Hawaii Campus School of Business

advertisement

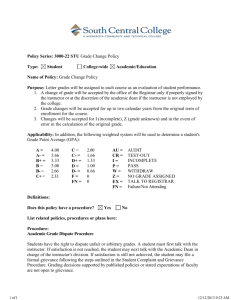

Hawaii Campus School of Business Mission Statement “Wayland Baptist University exists to educate students in an academically challenging, learning focused and distinctively Christian environment for professional success and service to God and humankind.” FINA 3315 – Personal Financial Planning Term: Spring-CMP 2016, section HI01 February 22nd to May 14th, 2016 Wednesdays: 5:30 - 10:00 PM Hybrid Course Location: Mililani Mauka Campus Instructor: Henrique Regina Work phone number: (808) 488-8570 x347 – Fax: 8576. Cellular phone number: (808) 222-9407 E-mail address: hregina@wbu.edu Office Hours: By appointment. Course Textbook: Lawrence J. Gitman, Michael D. Joehnk, Randall S. Billingsley, Personal Financial Planning. 13th ed. 2014 South-Western, Cengage Learning. ISBN: (13 digits) 978-1-111-97163-2 or (10 digits) 1-111-97163-3 Hybrid Course This course will have 8 sessions in the classroom and 3 sessions 100% on-line delivered via Blackboard. The in-classroom meetings will be from 17:30 to 22:00. See the Course Schedule section (page 4) for class meetings dates and delivery method. Blackboard On-line Platform This course will use Blackboard courseware. All registered students automatically have access to Blackboard. An enrolled student can link to Blackboard through the Wayland Baptist University main website by selecting the “Current Students” link and clicking on the Blackboard link. Click here to go to Blackboard https://wbu.blackboard.com. For first time users of Blackboard, see instructions at Log-in page for accessing Blackboard. It is important that all undergraduate students enrolled in this course establish a Wayland Email account, as the instructor will periodically send emails to enrolled students through Blackboard. Course Description: Recurring individual and family financial needs; budgeting, banking, investing, insurance, real estate, credit, personal taxes, and life-long financial planning. Course Prerequisite (s): None Course Outcome Competencies: Understand the foundations of the financial planning process Understand the management of basic assets including cash, savings, housing and automobile. Understand the management of personal credit such as credit cards and consumer loans Understand the management of personal investments including stocks, bonds and mutual funds Understand the retirement planning process Course Requirements: General: read course assigned chapters before the class meeting as indicated on the attached course schedule, attend all classes, participate in class discussions, submit homework assignments and research paper and take all exams. Exams must be taken as scheduled unless prior arrangements have been made with the instructor. Homework assignments are due based on the course schedule. Calculator: Calculator with exponential (power) key is required. A financial calculator is optional. Attendance: All Wayland students are expected to attend every class meeting; the minimum percentage of class participation required to avoid receiving a grade of "F" in the class is 75%. Students who miss the first two class meetings without providing a written explanation to the instructor will be automatically dropped from the roster as a "no-show." Students who know in advance that they will be absent the first two class meetings and who wish to remain in the class must inform the instructor in order to discuss possible arrangements for making up absences. Students enrolled at one of the university’s external campuses should make every effort to attend all class meetings. All absences must be explained to the instructor, who will then determine whether the omitted work may be made up. When a student reaches that number of absences considered by the instructor to be excessive, the instructor will so advise the student and file an unsatisfactory progress report with the external campus executive director/dean. Any student who misses 25 percent or more of the regularly scheduled class meetings may receive a grade of F in the course. Additional attendance policies for each course, as defined by the instructor in the course syllabus, are considered a part of the university’s attendance policy. A student may petition the Academic Council for exceptions to the above stated policies by filing a written request for an appeal to the executive vice president/provost. (Catalog 2015-2016). Assessment/Grading: A. Homework (15%) – Two homework assignments covering the most important topics from the course textbook. Each homework assignment is worth 75 points. B. Hybrid Sessions Assignments (45%) – Each on-line meeting session will require an assignment(s) to be completed. While the type of assignments may vary, each on-line session will be worth 150 points total. C. Exams (30%) - Both midterm and final exams are worth 150 points each. The exams are take-home. D. Attendance (10%) - The students can earn up to 100 points by attending and participating in classes meetings. Grade Scale: Grade Scale 90 to 100 % 80 to 89% 70 to 79% 60 to 69% 0 to 59% A B C D F Homework Hybrid Assignments Midterm Exam Final Exam Attendance 15% Total 100% 45% 15% 15% 10% Grade Appeal A basic