February 1, 2012

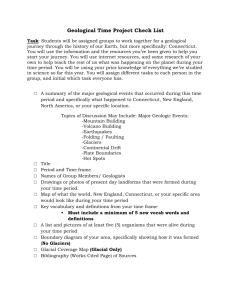

advertisement