Paving the Way for Germany’s “Energiewende”

advertisement

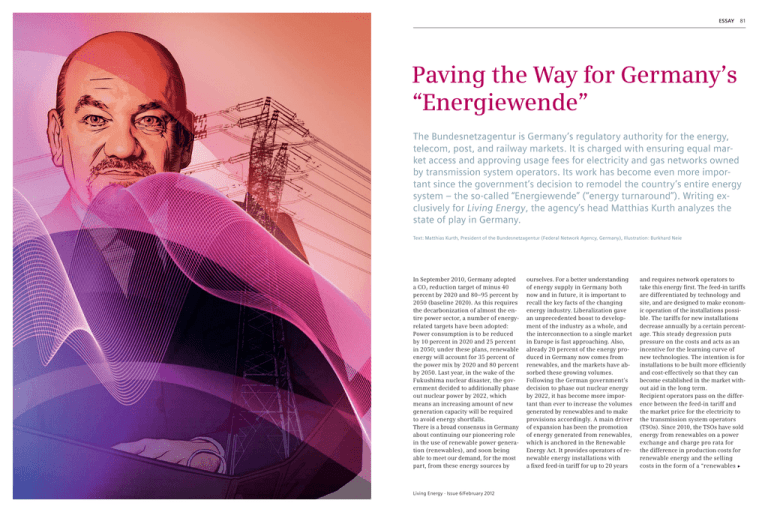

ESSAY 81 Paving the Way for Germany’s “Energiewende” The Bundesnetzagentur is Germany’s regulatory authority for the energy, telecom, post, and railway markets. It is charged with ensuring equal market access and approving usage fees for electricity and gas networks owned by transmission system operators. Its work has become even more important since the government’s decision to remodel the country’s entire energy system – the so-called “Energiewende” (“energy turnaround”). Writing exclusively for Living Energy, the agency’s head Matthias Kurth analyzes the state of play in Germany. Text: Matthias Kurth, President of the Bundesnetzagentur (Federal Network Agency, Germany), Illustration: Burkhard Neie In September 2010, Germany adopted a CO2 reduction target of minus 40 percent by 2020 and 80–95 percent by 2050 (baseline 2020). As this requires the decarbonization of almost the entire power sector, a number of energyrelated targets have been adopted: Power consumption is to be reduced by 10 percent in 2020 and 25 percent in 2050; under these plans, renewable energy will account for 35 percent of the power mix by 2020 and 80 percent by 2050. Last year, in the wake of the Fukushima nuclear disaster, the government decided to additionally phase out nuclear power by 2022, which means an increasing amount of new generation capacity will be required to avoid energy shortfalls. There is a broad consensus in Germany about continuing our pioneering role in the use of renewable power generation (renewables), and soon being able to meet our demand, for the most part, from these energy sources by Living Energy · Issue 6/February 2012 ourselves. For a better understanding of energy supply in Germany both now and in future, it is important to recall the key facts of the changing energy industry. Liberalization gave an unprecedented boost to development of the industry as a whole, and the interconnection to a single market in Europe is fast approaching. Also, already 20 percent of the energy produced in Germany now comes from renewables, and the markets have absorbed these growing volumes. Following the German government’s decision to phase out nuclear energy by 2022, it has become more important than ever to increase the volumes generated by renewables and to make provisions accordingly. A main driver of expansion has been the promotion of energy generated from renewables, which is anchored in the Renewable Energy Act. It provides operators of renewable energy installations with a fixed feed-in tariff for up to 20 years and requires network operators to take this energy first. The feed-in tariffs are differentiated by technology and site, and are designed to make economic operation of the installations possible. The tariffs for new installations decrease annually by a certain percentage. This steady degression puts pressure on the costs and acts as an incentive for the learning curve of new technologies. The intention is for installations to be built more efficiently and cost-effectively so that they can become established in the market without aid in the long term. Recipient operators pass on the difference between the feed-in tariff and the market price for the electricity to the transmission system operators (TSOs). Since 2010, the TSOs have sold energy from renewables on a power exchange and charge pro rata for the difference in production costs for renewable energy and the selling costs in the form of a “renewables u ESSAY contribution.” The electricity supply companies then include the added costs in the form of this contribution in the calculation of the end consumer prices. The electricity customers thus paid over €13 billion in 2011 to promote the generation and feed-in of renewable energy. These payments have enabled renewables in Germany to come of age and to leave their niche position – but renewables are untroubled by the pressures of competition that the rest of the energy market has been experiencing for some time now. Something must change if the expan- ESSAY Solar power is generated only when the sun shines. Hence, network operators cannot rely on their permanent availability and have to make arrangements accordingly. As long as there are not enough storage facilities to offset the volatile feed-in from renewable energy sources, sufficient reserve capacity will be needed to compensate for periods of little wind and little sunshine. Challenges from Fukushima Fallout The closure of eight nuclear power plants in the aftermath of the reactor “The Renewable Energy Act has brought about remarkable developments in renewables, but also tremendous challenges for the grid.” sion of renewables is to remain predictable. Renewables must leave behind the risk-free feed-in tariffs and be integrated, step by step, into the market. But declining feed-in tariffs alone will not involve the producers in the price and volume risks. It is true that trading energy from renewables on the exchange since January 2010 has been a big step forward, but real integration will require producers of renewable energy to take on the price and volume risks themselves. The Renewable Energy Act has brought about remarkable developments in renewables, but also tremendous challenges for the grid. For the grid, these developments mean one thing, above all: stress. Renewables, because of the fluctuating production, have little consideration for the concerns of the grid. Wind power can be generated only where and when the wind blows. accident in Fukushima adds to the challenges faced by the grid. The Bundesnetzagentur has probed the implications of this decision for the security of supply, and could have given orders for back-up operation of a nuclear plant. However, this is not considered necessary for this winter or the next. These were the findings