UNDERSTANDING THE COMPANY AND ITS ENVIRONMENT, INCLUDING ITS INTERNAL CONTROL

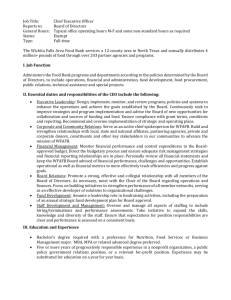

advertisement

UNDERSTANDING THE COMPANY AND ITS ENVIRONMENT, INCLUDING ITS INTERNAL CONTROL Industry, regulatory and other external factors Community Park Ltd was incorporated in 2000 as a company limited by guarantee of its members. The objective of establishing the company was to acquire a site for a community sports pitch and develop a number of soccer, gaelic football and rugby pitches on the site. Fundraising commenced immediately on incorporation of the company and by 2002 sufficient funds had been raised to allow the company acquire 10 acres of land close to the village centre. The purchase of land was funded by bank borrowings of €200,000 and funds on hand of €300,000. In 2003, work commenced on the development of the pitches and was completed in 2006. The pitch development cost €2 million and was funded by government grants of €800,000, lottery funding of €400,000, bank borrowings of €300,000 and local fundraising of €500,000. In 2009, new dressing rooms and meeting rooms were built on the site to replace the Portacabins that were initially used as dressing rooms. This development cost €1 million and was funded by lottery funding of €300,000, Pobal funding of €300,000 and bank borrowings of €400,000. The company has continued an active programme of fundraising over the years and this has allowed the bank borrowings to be reduced to € 100,000 (approximately) by 31st of December 2013. The fundraising activities undertaken include the running of the weekly local lottery and an annual Christmas sale of work. Nature of client including selection and application of accounting policies The company is limited by guarantee of its members and is registered in the Republic of Ireland. The registration number is 6025878. The company is registered with the Revenue Commissioners as a charity. There are six directors of the company and they meet on a monthly basis. The current directors of the company are: • Joe Duffy , • Gay Byrne , • Mike Murphy , • John Duffy , • Mary T Phelan , • Tom Johnson. One of the directors (Tom Johnson) acts as company secretary. The board is very active and maintains very good control over all aspects of the company’s affairs. At each monthly meeting the following matters are reviewed: • • • • • • Bank balances, Lottery returns, Income earned from pitch hire and amounts outstanding to the company from pitch users. Expenditure incurred in previous month. Planned income and expenditure for the coming months. Planned payments are approved. The company employs a caretaker who is paid a wage of €25,000 per year. Her duties include minor pitch maintenance, dressing room and meeting room cleaning, management of pitches and grass cutting. The employee does not handle any receipts or make any payments on behalf of the company. Company income is derived from: • Grants from the local authority (25% of total income); • Ongoing fundraising activities (25% of total income); • Pitch rental income (15% of total income) • and Pobal fundraising (35% of total income). UNDERSTANDING THE COMPANY AND ITS ENVIRONMENT, INCLUDING ITS INTERNAL CONTROL The Board is elected each year and board members cannot serve for a period in excess of 5 years. While it is not a rule of the company, it is generally accepted that the local GAA, Rugby and Soccer club would have one representative on the Board. The company’s accounting policies comply with the requirements of company law and Irish GAAP. Due to the simple nature of the transactions undertaken by the company no complex accounting matters arise. Parties identified as related parties of the company. Directors Ballyhay GAA Club Ballyhay AFC Ballyhay RUFC The financial framework adopted by the company in preparing the financial statements. The client is preparing their financial statements in accordance with UK and Irish Financial Reporting Standards. The overall objectives and strategies pursued by the company and the related business risks flowing from these objectives and strategies. The objective of the company is to provide sports facilities for the people of Ballyhay parish at a reasonable cost. In order to achieve this objective, the directors intend to continue ongoing fundraising activities to ensure that the facilities developed are maintained to a high standard and can be provided to the sports clubs at a reasonable cost. It is the strategy of the directors that pitch rental income and the local authority grant income should cover annual running costs of the company, with other income meeting new capital expenditure and debt repayments. Since 2007 the Board has broadly achieved this objective. This strategy does not result in an increased audit risk. Procedures used to measure and review the financial performance of the company and possible financial pressures on directors/management arising from the above procedures. The main measure used by the directors to judge the company's