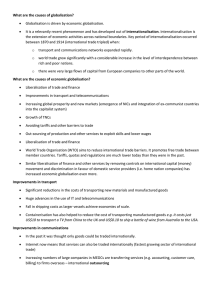

GLOBALIZATION OF R&D AND DEVELOPING COUNTRIES PART I

advertisement