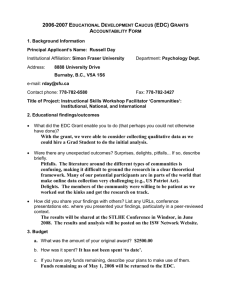

Education Development Charges Background Study and Review of

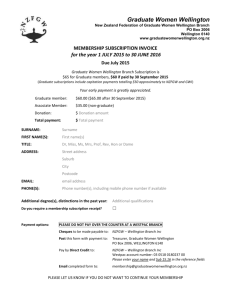

advertisement