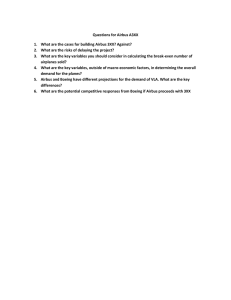

Airbus vs. Boeing in Superjumbos: A Case of Failed Preemption*

advertisement