February 1, 2012

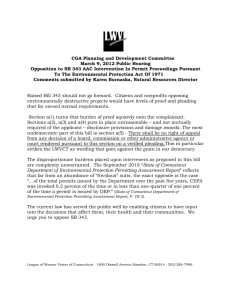

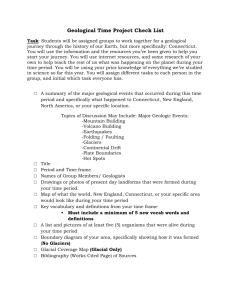

advertisement