financial performance is the level of bank debt and income raised in the month. The directors have a strong desire to keep the bank debt at a low-level which can be serviced out of ongoing fundraising activities. This measure of performance does not create any performance pressures on the directors to manipulate the results of the company. UNDERSTANDING THE COMPANY AND ITS ENVIRONMENT, INCLUDING ITS INTERNAL CONTROL Internal control Auditor’s assessment of the control environment in which the company operates and the implications of this for the risk of material misstatement in the financial statements. Assessment of control environment. We have assessed the environment in which the internal controls operate as good. This assessment is based on: a. The tight control operated by the Board of Directors. b. The excellent accounting records maintained by Tom Johnson with assistance from Gay Byrne. c. The excellent systems of control that the directors have developed over weekly lottery. d. The reconciliation of pitch rental income to bookings on a monthly basis by individuals not involved in handling cash receipts. The manner in which the company assesses and manages risk and possible implications of this for the risk of material misstatement in the financial statements As would be expected in a small company, the company does not have a formal risk assessment process. The company identifies the risk that the company is exposed to through the regular review of the company's activities by the directors. A review of the minutes of the directors meetings and meeting with the directors will provide audit staff with an overview of the risks that the company is exposed to and the possible impact of these risks on the results of the company for the year. Any risks identified will be addressed in the audit plan. The company’s accounting and information system (including controls over accuracy and completeness of the processing of transactions from the initiation of the transaction through to settlement of the transaction). Income / debtors / receipts accounting cycle including controls in the cycle. A pitch booking system is operated. All pitch bookings are made with Mary Phelan (director). Mary records the booking in a diary. This diary is used as the source document for billing the club / user of the facility. Bills are prepared by Mike Murphy (director) at the end of each month. Tom Johnson enters the bills on the company's accounting records on TAS books accounts package. Clubs can take an extended period of time to pay and to counteract this late payment approach; Tom has started to issue statements of accounts to all pitch users on a monthly basis. This has brought about improvement in collection. When payment is received it is lodged by Gay Byrne (director). Clubs / users are encouraged to pay by electronic banking. Purchases/ creditors / payments cycle including controls in the cycle. The purchases are made up of materials (pitch materials, fertiliser, pitch sand, paint), tools, services (grounds contractor, accounting services) and office supplies. When a request for a purchase is made it is recorded in a duplicate book. The request is passed to Mary Phelan and she will order the goods. Mike Murphy arranges for the payment for the goods and the cheque is co-signed by another director. A petty cash system is not operated. On receipt of the purchase invoices it is recorded on the TAS book accounting system maintained by Tom Johnson. The payments are recorded monthly. Tom checks the records against supplier statements and bank statements on a monthly basis. UNDERSTANDING THE COMPANY AND ITS ENVIRONMENT, INCLUDING ITS INTERNAL CONTROL Wages cycle including controls in the cycle. The wages are paid weekly. The payroll is prepared by Tom Johnson using a computerised software package. Mary Phelan provides Tom with details of hours worked by the company employees. The final payroll is approved by another director before payment is made via an electronic transfer. Preparation of the financial statements. Tom Johnson maintains the company's accounting records on TAS books accounts package. In February 2014 Tom will drop the following into our office: • Bank statements, • Purchase invoices, • Pitch bookings diary for 2013, • Backup of TAS books data file, • Cheque stubs, • Grant remittance advices. Tom will not have made the final adjustments (depreciation, accruals and prepayments) to TAS books and our staff will be required to make the final amendments. Once the accounts are finalised on TAS books, the completed nominal ledger will be entered on our accounts production software package and statutory accounts will be produced. Manner in which the company monitors the above controls Monitoring of controls. As is common in many small companies, a formal system of monitoring of controls does not exist and monitoring of controls relies solely on the overview exercised by the directors. The directors would appear to exercise the monitoring function in a diligent manner.