of all the feed-in and load scenarios studied. All the studies have shown that the transmission network would remain controllable even in a situation of exceptional contingency. Indeed, to avert states that threatened the stability of the grid, considerable intervention by the TSOs in the operation of the power plants would be necessary, and extreme situations in the grid could be managed only with the help of changes to the power plant schedules, which are determined by market outcomes. However, given our current level of knowledge, the main extreme situations for the transmission networks are manageable as a result of the TSOs’ intervention instruments, without the need to order operation of a nuclear reserve power plant. The Bundesnetzagentur’s studies on the impact on the transmission networks of exiting nuclear power show that the networks have reached the limits of their capacity as a result of the large number of additional transport tasks in the last few years and the changes in the structure of generation. Electricity must be transported on average much farther today than just a few years ago, and no end to this trend is in sight. In past decades, the grid was built around the main fossil and nuclear production plants, not all of which were close to where the energy was actually needed. Grid expansion is therefore urgently required, as the changes in energy production call for radical structural changes to the conventional grid. At present, every figure on the expansion required is dependent on a number of unknowns. This begins with the period for consideration. If we are talking about 2015, we need to add some 850 kilometers of new lines to the transmission network. Since summer 2009, only about 100 kilometers have been installed, however. On the other hand, if we focus on 2020, we can refer to the second, highly nuanced study by the Deutsche Energie-Agentur (dena), which states the following: Using current technology, we need up to 3,600 kilometers of additional extrahigh-voltage lines. If we take a wholly new technical approach and convert existing lines to high-temperature lines across the country, then – put simply – the costs would double, but the number of new lines would be halved. One thing is clear, however. The longer the period we are looking at, the more lines we will need. An 80 percent share of renewables by 2050 will necessitate significantly more lines, and we will have to think about entirely new technical solutions. Where exactly Living Energy · Issue 6/February 2012 the networks need reinforcement and additions calls for diligent analysis and discussion – which the Bundesnetzagentur will undertake as part of the network development plans. The network development plans will include all the measures needed in the next ten years to optimize and to reinforce and expand the grid. To this end, the Bundesnetzagentur consulted on the scenario framework in July last year. The scenario framework, drawn up by the TSOs, provides a sound basis under the changed legal framework for drawing up the first ten-year network development plan, and consultation on the scenarios is an essential part of the process as a whole. All this naturally raises the question of the costs. Many fear it will automatically lead to higher energy prices. I hasten to qualify this somewhat, however. First of all, no one can seriously predict what the prices will be in 2015, let alone in 2020. The best indicators of price trends are the futures on the power exchanges. While they do indeed signal rising prices, they do not signal dramatically rising prices. 83 The same is true of the feed-in tariffs. As expansion proceeds, the costs will rise, but degression will kick in. Also, there is another effect that will slow the rise of the added costs. Falling prices on the exchange will offset the contribution through lower procurement costs, and rising prices on the exchange will improve the revenues from renewables, in turn lowering the renewables contribution. I will risk a cautious forecast, though, of the costs of grid expansion. We really should keep an eye on these. The Bundesnetzagentur anticipates u German Energy Statistics Gross electricity generation Population 2009: Hydro (incl. pump storage) Renewables 14% Gas 4% 2% 14% Others (e.g., oil, fuel cells) 82 million Electricity total final consumption 621 TWh 2009: 23% 44% Nuclear* Coal 6,055 kWh per capita 2010 Transmission grid operators: ➔ ➔ ➔ ➔ Graphic: independent 82 50Hertz Transmission Amprion EnBW Transportnetze TenneT TSO Major electricity utilities: ➔ ➔ ➔ ➔ ➔ EnBW E.ON EWE AG RWE Vattenfall Europe CO2 emissions / population 2009: 9.16 tonnes CO … and about 950 smaller electricity utilities *Expert estimate for 2011: ~15 TWh gross electricity generation less from nuclear due to moratorium; to be compensated by other fuels Source: IEA Statistics Living Energy · Issue 6/February 2012 2 per capita IN SHORT ESSAY €30 to 60 billion, depending on the technology. Given the long depreciation periods, that is much less per consumer than appears at first sight. The need to expand the grid is occasionally used to demand less regulation and higher returns. Now and again, we see attempts to reduce efficiency requirements and to increase profit margins. If these ideas gain ground, then it really can become expensive for the network users and end customers. A second cost driver could be the tendency to conceal privileges or subsidies, even for particular branches or stakeholders in the use of system charges. If these charges are waived or considerably reduced for these branches and stakeholders, the costs for the remaining network users become commensurately higher. The main obstacles to new networks, though, are undoubtedly not the framework conditions for investors, but the approval procedures, which have often been intolerably long in the past. The recently adopted Grid Expansion