Document 10457236

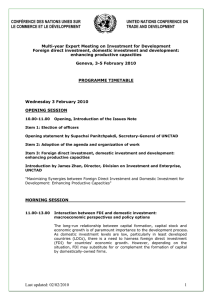

advertisement