Università degli Studi del Molise Facoltà di Economia

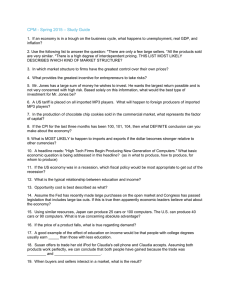

advertisement