aspect of the teaching-learning process is the evaluation of student performances and the assignment of grades. Student performance is evaluated solely on an academic basis, and not on opinions or conduct in matters unrelated to the course taken. Faculty are responsible for providing syllabi which clearly specify course objectives and/ or competencies, and for making clear the means of evaluation for purposes of grading students. Students are responsible for class attendance, for learning the content of any course of study and for those standards of academic performance established for a given course. Students who violate academic integrity and regulations by plagiarism, classroom misdemeanor, or academic dishonesty will be held accountable to faculty and may have their grades adjusted accordingly. Students shall have protection through orderly procedures against prejudices or capricious academic evaluation. A student, who believes that he or she has not been held to realistic academic standards, just evaluation procedures, or appropriate grading, may appeal the final grade given in the course by using the following grievance and appeal procedures. Appeals are limited to the final course grade, which may be upheld, raised, or lowered at any stage of the appeal process. Appeals may not be made for advanced placement examinations or course bypass examinations. If a student feels the matter is not satisfactorily resolved at the student-faculty level, the student should follow the steps below: 1. A student shall first present, in writing, the matter of grievance to the instructor of the course. This must be done within thirty days after the beginning of the next regular term. If agreement is reached, the faculty member will either sustain the judgment made or make a change according to the agreement reached within two weeks. 2. If the student feels the matter is not satisfactorily resolved at the studentfaculty level, the external campus student should submit the grievance to the campus executive director within two weeks after the decision by the professor. The external campus executive director will either sustain the judgment of the professor or make a change according to the agreement reached with the student within two weeks. The executive director will notify the appropriate school dean of this decision. 3. If the student feels the matter is not satisfactorily resolved at studentexecutive director level, the grievance should be submitted to the dean of the school in which the course is taught. The appeal must be made in writing within two weeks after the faculty member or external campus executive director has acted on the grievance; otherwise, the grievance shall be considered withdrawn. The dean of the school will review all facts and evidence in the case and mediate a decision within two weeks after the receipt of the grievance. If the grievance is not further appealed, it will be considered resolved. 4. If the student is not satisfied, he/she may request the executive vice president/provost to refer the appeal to the university Faculty Assembly Grade Appeals Committee. This request must be made in writing, must include the basis for the appeal, and must be submitted within two weeks following receipt of the decision of the dean of the school. 5. The student or faculty member may appeal the findings of the committee in writing to the executive vice president/provost within one week after receiving the committee’s report. The executive vice president/provost will render a decision within two weeks and copies of such decision will be sent to the student, the faculty member, the external campus executive director, and the dean of the school involved. This decision shall be final in all cases of grade appeals. 6. Failure to submit grievances within the required time period will negate the student’s complaint. Academic Honesty: University students are expected to conduct themselves according to the highest standards of academic honesty. Academic misconduct for which a student is subject to penalty includes all forms of cheating, such as illicit possession of examinations or examination materials, forgery, or plagiarism. (Plagiarism is the presentation of the work of another as one’s own work.) Disciplinary action for academic misconduct is the responsibility of the faculty member assigned to the course. The faculty member is charged with assessing the gravity of any case of academic dishonesty and with giving sanctions to any student involved. Penalties that may be applied to individual cases of academic dishonesty include one or more of the following: 1. 2. 3. 4. 5. 6. 