Document 10429364

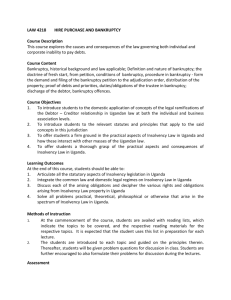

advertisement