The Evaluation of Barrier Option Prices Abstract Professor Carl Chiarella

advertisement

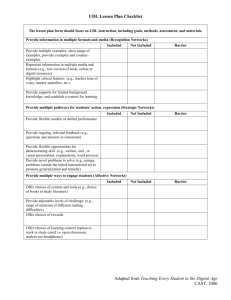

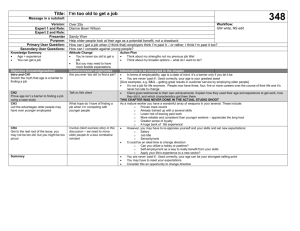

数学系学术报告 Mathematics Department Colloquium 2012.12.14 (周五) 13:30-14:30,工商楼 2 楼报告厅 The Evaluation of Barrier Option Prices Under Stochastic Volatility Professor Carl Chiarella Emeritus Professor, Head of Finance Discipline Group University of Technology, Sydney (Australia) Abstract In this talk we consider the problem of numerically evaluating barrier option prices when the dynamics of the underlying are driven by stochastic volatility following the square root process of Heston (1993). We develop a method of lines approach to evaluate the price as well as the delta and gamma of the option. The method is able to efficiently handle both continuously monitored and discretely monitored barrier options and can also handle barrier options with early exercise features. In the latter case, we can calculate the early exercise boundary of an American barrier option in both the continuously and discretely monitored cases. Introduction Professor Chiarella completed the MCom (Hons) in economics at the University of New South Wales and took out a PhD in economics in 1987 from the same University for a thesis in economic dynamics. He joined the School of Banking and Finance at the University of New South Wales in 1986 as a senior lecturer and was appointed Associate Professor in 1988. He took up the position of Professor of Finance at the University of Technology, Sydney in 1989, a position from which he retired early in 2004 as an Emeritus Professor. He returned to the School as a Professor of Quantitative Finance in mid-2005. Carl has held visiting appointments at a number of universities including University of Kyoto, Nanyang Technological University, Hitotsubashi University, Tokyo Metropolitan University, University of Bielefeld and University of Urbino. Professor Chiarella is the author of over 150 research articles in international and national journals and edited volumes and the author/coauthor of 5 books. Carl is a Co-Editor of the Journal of Economic Dynamics and Control and Associate Editor of Journal of Economic Behavior and Organization, Quantitative Finance, Studies in Nonlinear Dynamics and Econometrics and European Journal of Finance. 联系人:李胜宏 教授 (shli@zju.edu.cn) 骆兴国 讲师 (xgluo@zju.edu.cn) 欢迎老师和同学参加!