OMB APPROVAL Estimated average burden

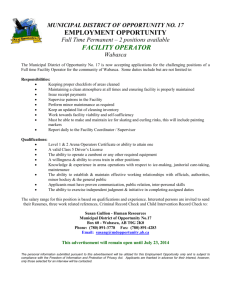

advertisement