BUSINESS LAWS FORMATION 1 EXAMINATION - AUGUST 2008 NOTES

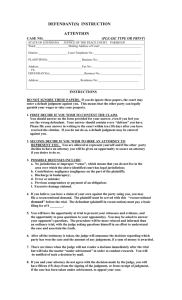

advertisement

BUSINESS LAWS FORMATION 1 EXAMINATION - AUGUST 2008 NOTES You are required to answer 5 questions. If you provide answers to more than five questions, you must draw a clearly distinguishable line through the answer(s) not to be marked. Otherwise, only the first five answers to hand will be marked. TIME ALLOWED: 3 hours, plus 10 minutes to read the paper. INSTRUCTIONS: During the reading time you may write notes on the examination paper but you may not commence writing in your answer book. Marks for each question are shown. The pass mark required is 50% in total over the whole paper. Start your answer to each question on a new page. You are reminded that candidates are expected to pay particular attention to their communication skills and care must be taken regarding the format and literacy of the solutions. The marking system will take into account the content of the candidates' answers and the extent to which answers are supported with relevant legislation, case law or examples where appropriate. List on the cover of each answer booklet, in the space provided, the number of each question(s) attempted. The Institute of Certified Public Accountants in Ireland, 17 Harcourt Street, Dublin 2. BUSINESS LAWS THE INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS IN IRELAND FORMATION I EXAMINATION – AUGUST 2008 Time Allowed: 3 hours, plus 10 minutes to read the paper. Number of Questions to be answered: FIVE (Only the first five questions answered will be marked). All questions carry equal marks. 1. 2. 3. 4. 5. 6. 7. Discuss the relative importance and relationship between statute law and judicial precedent as sources of law in the Irish legal system. [Total: 20 marks] Discuss the doctrine of the separation of powers and illustrate how it finds expression in the structure of the basic Institutions of the State. [Total: 20 marks] Discuss, with respect to real property, the concept of ownership in Irish law distinguishing between legal and equitable ownership. [Total: 20 marks] Explain and outline the characteristics of negotiable instruments, distinguishing in particular between bills of exchange and cheques. [Total: 20 marks] Finbarr entered into email negotiations with Frank to buy Frankʼs car. Over the course of a number of emails the parties haggled over price until Finbarr sent Frank an email on Tuesday evening offering €8,000 for the car and stating that if heard nothing further that he would consider the car his and that he would be around with a cheque on Friday to collect the car. On Thursday morning Finbarr was told that Frank had sold the car to Fred on Wednesday evening and that Fred was now in possession of the vehicle having paid the sum of €8,000. Advise Finbarr whether or not he had a valid contract. Discuss the principles of the tort of negligence in Irish law. [Total: 20 marks] [Total: 20 marks] A friend is considering starting a business has approached you for advice. She wants to know what are the benefits of incorporation. Advise her. [Total: 20 marks] END OF PAPER Page 1 SUGGESTED SOLUTIONS BUSINESS LAWS THE INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS IN IRELAND FORMATION I EXAMINATION – AUGUST 2008 Discuss the relative importance and relationship between statute law and judicial precedent as sources of law in the Irish legal system. SOLUTION 1 AIM: The aim of this question is to test the studentsʼ knowledge in relation to statute law and common law as Sources of Irish Law. Students must demonstrate knowledge of the Common Law System; precedent and the development of Case Law; Legislation and Statute. Sources of Law The principal sources of law are the Constitution, European law, and statute law, as well as common law. The Irish statute book is comprised of over 3,000 Acts, and a further 25,000 pieces of secondary legislation, and is, accordingly, an important source of our law. Statute law is written law set down by the legislature or the executive branch of government in response to a perceived need to clarify the functioning of government, improve civil order, to codify existing law, or for an individual or company to obtain special treatment , it is in contrast to common law. A statute is the formal, written law of Ireland, written and enacted by the legislative authority, to be ratified by the executive, and finally published. Typically, statutes command, prohibit, or declare policy. Statutes are sometimes referred to as legislation or "black letter law." The Irish courts were re-established in 1961 (which was necessitated by the enactment of a new Constitution in 1937), and remains the same today. Pre-1922 statute and common law remain in force to the extent that they were consistent with the Constitution. There is a difference between the legal strictures or impositions of statute law and the binding precedence of Case Law. Despite the enormous volume of legislation produced by parliaments down through the ages, statute law remains an incomplete system of law. Large parts of our law still derive from the decisions of judges. This judge-made law is based on a rule known as the doctrine of binding precedent. The principle underlying this doctrine is that a decision made by a court in a case involving a particular set of circumstances is binding