

8A Ensuring

enhanced serv,ce

delivery with efficienl

institutional

arrangements

",

StOlfI availablhty as

measure by %

absentee,sm lor

Finance Directorate

~4%

Achievement as

at 30 June 2011

0

(average

ouer 12Quarterly

month rellin9

perrod)

<4% (average

over 12·month

rolling penod)

<4% (average

ouer 12·month

roiling period)

~4% (average

over 12-month

rolling penod)

~4% (average

ouer 12·month

rolhng periOd)

AbsenteeISm is defined as be,ng absent fro'n Ill .. workplace due Ie unplanned absences "5 a

resUI of ill health. uneulherised absences (AWOL). ,nJury on dClly and ~Iegal strike ael,oo

All line manege," must manage employees' ~m" snd attendance ""Ill a ",ew ta reducmg

l.O'I\>.. nned absenteeism's I.,.. than "r equell" 4% """,age for lIle 12 month period, Th;s IS

!raining manual i.

an Internationa' Benchmark In so doing managers must apply the Time and Attendance

available to aSSISt WIth the po~cy. the Incepacity policy aoo the Leave Management framework to mon~or aoo evaluate

e""action el the report

employees' attendance and abs""ce trends and take remedial action where ,equ~ed ,n terms

or such policy

Formuta: Number or UI1planned absern:e days~ by the number 01 planned days or

work ~by 100 (over 12th month rolling period)

0

28

Data Source: SAP & SAP The Workplace Sldlls Plan i. the appraued EducaMn Tra,ning and Development plan or an

orga .. zatJon thatsupparts the achievemellls al the o<gan<zation's slrateg'c goals and

operatianar reau~ements by lden~fying pnOlilized Ira,n,ng needs and benefrcrarles

Oata extrac~on will be

lacjitated by Co<po<ate

lis purpase IS to lormally plan and allacate budget lor appropnate tra,nrng interventions whiCh

Services

will address the needs arising out al the City's strategic 'equWements as contained in the lOP

tt'e 1ndividual departmentel staffing strategies and Indovklual employees' Persanal

Development Plans and Local Gouernment's Skrlis Seclor Plan

"

SFA 8

Good

Govemanc

e and

Regulatory

Reform

,i

8A

~

~

~

SA Ensunng

enhanced service

delivery ~th efllcient

,nst,tut,onal

arrangements

",

Percentage budget

spent on

,mplementaMn 01

WSP lar Finance

Drrectorate

AChievement as

at 30 June 2011

90%

Quarterly

Deparlmental

projected %

spent

Departmental

projected %

spent

Departmental

projected %

spent

The WSP shall aiso take Inta account the Employment Equ,ty ?Jan, ensuring "eo'poraban 01

relevant developmental equoty interventro"" "to the ptan

90%

The WPSP is. coilaborative ptan, i""elVlng employees and the unions rn ,ts lermut.tion

8

E2ml!.!.Ill; % spent against planned trn.ng budget

"

Data SO!Xce' SAP & SAP The notiftcatJon system is an electronic recarding system to capture:ervice requ:sts received

from customers (illternal and extemal)

"

nw rndicator measure, the % achievement agai""t a set improvement ~s an'auerage

01 the following two components

~

• The time to crose no~lications

• The closu-e rate al natif",ations

W

The indrcator is calculated as lolows

Sf A 8

Good

Gouarnanc

e and

Regulatory

Relorm

"

~•

"~

S

8A Ensunng

enhanced service

deliuery w,th effiCient

Institutional

arrangements

Reduce time to

resolve complaints

SA 2 Percent.ge

improvement 01

responsiveness ,n

""

1 A Base,ne is determined 10< each of the comp:>nents usrng a rO""'g aoleJage-: The SOUfce 01

informaHan lor this is the SAP NotificabOll system

2. The Target lor imp.-ovement OS calculeted based on the baselille The terg~ts lor

imp.-ovement are as foilows

New measure

Quarterly

100%

100%

100%

100%

100%

Target Ql ~ 3% Improuement .garnst basel'ne

Target Q2 ~ 6% Improvement against basel,ne

Target Q3 ~ 9% ""provement agaInSt baseline

Target Q~ ~ t2% impro""ment against base,ne

service del'very

3 Measure the actual performarn:e aga,nst th .. 'mprovement target usrng the fellowing

Io<mula' % al achie""ment ~[(actual-target)ltargetl·tOO

4 Calculate the perlermance against the target 01 100% as lellews (% 01 achrevement far

Ave days I<> close) + (% al achievement for closure rate) 42 ~ %

Data source Is SAP Busrness Inter,genee (BI)

"

SAP Report VIa

Corporate EE Office

SFA B

Good

Governanc

e and

Regulatory

Relorm

8A

~

~

~

~

0

0

BA Ensuring

enhanced service

delluery with elf,cient

inslitutronal

arrangements

""

% Compliance with EE

aproved plan per

directorateJdepartment

In terms 01 new

appointments tor Ihe

current linancial year

..

