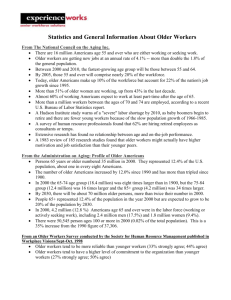

Employment Trends by Age in the United States: Working Paper M R

advertisement