on other courts in later cases, where the relevant facts are the same or similar. The idea of judges making use of previously decided cases dates back to the formation of the common law by the royal justices out of English customary law. English common law was introduced to Ireland after the Norman invasion in 1167. It was not until the 19th century that the general principle of judicial consistency in decision-making developed into a more rigid system of binding precedents. The necessary conditions for such a system did not exist until the standard of law reporting was improved by the creation of the Council of Law Reporting in 1865 and a hierarchy of courts was established by the Supreme Court of Judicature (Ireland) Act 1877. Precedents may be either binding or persuasive. A binding precedent is one which a court must follow, while a persuasive precedent is one to which respect is paid but is not binding. Whether a court is bound by a particular precedent depends on its position in the hierarchy of courts relative to the court which established the precedent. The general rule is that the decisions of superior courts are binding on lower courts. Thus, decisions of the Supreme Court are binding on all lower courts, but decisions of the High Court are not binding on the Supreme Court etc. A decision of an earlier court at the same level of the system is binding on a later court unless that court has good reason not to follow it. Not every part of a judge's decision is binding. Only the ratio decidendi, i.e. the reason for the decision, is binding on later courts. This may also be called the rule or principle of the case. Extracting the ratio decidendi from a decision is a very precise art, given the length of some judgments, but simply stated, it could be said to consist of the legal principle based on the material facts of the case. Other statements of law in a case are referred to as obiter dicta. These are statements of legal principle that relate to facts that were not in the case or were not material to the case. Obiter dicta are not binding although they may be persuasive precedents. The advantages of the system of binding precedent are as follows: Page 3 (a) (b) Consistency: Similar cases are treated in a similar manner. The law is thus decided fairly and predictably and it should be possible to predict the ruling of the court given a certain set of circumstances; Flexibility: The law is capable of growth as new decisions are always being added to the body of law as new factual situations come before the court .The disadvantages can be stated as follows: (a) (b) Judicial discretion is limited: the binding force of precedent can have the effect of limiting a judge's discretion to decide a case in a particular way. Thus, there is a danger that the law could become "fossilised" or rigid. In order to avoid having to follow precedent, judges may have to identify distinctions in the facts of cases which have no real substance and have the effect of complicating the law. To stop the system of precedent from becoming rigid, the courts can refuse to follow a previous case. This can be done in a number of circumstances: (a) (b) (c) (d) (e) (f) by "distinguishing" the facts of the case. The court may do this if the facts are not identical and the differences appear significant; by declaring the ratio to be obscure or unclear; by declaring an earlier precedent to be too wide and thus not applicable except in narrower circumstances; by declaring an earlier decision to have been made per incuriam, which means that the past decision was made without taking account of some binding point of law, e.g. an applicable piece of legislation or a previous case; by declaring that a previous decision was made sub silentio, which means that the point decided by the judge was not argued or was silent before the court; because the earlier decision has been subsequently overruled by another court or statute. Thus Common Law is generally understood to be "law by precedent" distinguished from statutory law.ie. statutes created by the Oireachtas, the above answer illustrates the importance of each and the relationship between them both as sources of law in the Irish legal system. Discuss the doctrine of the separation of powers and illustrate how it finds expression in the structure of the basic institutions of the State. SOLUTION 2 AIM: The aim of this question to test the studentsʼ knowledge of the doctrine of the separation of powers and to illustrate same by examining the three main branches of government. The doctrine of the Separation of Powers constitutes the basic framework of the Irish Constitution. Most of the functions of Government can be seen as that of three specific types, each type being independent of each other. ʻPower corrupts; absolute power corrupts absolutelyʼ . Thus, Separation of powers is related to the idea of checks and balances. The three arms of Government are the Legislature; the Executive and the Judiciary, each independent but intrinsically interdependent. Article 15.1 of the 1937 Constitution invests the Oireachtas with Law making Power; Article 28.2 and 29.4.1 invest the Executive with power including power over foreign relations; Article 34.1 and 37 invest the Judicial power in the courts. Legislature (Oireachtas) – The legislature, or the national parliament, is called the Oireachtas (Article 15 of the Constitution). This is made up of the President, Dail Eireann and Seanad Eireann. The sole and exclusive power of making laws for the State is vested in the Oireachtas; this is the National Parliament and consists of the President and two houses, the Lower House - Dáil Éireann (the House of directly elected representatives of the people) and the Upper House - Seanad Éireann (Senate). Under Article 15.1 the Executive has no inherent Law making power. The definitive test on the power of the Oireachtas to delegate law-making functions was laid down in City view Press Ltd v AnCo [1980] IR 81. The Statutory provision impugned allowed the defendant to impose levies on firms to finance training activities. The Legislation was silent as to how such levies would be calculated and imposed no ceiling. The Supreme Court found the provision to be Constitutional. The delegation of the power to calculate levies was a permissible delegation and did not amount to legislation. OʼHiggins CJ outlined the appropriate test to determine whether delegation was within the terms of Article 15. .the test is whether that which is challenged Page 4 as an unauthorised delegation of parliamentary power is more than a mere giving effect to principles and policies which are contained in the statute. If it be then it is not authorised for such would constitute a purported exercise of legislative power by an authority, which is not permitted to do so under the constitution. On the other hand if it be within permitted limits – if the law is laid down in statute and details only are filled in or completed by the designated Minister or subordinate body – there is no unauthorised delegation of legislative power. The test was laid down in Cooke v Walsh [1984] IR 719. In that case a regulation made by the Minister for Health, which appeared to exclude certain parties otherwise eligible from entitlement under the Health Acts was held to be ultra vires his powers, as the Ministers actions amounted to more than a mere dotting of Iʼs and crossing of Tʼs. Casey states that anything going beyond putting flesh on the bones of an act will be constitutionally suspect and argues that an act, which is essentially a vehicle for the making of regulations, will be in peril. Executive (Government) – The executive power of the State is exercised by or on the authority of the Government (Article 28). The Government is collectively responsible for the Departments of State administered by its members, it is responsible to Dail Eireann. The Taoiseach, the Tánaiste, and the Minister for Finance must be members of Dail Eireann. Halsbury states that Executive functions are incapable of comprehensive definition, for they are merely the residue functions of government after legislative and judicial functions have been taken away. Judiciary (the Courts) – The judiciary administers justice through the Courts (Article 34). The Courts have a very significant function in the interpretation of legislation, including the Constitution. The Courts are independent in the exercise of judicial functions and are subject only to the Constitution and the law (including EU Law). Fundamental rights are set out in the Constitution and, in addition, the Courts have identified other Constitutional rights not expressly specified in the Constitution. In interpreting and applying any statute or rule of law the Courts, in so far as is possible and subject to the rules of interpretation and application, are required to do so in a manner compatible with the Stateʼs obligations under the European Convention on Human Rights (see European Convention on Human Rights Act 2003). The Courts and only the Courts have any function in respect of criminal matters. The principle characteristic of a crime is that it carries a punitive sanction, Melling v OʼMathghamhna [1962] IR 1. Re Haughey OʼDalaigh held the Constitution vests the judicial power of government solely in the courts and reserves exclusively to the Courts the power to try persons on criminal charges. Trial, conviction and sentence are indivisible parts of the exercise of this power. The Courts are very watchful of the interference of the executive and legislature in the administration of justice in criminal matters. In C v Minister for Justice [1967] IR 106 the Minister for Justice was empowered to direct that a prisoner on remand where certified to be of unsound mind should be confined to a mental hospital until such time as he was certified to have recovered. The Minister could then direct that he be brought once again before the Court that had remanded him. The provision was held to be an unconstitutional interference by the Executive in the judicial domain. Conversely, framing the precise counts of an indictment was held to be an executive and not a judicial function. O Shea v DPP [1988] IR 655. Thus the doctrine of the Separation of Powers constitutes the basic framework of the Irish Constitution, and an incursion by one arm of government into anotherʼs area of competence and authority is not tolerated. The Courts tend to be most protective of their own function and will not countenance interference with same. Page 5 Discuss, with respect to real property, the concept of ownership in Irish law distinguishing between legal and equitable ownership. SOLUTION 3 AIM: The aim of this question is to examine the studentsʼ knowledge of the concept of legal and equitable ownership in Irish Law, and clearly distinguishing each on their own merits. The most fundamental distinction in the law of real property is that between legal and equitable interests in land. This distinction has its origins in the history of the courts. Judges in the courts of common law were more concerned with legal interests and the Chancellor of the Court of Chancery was concerned with equitable interests. Even though these two systems were integrated towards the end of the 19th century, the distinctions between the two systems remain embedded deeply in the law. As a result of the development of the common law and equity in England and Ireland, the law of real property has been based on a distinction between those property rights in land which are considered to be legal rights and those which are considered to be equitable rights. The importance of whether rights are attributed with legal or equitable character has its origin in the time when legal rights were those that were recognised exclusively by the courts of the common law, while equitable rights were enforced by the courts of equity. The distinction between these two types of rights is extremely relevant and important in some circumstances. This is particularly true in the case of unregistered land, where the attribution of legal or equitable character may in fact determine the effect of rights on third parties who purchase the land. Once a legal estate or interest has been created, it can be enforced against any and all persons who later acquire rights in the land, irrespective of whether those subsequent rights were granted in return for valuable consideration and also irrespective of whether the person who acquired them had any knowledge as to the existence of the prior legal estate or interest. In general, the common law takes a simple approach to priority between two competing legal interests – the interest that was created first is the one that prevails. When land (or an interest in land) is transferred to a third party, legal rights that previously attached to the land remain attached to it and are as a result binding on the third party. The result of this rule is one of efficiency and clarity in that the owner of the legal rights knows that his position is secure notwithstanding the transfer of the land. On a similar note, the purchaser knows that he takes over the property subject to any legal rights which belong to others. One of the main influences of equity on the law of real property is in the area of uses and trusts. These two concepts have a strong influence on property arrangements such as the claim of a wife to share the property home, which was often based on the notion of beneficial as opposed to legal ownership. The main difference between legal and equitable rights in land is evident when comparing absolute ownership and trusts. Trusts in land were originally unenforceable at common law as common law did not recognise that beneficiaries of trusts had rights. In equity however, the Chancellor would enforce trusts and all beneficiaries to enjoy their rights. In such instances, the trustee of the land was the legal owner holding the land on behalf of the beneficiary and the beneficiary was the equitable owner. Now legal ownership confers rights in rem, rights in the property itself which can be enforced against anyone. Equitable ownership conferred initially only rights in personam, which compelled trustees to personally perform the trust. However, equity developed the concept of the bona fide purchaser for value and the doctrine of notice. But the equitable owner was never in the same position as the legal owner as he never had an absolutely indefeasible title. As a result, a rule developed, under which the purchaser of the legal estate who knows of the existence of an equitable interest or should have known of it at the time of purchase, is bound by the interest. However, a person who purchases a legal estate without such knowledge can take the land free from the equitable interest because his conscience is clear. This is the main difference between a legal and an equitable interest. Page 6 Explain and outline the characteristics of negotiable instruments, distinguishing in particular between bills of exchange and cheques. SOLUTION 4 General Comments This question is designed to test studentsʼ knowledge in the area of documentary intangibles, in particular in relation the types of documentary payment mechanisms. Documentary intangibles are notable because the document represents the property rights which can be transferred by transfer of the document itself. The question demands essentially a descriptive type answer. Students are expected to set out any general issues regarding documentary intangibles before going on to explain what a bill of exchange is and what a cheque is. The question specifically asks students to distinguish between the two and therefore students who engage in this distinguishing exercise will perform well in the question. Extra marks will also be awarded if students can refer to any relevant secondary legislation. Documentary intangibles are of two types - document of title of goods, called a bill of lading and document of title to the payment of money, which are bills of exchange. A cheque is a form of a bill of exchange. The bearer of a bill