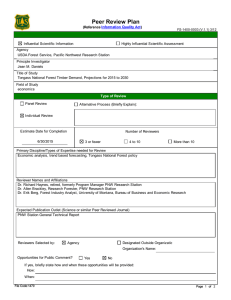

Tongass National Forest Timber Demand, Projections for 2015 to 2030

advertisement