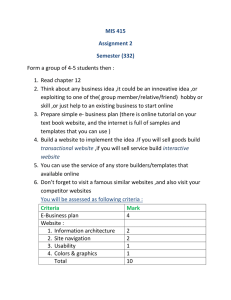

CHAPTER 2.

advertisement