of exchange has legal entitlement to the amount embodied in the bill. Where documentary intangibles are concerned, the debt or obligation is considered in law to be locked up in the instrument. Documentary intangibles are negotiable instruments, meaning that they can be transferred by delivery and endorsement to a bona fide purchaser for value. It is this process of transfer that is at the basis of the negotiation. The major difference between a cheque and a bill of exchange is that a cheque by law must be drawn on a bank whereas a bill of exchange need not be. While it is similar to a cheque in characteristics, a bill of exchange is more like a credit instrument. Section 3 of the Bill of Exchange Act 1882 defines a bill of exchange as an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time, a sum certain in money to or to the order of a specified person or to the bearer. A bill of exchange is unconditional in that there are no conditions attached. It is therefore independent, it speaks for itself; unlike conditional documentary credit, there are no ifs attached. It is an order so to speak, a positive direction to pay from the drawee to the drawer. If it is made to pay on demand, it is called a demand bill and a site payment must be made on demand. If it is made to pay at a determinable future time, for example, a postdated cheque, it is a time bill and will only be payable at a particular time. The drawee can accept the bill or reject it. If the drawee accepts the bill by agreement, then he becomes the acceptor and is liable to pay the bill, and if the drawee refuses to accept it, then it is dishonoured. A bill is legally issued only when it is delivered to the first holder. Normally, this will be the named payee if an order bill or the bearer if a bearer bill. A bearer bill will be paid out to whoever is in physical possession of the bill. If the drawee pays out and the bill has been presented by the wrong person, the drawees obligation has nonetheless been discharged. An order bill will be made out to a specific person and the liability of the drawee is only discharged when the drawee pays the person ordered. If not, then the drawee is liable. It is possible that the method of payment is directed. Payment can take place by special endorsement or by endorsement in blank. In a special endorsement, the endorser names the endorsee, the person to whom the payment is to be transferred. A blank endorsement takes place where you only write your own name and the bill therefore becomes a bearer bill. Whoever holds the bill is the holder of the bill. There are three types of holder a holder, a holder for value and a holder in due course. The difference between the three lies in the rights attaching to the status of each. A truly negotiable bill can be transferred by to the holder for delivery for valuable consideration without notice (of defect). As for a holder for value - this occurs where you have notice that something is wrong and you only have defective title. As for a holder in due course, this occurs where the original holder had bad title, but you have taken the bill in good faith for valuable consideration without notice. In this situation, the law pretends that you have good title. Page 7 The 1. 2. 3. 4. 5. 6. advantages of a bill of exchange are: Its ease of transfer - delivery of possession suffices and there are no formalities per se. It is an autonomous instrument. It is a separate undertaking to a sale of goods contract. It can be drawn on anybody and this improves the standing of the bill. It can be discounted. This means that if it is a time bill payable in the future but you want it now, you can agree to a lesser amount. Negotiability - if you are a holder in due course, you are guaranteed payment as you have good title. Depending on the company on which the bill is being drawn or negotiated to, the marketability of the bill improves. The differences between a bill and a cheque are as follows: 1. A bill can be drawn on any person; cheques must be drawn on a banker, as mentioned already. 2. Whereas a bill may be one of demand or time, a cheque is always a demand bill, and a refusal to pay will result in a right of action. 3. A time bill must be presented for payment when due, otherwise the liability of the drawee will be discharged. A cheque is valid for six months after its date. 4. Cheques may be crossed, bills cannot be. There are two types of crossing - general crossings and special crossings. A general crossing is usually indicated by two traverse lines only and special crossings by two traverse lines, in which will be found the words account payee only. For a good discharge of liability, a general crossing must be paid to a banker, but a special crossing can only be paid to whom it is crossed. Special crossing cheques therefore have a restricted negotiability. The definition of a cheque is a bill of exchange drawn on a banker payable on demand, there is no question of it being accepted. The bank must either pay or refuse to do so. A refusal to pay will occur where the account on which the cheque is drawn is not sufficiently in funds or it is a countermand or cancelled cheque. There is a possibility of set-off - if a person holds two accounts, one in credit and one on overdraft, it is possible to set off the overdrawn account for the credit account. There is no such thing as bearer