TNCs and the Removal of Textiles and Clothing Quotas UNITED NATIONS

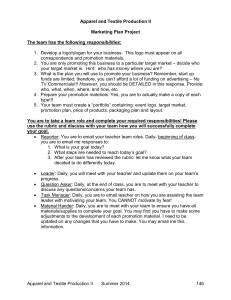

advertisement