%

compliance

Ach,evement as

at 30 June 2011

determmed

by

Departmenta

I EE plan

Quarterly

% compliance

as determined

% comphance

as determinad

by

by

Departmental

EE plan

Departmental

EEplan

% compliance % compliance as

es determined

determined by

by Departmental Departmental EE

EE plan

plan

Thos Ind1cator measures the number of appolntmenlS across all directorates over the

preceding 12 month period Appointments are benchmarked against Sta~srics SA's

Economically Active Popu~~011 oonchmarl< demographics for the Westem Cape based on the

2001 census data, The benchmark demographics are used to measure compliance rn terms

designated groups i,e, (African Female, Coloured Female, Indian Female, WMe Female

African Male, Caloured Male, Indian Male) The IOlowing lob catego"es are e.duded from this

measurement Councdlors, students, appr<mtices. contracto,," atld non-employees

indicator perta'ns to the current financial year

",

31

1112 SDSIP Finance D,rectorate 13Aprll FINAL

Page 5

A

SFA &

Directorate

Objective

No.

,

i

SFA 8

Good

Governanc

e and

,

c

Corporate

Scorecard

Indicator No.

and Lead

~

Directorare

i

88

SFA8

Good

Governanc

e and

Regulatory

Reform

!

,

8B

SFA 8

Good

GOvernanc

e and

Regulatory

Raform

!

;

eo

Legotle Top 20

Objective

Objective

i

88 Management of

key financial and

govemallce areas,

such as income

cOlltrol, cash flow,

indigent support,

alternative Income

opportunities, asset

and nsk management

~

"

88 Management of

key financial alld

governance areas.

such as Income

control, cash flow,

Indigent support,

alternative oncome

opportunities, asset

and oisk management

33

!

~

!

;

~

G

I

>

'~

i 32

,

E

~

"

Regulatory

Reform

0

a

88 Managemellt of

key financial and

governance areas,

such as Income

control, cash flow,

Indigent support,

alternative incOme

opportunoties, asset

and risk management

Indicator

(To include unit of

measure)

,,i•

Annual

Baseline

(201012011)

Target

2011/2012

"

"

N

R

V

30 Sept 2011

31 Dec 2011

31 March 2012

30 June 2012

Target

Target

Target

Target

Z

AA

General Comments

Evidence

D~ec!orale FlnaflCC

M"""oef" ertracl dala

.Elll!n!l!!; Percentage reOecting Actual spend I Planned Spend

QUarterly

Create assels for

pUbb'C benefit

88 3 percentage of

Cap'tal Budget spent

for F'nance Directorate

AChievement as

at 30 June 2011

Dir/Depart

Quarter1y prOjected cash

Oow

95%

Dir/Depart

projected cash

flow

Dir/Depart

projected cash

Oow

95%

Directorate Finance

Manage", e><tract data

quarterly. SAP

Percentage of

Operating 8udget

spellt lor Finance

Directorate

,",

Achievement as

al 30 June 2011

Dlr/Depart

Quarlerly prOjected cash

Oow

g5%

DirlDeparl

projected Cash

",w

Dir/Depart

projected cash

Oow

~Tstal

actual to date aa a percentage sf the Iotal budgetlnciuding secondary

expendt\Jre.

95%

Schedule suppl",d by

The ,ndicatar renecis the percentage of assets verified annually for avdit assurance

Assets Seclian, Treasury It IS an 'nternal data oource being the Qui. svs'em scanning all assets and "P,aadlng them

Dapartment

against the SAP data files

Data are dawnlaaded at specific ~mes and are Ihe bases far the assessment at prsgress

,",

Percentage of annual

esset verification

process completed for

Department

100%

AChievement as

at 30 June 2011

completed

by 30 June

2012

Annual

0%

0%

0%

100% compleled

by 30 June

,"

!

i

SFA 8

Good

Governanc

e and

RegUlatory

Reform

eo

~

1

~

88 Management 01

key flnanclel and

governance areas,

such as Income

control, cash flow,

,ndigent support,

alternative Income

opportunllies, asset

and nsk management

Schedule supplied by

Intemal Audit . Support

Services Manager

,",

Percentage Internel

Audit findings resolved

for Department

Achievement as

at 30 June 2011

70%

Quarterly

70%

70%

.

.

.:

The Baseline 2010/2011 data will be updated and reflect actuals as at 30 June 2011, once finalised.

..l2.

2!.

Approved by Chief Finance Officer:

£

f-!l Data:

fi'.

Approved by Mayco Member'

~

~

~

( '1-1 4-R"7i I

'

(

h;.

Z~,..---------

/Ahj.~~

~

"

-

.-

.1Z.

fi'.

70%

.

30

2!.

70%

il,s the reportmg and mootsriog of the reduc~on (In percentage) afthe findings sl audit 1~law·

ups performed in the quarter

The bmng lor ca"eclive aclian iml>ementatian IS normally pravided by I"",

Audits /f~law-ups ""I always snly take place after agreed implemem.mOll dates af correcli.e

aclron 11 will ell/rer be 'Not ApplK:ab ..' to Management ~ an aud~ ar 1~law·up hasn'l taken

place at the bme 01 reporting or there wi! be • percentage change I status qua if sn aud~ has

taken place and there has been impravement I no change respectively., the srtua~on sonce

the last audit

--

1i/4/1!

Date:

1112 S081P FInance Directorate 13Apr11 FINAL

Page 6