cheques - all cheques are order instruments. [20 marks] Finbarr entered into email negotiations with Frank to buy Frankʼs car. Over the course of a number of emails the parties haggled over price until Finbarr sent Frank an email on Tuesday evening offering €8,000 for the car and stating that if heard nothing further that he would consider the car his and that he would be around with a cheque on Friday to collect the car. On Thursday morning Finbarr was told that Frank had sold the car to Fred on Wednesday evening and that Fred was now in possession of the vehicle having paid the sum of €8,000. Advise Finbarr whether or not he has a valid contract. SOLUTION 5 AIM: This question requires students to show an understanding of the basic requirements in the formation of a contract, communication of acceptance and counter-offers. Extra marks will be awarded to those students who show a good knowledge of case law in the area. See offer, [communication of] acceptance and consideration Question 4 above. The general rule is that an offer must be communicated to be effective. This rule applies to most method of communication, such as oral negotiations, telephone negotiations, and negotiations by email and fax. The courts have taken the view that where an acceptance is communicated by way of an instantaneous means of communication, then the general rule applies that acceptance becomes effective only when it is received by the offeror. This can be seen from Entores Ltd v Miles Far East Cooperation [1955] 2 QB 327 (CA; Denning LJ) where an offer was telexed by the plaintiffs in London to the defendants in Amsterdam and an acceptance telexed back. The issue arose as to whether the contract had been formed. The Court of Appeal held that the parties were effectively in the same position as if they had been in each otherʼs physical presence or had spoken on the telephone. There was therefore no reason to depart from the normal rule that acceptance became effective once received. Since receipt took place in London the contract was deemed to have been formed there. This was adopted by the House of Lords in Brinkibon v Stahag Stahl MBH [1983] 2 AC 34 where it held that this holding may need to be varied for other methods of communication such as fax machines and now emails. Page 8 The Electronic Commerce Act 2000 under Section 21 provides that: Where an electronic communications enters an information system, or the first information system, outside the control of the originator, then unless otherwise agreed between the originator and the addressee, it is taken to have been sent when it enters such information system or first information systemʼ. Therefore the contract is created when the addressee could have accessed the e-mail, regardless of whether Frank had read it or not. The offer was sent on Tuesday evening, thus per the Electronic Commerce Act 2000 the offer was communicated then by Finbarr. Not all agreements are legally enforceable; the parties must have intended that the agreement should give rise to legal consequences. Counter-offer It is important to note that although acceptance is final, unconditional and a certain indication of an agreement to the terms of an offer, communicated to the offeror, with the intention of accepting the offer, the acceptance must amount to an agreement as to the terms proposed in the offer. We are told that the ʻparties haggled over priceʼ thus if the purported acceptance sought to vary the terms of the offer, or to insert new terms, then it is not acceptance of the offer, but rather a counter-offer. This may be accepted or rejected by the other party. There can be no contract until the parties are agreed to the same terms; no contract will be in existence where the offeror proposes one set of terms and the offeree purports to accept a different set of terms. Swan v Miller [1919]1 IR 151 illustrates this point. A purchaser offered to buy a premises for £4,750 but was unaware of the ground rent to which it would be subject to. The vendors thought the purchaser was aware and replied accepting his offer of £4,750 ʻplus £50 annual rentʼ. The Court of Appeal held that no contract came into being at this point. The vendor had by his reply sought to put in a new term. The consequences were that the reply did not constitute an acceptance of the offer which was made, but rather a counter offer. Thus in advising Finbarr it is also necessary to establish the communicated acceptance was as per the terms in the offer. [20 marks] Discuss the principles of the tort of negligence in Irish law. This question requires students to have an extensive knowledge of tort of negligence in Irish Law. Students should discuss the duty of care; Lord Atkins Neighbourhood principle; reasonably foreseeability; Res Ipsa Loquitor; contributory negligence and make reference to relevant cases. High marks will be awarded to students who present this essay question in a clear, logical and detailed format. SOLUTION 6 The tort of negligence give rights to persons who have suffered damage to themselves or their property as against a party who has failed to take reasonable care, where that person owes them a duty of care. To succeed in a negligence action, the plaintiff must prove that the defendant owed him a duty of care; that the defendant breached that duty and that the plaintiff suffered loss or damage as a