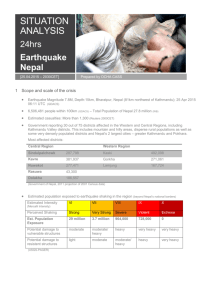

AL EP N NATIONAL SERVICES

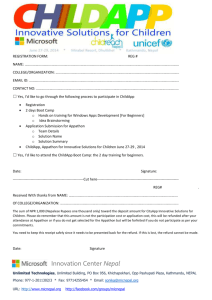

advertisement