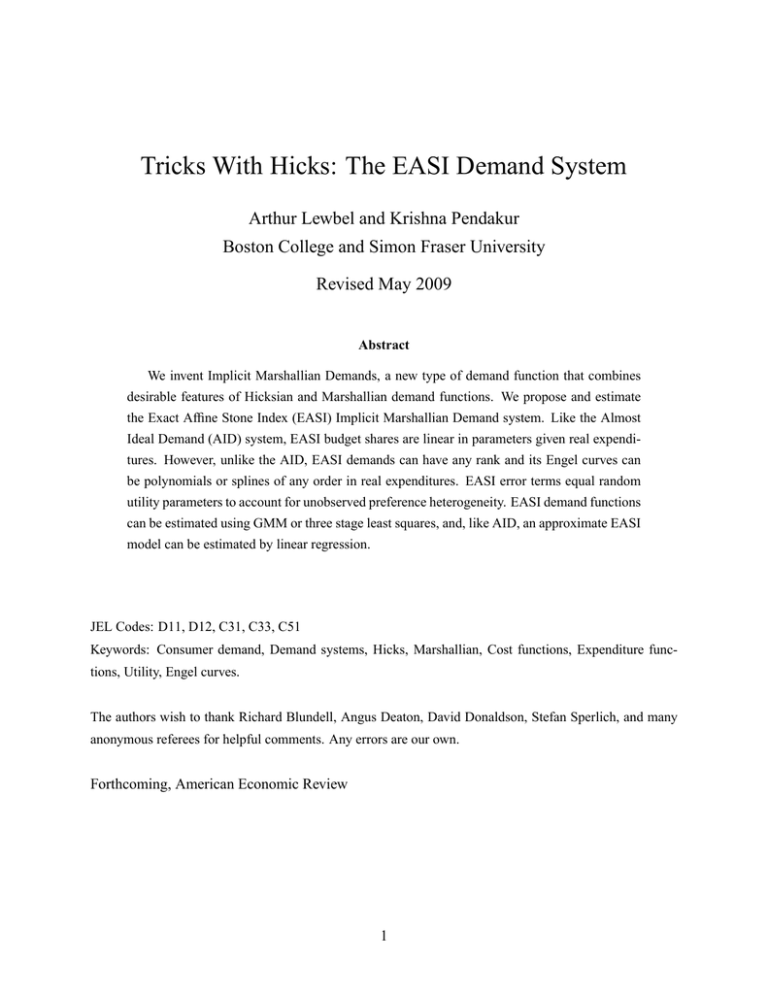

Tricks With Hicks: The EASI Demand System Revised May 2009

advertisement