result of the breach. (a) Duty of Care - The plaintiff must be able to show that he or she is someone who, in the circumstances, the defendant should have had in mind when embarking on the course of conduct which led to the alleged damage. A duty of care is owed to any person who we can reasonably foresee will be injured by our acts or omissions. Such persons are known in law as our ʻneighboursʼ. The neighbourhood principle was established in Donoghue v. Stevenson (1932). In this case, Mrs. Donoghue and a friend stopped for refreshment at a café. The friend bought some ginger beer manufactured by the defendant. This was supplied in opaque bottles which were opened at the table. Having consumed a glassful, Mrs Donoghue tipped the bottle to make sure nothing was left and found the decomposing remains of a snail. She consequently became ill with gastro-enteritis and sued the defendant in negligence. The defendant argued that they were not liable as there was no contract between them and the plaintiff. However, the House of Lords held that the defendant had prepared the product in such a way as to show that he intended it to reach the ultimate consumer in the form which it left him. He could reasonably foresee that somebody other than the original purchaser might consume the product, and the defendant owed Mrs Donoghue a duty of care. Page 9 In this case, Lord Atkin formulated the test for establishing whether a duty of care exists. Under the ʻneighbourhood principleʼ, Lord Atkin stated "you must take reasonable care to avoid acts or omissions which you can reasonably foresee would be likely to injure your neighbour". Oneʼs ʻneighbourʼ was defined as ʻall persons who are so closely and directly affected by my act that I ought reasonably to have had them in contemplation as being so affected when I am directing my mind to the acts or omissions which are called into questionʼ. b) The test is objective and the effect of its application is that a person is not liable for every injury which results from his carelessness. In King v. Phillips (1952), the defendant carelessly drove his car over a boyʼs bicycle. The boy, who was not on his bicycle at the time, screamed. The plaintiff, his mother, on hearing the scream, looked out the window and saw the mangled bicycle, but not her son. As a result, she suffered a severe shock and became ill. She sued the defendant for negligence. It was held that the defendant could only reasonably foresee that his carelessness would affect other road users, and not persons in houses. The defendant was held not to be liable to the plaintiff, since he did not owe her a duty of care. Res Ipsa Loquitor - The burden of proving the tort of negligence rests on the plaintiff, however, there is a principle known as res ipsa loquitur (the thing speaks for itself) and where the principle applies, the court is prepared to lighten the plaintiffʼs burden of proof. The facts of a particular case may be such as to raise a presumption of negligence where there is no other obvious cause of the incident. Before the principle can apply, the following circumstances must exist: the thing causing the damage must be shown to be under the control of the defendant; the accident which happened must be one which does not normally occur unless negligence is present .On proof of these circumstances, negligence on part of the defendant will be assumed and he will be liable unless he can prove that, despite the facts, reasonable care was shown. In Byrne v. Boadle (1863), a barrel of flour fell from the window of the defendantʼs warehouse onto the public street and injured the plaintiff, a passer-by. The defendant was a dealer in flour but there was no evidence that the defendant or any of his employees were engaged in moving the barrel at the time. The defendant submitted that there was no evidence of negligence, however, it was held that the happening of the event was of itself evidence of negligence and the defendant was obliged to show that he had not broken his duty of care. c) In OʼLoughlin v. Kearney (1939), the defendant had a trailer coupled to his car. It became detached and injured the plaintiff who sued for negligence. The court applied the principle of res ipsa loquitur and placed the burden of proof on the defendant. The cause of the detachment remained unknown and the defendant successfully proved that there was no defect in the coupling, and was held not to be negligent. Contributory Negligence - In many incidents where loss occurs, both parties may have, by their negligence, contributed to the loss. At common law, it was generally the case that if the plaintiff was to blame at all for the accident he would receive no damages. Since 1961, by virtue of the Civil Liability Act 1961, where a person suffers loss partly as a result of their own fault, and partly due to the fault of another, the damages recoverable will be reduced according to the share of the responsibility. S.34 of the Act provides that where it is not possible to establish different degrees of fault, the liability will be apportioned equally. In Froom v. Butcher [1975] 3 All ER 520, Denning LJ extended the definition of contributory negligence to two situations: where the plaintiff contributes to the accident; and where the plaintiff contributes to the resulting damage. The following cases illustrate the two types of contributory