Document 10383722

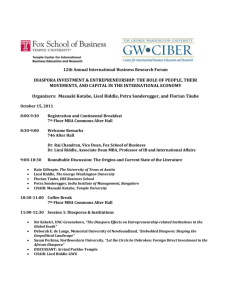

advertisement