Acceleration Act, most notably, marks an important new direction here. It will streamline procedures to ensure uniform regional planning and approval. And so, in future, the Bundesnetzagentur will be responsible for the following: • the ten-year network development plan, updated yearly, which the Bundesnetzagentur will submit every three years, at the latest, as a draft for a federal requirements plan Matthias Kurth President (2001–), Bundesnetzagentur (German Federal Network Agency) Background Chief Regulator Kurth studied Law and Political Economics at the University of Frankfurt/Main, Germany. He was admitted to the bar in 1978. Served as MP in Hesse state parliament (1978–1994). State Secretary in the Hesse Ministry of Economics (1994 to 1999). In February 2001, Kurth was appointed President of the Regulatory Authority for Telecommunications and Posts, later renamed the Federal Network Agency – Germany’s supreme regulatory agency for telecommunications, gas, and railway networks as well as postal services. “The exit from nuclear power has been decided and the accelerated expansion of energy from renewable sources is under way. Now, grid expansion and optimization must keep up.” for the transmission network, which will be submitted to the lawmakers; • specialist federal planning, which will examine planned routes and corridors with a view to their compatibility with regional planning and the environment and whose findings will be binding on the federal states and local authorities; and • planning approval procedures for specific line build projects when an ordinance requiring the consent of the Bundesrat determines that the Bundesnetzagentur will carry out these procedures. This will strengthen the Bundesnetzagentur’s contribution to accelerating expansion of the grid. If all the procedures could be carried out uniformly under federal authority, it would be possible to achieve timescales of around five years. Crucially important here, however, is constructive participation by a wide public at an early stage. Power lines are not particularly attractive, whether above or below ground. But attractive or not, they are needed, and it is vital that this is understood. Those affected at the local level need to accept that particular construction measures are required at the federal level and need to be able to have their say much sooner, and more vigorously, than hitherto. Procedures should therefore be transparent and must be conducted openly for all those who are interested and/or affected. I expect constructive participation from intensive, open discussions that are held in a timely manner and that have been well prepared. People do not want to be presented with plans that have already reached the completion stage. No, they want to take part, to have a say, in finding the best solution possible. The exit from nuclear power has been decided and the accelerated expansion of energy from renewable sources is under way. Now, grid expansion and optimization must keep up. Many questions and challenges still remain. But all these questions can be resolved and all the challenges can be met, given commitment on the part of all concerned. p Living Energy · Issue 6/February 2012 85 International News in Short Twelve brief news items on current projects, recent developments, and the latest innovations in the Siemens Energy portfolio. Taking to the Hills: Solar Farm for South of France In mid-October 2011, Siemens put the Les Mées solar farm in the department of Alpes-de-Haute-Provence in France on line. Located at an elevation of 800 meters above sea level on the wide, undulating La Colle des Mées plateau, the solar farm comprises a total of 112,000 solar modules covering an area of 70 hectares. For this project, Siemens installed a total of six turnkey photovoltaic (PV) power plants. Siemens was not only responsible for grid connection and the control systems for Les Mées, but also for supply and installation of the inverters, low- and medium-voltage components and transformers. The customer was Eco Delta Développement (EDD), whose subsidiary Delta Solar and Siemens jointly developed the PV farm in the district of Les Mées. The plant design met the demands for maximized efficiency despite the difficult landscape. Siemens erected the six PV plants in Les Mées in only ten months. The solar power plants, for which Siemens will also handle maintenance, will generate a combined peak output of 31 MWp. Approximately 12,000 French households can thus be supplied with clean electricity. “The Les Mées project demonstrates that we’re the right partner for successful, on-schedule implementation of complete PV plants,” says Martin Schulz, Vice President of the Photovoltaics Business Unit of the Siemens Solar & Hydro Division. An engineering and construction wonder: the Les Mées solar farm on the 800-meter-high La Colle des Mées plateau near the French Alps, completed in just ten months. Siemens Smart Grid Portfolio Enhanced Photo: Siemens 84 With the aim of enhancing its global market position in the field of smart metering, Siemens closed a deal in December to acquire eMeter, a meter data management specialist based in San Mateo, California (USA). “The acquisition means that the EnergyIP meter data management software of eMeter will become an Living Energy · Issue 6/February 2012 integral part of our smart grid portfolio,” says Jan Mrosik, CEO of the Smart Grid Division of the Siemens Infrastructure & Cities Sector. “Ever-increasing demand for more efficient power supply networks for cities and utilities make this acquisition even more important.” Siemens has partnered with eMeter since 2008. With the EnergyIP platform, Siemens is now one of the world’s leading providers of meter data management software, which can efficiently read out, manage and provide the increasing quantities of data from smart meters in the power supply network.