negligence: In OʼLeary v. OʼConnell (1968), the defendant, a motor-cyclist, knocked down the plaintiff who was walking across a road. As a result the plaintiffʼs leg was broken. It was held that both parties were negligent in not paying proper attention and the degree of fault was apportioned 85% to the defendant and 15% to the plaintiff. Damages were awarded accordingly. S.34(2)(b) of the Civil Liability Act provides that a negligent or careless failure to mitigate damage can also be deemed to be contributory negligence in respect of the amount by which such damage exceeds the damage that otherwise would have occurred. Thus, a failure to wear a seatbelt will be contributory negligence. In Sinnot v. Quinnsworth (1984), the plaintiff was a passenger in a car owned by the defendant, and was injured in a collision with a bus. Evidence showed that the injuries would have been less serious if the plaintiff had been wearing a seat belt. It was held that the plaintiffʼs damages would be reduced by 15%. [20 marks] Page 10 A Friend who is considering starting a business has approached you for advice. She wants to know what are the benefits of incorporation. Advise her. SOLUTION 7 AIM: This question requires students to have an extensive knowledge of the incorporation of a company. It is a very general and straightforward question and students should simply state the advantages of incorporation. Students should make reference to any relevant case law but importantly state as many advantages as possible and provide detailed explanations and examples. High marks will be awarded to students who present this essay question in a clear, logical and detailed format. Individuals may choose to conduct their businesses either in their own names as sole traders or under the aegis of registered companies, in which they own all or virtually all the shares. There are a number of advantages of running a business under the registered company form i.e. incorporation. A principal advantage is the separate corporate personality of the company. A registered company exists in law entirely separately from its members or shareholders; company assets belong to it and not to the shareholders, and the shareholders are not directly answerable for the companyʼs liabilities. Legal proceedings are brought by or against the company in its own name. The separate legal personality of companies therefore enables business persons to segregate their own private affairs from their business and also to segregate the affairs of their various businesses that are conducted under the aegis of different companies Secondly, for most companies there is ʻowner shieldingʼ in the form of limited liability. This means that the liability of the companyʼs owners (i.e. members and shareholders) for debts incurred by their company is subject to a limit or ceiling; the owners cannot be held personally responsible for debts beyond that limit. This limit is one which the owners agreed when establishing the company. If the shares are fully paid shareholders cannot be held personally responsible for the companyʼs debts; in companies limited by shares, shareholders liability is limited to the amount owed on the shares. Limited liability is advantageous for the owner as if the enterprise fails; itʼs the companyʼs and not the ownersʼ wealth that is called upon to satisfy the unpaid business creditors. Thirdly, the transferability of interests. An incorporated company is comprised of members and shareholders. Shareholders who wish to liquidate their investment in the company can do so easily by selling their shares. This is a simple transaction and does not require the assistance of a lawyer. This is in comparison to a sole trader who wishes to dispose of his interest; he must execute conveyances and other elaborate contracts. A fourth advantage is the perpetual succession. When a sole trader dies the business comes to an end. By contrast, a company never dies but continues in existence until it is wound up. Therefore the business is not disrupted to any like extend when the principal or sole shareholder dies as when the sole trader dies. Also, there is a floating charge advantage. A floating charge is one very important method of borrowing, which in practice is only available to registered companies. An incorporated business is able to use charges over assets as securities for borrowings. The company can continue to use those assets until the charge crystalises and becomes fixed on the assets remaining in that category. A fixed charge attaches to specific identifiable property and the company is restricted in its dealings with that asset. An incorporated company can have large membership numbers (unlimited and huge) in comparison to a partnership, which for example is limited to 20 persons. Finally there are also taxation benefits in doing business as an incorporated company in comparison to a sole trader or partnership. At different times the divergence between corporate tax rates and personal tax rates has been substantial. Also some tax incentives are only available to companies. For example the tax rules governing pension contributions are vastly more generous for company directors than they are for employees or self employed persons. It may also be possible for company directors to access their pensions sooner than if they were self employed. [20 marks] Page 11