7. Written reprimand. Requirement to redo work in question. Requirement to submit additional work. Lowering of grade on work in question. Assigning the grade of F to work in question. Assigning the grade of F for course. Recommendation for more severe punishment (see Student Handbook for further information). The faculty member involved will file a record of the offense and the punishment imposed with the school dean, external campus executive director/dean, and the executive vice president/ provost. The executive vice president/provost will maintain records of all cases of academic dishonesty reported for not more than two years. Any student who has been penalized for academic dishonesty has the right to appeal the judgment or the penalty assessed. The appeals procedure will be the same as that specified for student grade appeals. (See Student Handbook for further information or, for external students, the external campus executive director/dean). Wayland Baptist University Statement on Plagiarism and Academic Dishonesty Writing is a collaborative art. Working out ideas for your paper with an instructor, writing tutor, classmate, family member, or friend is encouraged not only for this class, but also for other classes that involve writing. Discussion and collaborative brainstorming are good. However, passing off another's writing or ideas as your own is plagiarism. It is unethical, it constitutes Academic Dishonesty (cheating), and it is sufficient grounds both for failure of a course and suspension from the university. Common examples of plagiarism or academic dishonesty include the following: Copying any amount of text directly from an internet website, book, or other document without appropriate citation and synthesis into one’s own discussion. Paraphrasing the ideas presented in any source or oral discussion without appropriate citation. Using the evidence and conclusions of any source as the controlling framework for one’s own paper. Recycling work from a previous or current course, whether your own work or another student’s work. Purchasing or otherwise downloading a paper from an internet website. In some writing assignments, you will be expected to incorporate scholarly sources into your document. ALL OF THE FOLLOWING must be met to constitute appropriate citation of any source: Including MLA, Chicago, or APA parenthetical or note-style citation format as required by the instructor. Placing borrowed text directly from another source within “quotation marks.” Introducing clearly another author’s voice into the document by means of a signal phrase (an introduction of that author). Offering, in short, a clear distinction between one’s own voice or ideas and those of any outside authors brought into the discussion. Wayland Baptist University observes a ZERO TOLERANCE policy regarding Academic Dishonesty. Any suspected instance of academic dishonesty, including plagiarism, will first be evaluated by the instructor and discussed individually with the student. If the instructor determines that a student’s actions constitute Academic Dishonesty, the case will be filed with the dean of the School of Business and reported to the university executive vice president/provost, as per university policy. Per university policy, second offenses RESULT IN SUSPENSION FROM THE UNIVERSITY. In this course, the first instance of Academic Dishonesty may also result in a zero on the assignment. Classroom Conduct Students who disrupt a class will be directed to leave immediately and report to the external campus executive director/dean or dean of students, who will discuss with the student the cause of the disruption. The student will return to the class only with permission of the executive director/campus dean or dean of students and faculty member involved. Special Needs “In compliance with the Americans with Disabilities Act of 1990 (ADA), it is the policy of Wayland Baptist University that no otherwise qualified person with a disability be excluded from participation in, be denied the benefits of, or be subject to discrimination under any educational program or activity in the university. The Coordinator of Counseling Services serves as the coordinator of students with a disability and should be contacted concerning accommodation requests at (806) 291- 3765. Documentation of a disability must accompany any request for accommodations” Course Meetings Schedule Foundations of Financial Plans February 24th (Module 1 – Classroom) Chapter 1: Unders. the Financial Planning Process Chapter 2: Your financial statements and Plans Foundations of Financial Plans March 2 (Module 2 – Classroom) nd Chapter 2 Time Value of Money Homework 1 Due Foundations of Financial Plans & Managing Basic Assets March 8th (Module 3 – On-line) Chapter 3: Managing your Taxes Chapter 4: Managing your cash & Savings Homework 2 due Managing Basic Assets March 22nd Chapter 5: Making Automobile & Housing Decisions (Module 4 – Classroom) Module 3 On-line Assignments Due Managing Credit March 29 th (Module 5 – On-line) Chapter 6: Borrowing on Open Account Chapter 7: Using Consumer Loans Managing Investments April 5th (Module 6 - classroom) Chapter 11: Investment Planning Module 5 on-line Assignments due Midterm Exam Due Managing Insurance Needs April 12th (Module 7 – On-line) April 19th (Module 8 – Classroom) Chapter 8: Insuring Your Life Chapter 9: Insuring Your Health Chapter 10: Protecting your Property Managing Investments Chapter 12: Investing in Stocks & Bonds Chapter 13: Investing in Mutual Funds Module 7 on-line Assignments due Retirement Planning & Estate Planning April 26 th Chapter 14: Planning for Retirement (Module 9 - Classroom) Chapter 15: Preserving your Estate Final Course Meetings May 3 (Module 10 – Classroom) May 10th (Module 11 – Classroom) rd Make up Class Final Exam Due & Course Final Review