16.0

Chapter

16

16.1

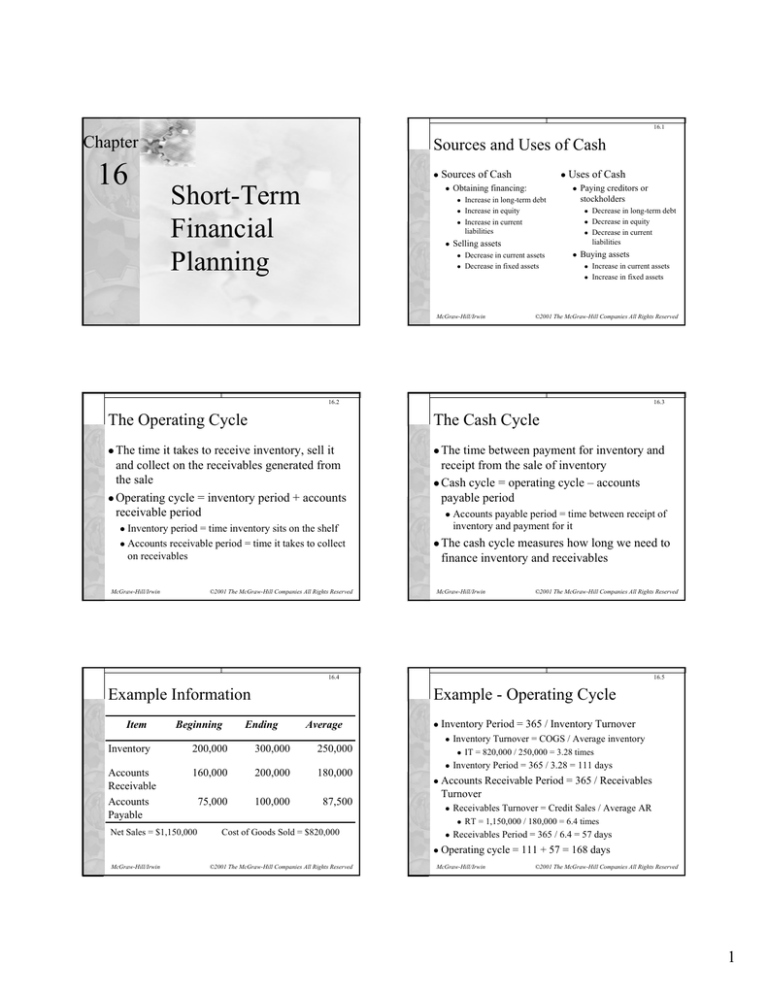

Sources and Uses of Cash

z

Short-Term

Financial

Planning

McGraw-Hill/Irwin

Sources of Cash

z

z

z

z

z

z

Obtaining financing:

Uses of Cash

z

Increase in long-term debt

Increase in equity

Increase in current

liabilities

Paying creditors or

stockholders

z

z

z

Selling assets

z

z

Decrease in current assets

Decrease in fixed assets

z

Buying assets

z

z

©2001 The McGraw-Hill Companies All Rights Reserved

McGraw-Hill/Irwin

Decrease in long-term debt

Decrease in equity

Decrease in current

liabilities

Increase in current assets

Increase in fixed assets

©2001 The McGraw-Hill Companies All Rights Reserved

16.2

16.3

The Operating Cycle

The Cash Cycle

z The

z The

time it takes to receive inventory, sell it

and collect on the receivables generated from

the sale

z Operating cycle = inventory period + accounts

receivable period

Inventory period = time inventory sits on the shelf

z Accounts receivable period = time it takes to collect

on receivables

time between payment for inventory and

receipt from the sale of inventory

z Cash cycle = operating cycle – accounts

payable period

z

z

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

Accounts payable period = time between receipt of

inventory and payment for it

z The

cash cycle measures how long we need to

finance inventory and receivables

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

16.4

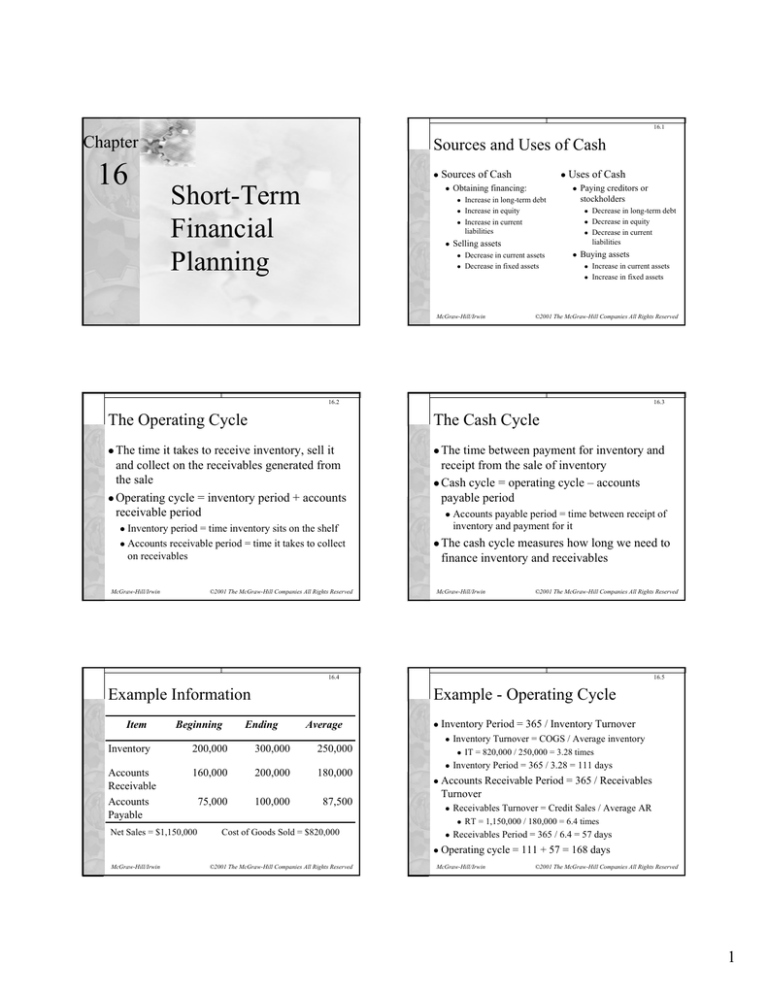

Example Information

Item

Inventory

Accounts

Receivable

Accounts

Payable

Beginning

200,000

Example - Operating Cycle

Ending

300,000

Average

z

250,000

160,000

200,000

180,000

75,000

100,000

87,500

Net Sales = $1,150,000

16.5

z

Inventory Turnover = COGS / Average inventory

z

Inventory Period = 365 / 3.28 = 111 days

z

z

©2001 The McGraw-Hill Companies All Rights Reserved

IT = 820,000 / 250,000 = 3.28 times

Accounts Receivable Period = 365 / Receivables

Turnover

z

Receivables Turnover = Credit Sales / Average AR

z

Receivables Period = 365 / 6.4 = 57 days

z

Cost of Goods Sold = $820,000

z

McGraw-Hill/Irwin

Inventory Period = 365 / Inventory Turnover

RT = 1,150,000 / 180,000 = 6.4 times

Operating cycle = 111 + 57 = 168 days

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

1

16.6

16.7

Example - Cash Cycle

Short-Term Financial Policy

z Accounts

z

Payables Period = 365 / payables

turnover

z

z

Payables turnover = COGS / Average AP

z

Accounts payables period = 365 / 9.4 = 39 days

z

PT = 820,000 / 87,500 = 9.4 times

z

z Cash

cycle = 168 – 39 = 129 days

z So, we have to finance our inventory and

receivables for 129 days

z

z

z

McGraw-Hill/Irwin

Flexible (Conservative)

Policy

©2001 The McGraw-Hill Companies All Rights Reserved

Large amounts of cash and

marketable securities

Large amounts of

inventory

Liberal credit policies

(large accounts receivable)

Relatively low levels of

short-term liabilities

High liquidity

McGraw-Hill/Irwin

z

Restrictive (Aggressive)

Policy

z

z

z

z

z

Low cash and marketable

security balances

Low inventory levels

Little or no credit sales

(low accounts receivable)

Relatively high levels of

short-term liabilities

Low liquidity

©2001 The McGraw-Hill Companies All Rights Reserved

16.8

16.9

Carrying versus Shortage Costs

Temporary versus Permanent Assets

z Carrying

z Are

costs

Opportunity cost of owning current assets versus

long-term assets that pay higher returns

z Cost of storing larger amounts of inventory

z

z Shortage

costs

Order costs – the cost of ordering additional

inventory or transferring cash

z Stock-out costs – the cost of lost sales due to lack of

inventory, including lost customers

z

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

z

current assets temporary or permanent?

Both!

z Permanent

current assets refer to the level of

current assets that the company retains

regardless of any seasonality in sales

z Temporary current assets refer to the additional

current assets that are added when sales are

expected to increase on a seasonal basis

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

16.10

Figure 16.4

Policy F

Dollars

Choosing the Best Policy

z Best

Policy R

Total asset

requirement

Marketable

securities

16.11

Dollars

Long-term

financing

Short-term

financing

Total asset

requirement

Long-term

financing

policy will be a combination of flexible

and restrictive policies

z Things to consider

Cash reserves

Maturity hedging

z Relative interest rates

z

z

Time

Policy F always implies a short-term

cash surplus and a large investment

in cash and marketable securities.

McGraw-Hill/Irwin

Time

Policy R uses long-term financing for

permanent asset requirements only and

short-term borrowing for seasonal

variations.

©2001 The McGraw-Hill Companies All Rights Reserved

z Compromise

policy – borrow short-term to

meet peak needs, maintain a cash reserve for

emergencies

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

2

16.12

Figure 16.5

16.13

Cash Budget

z Primary

Dollars

Total seasonal

variation

Short-term

financing

Flexible policy (F)

Compromise policy (C)

Restrictive policy (R)

z How

Marketable

securities

it works

Identify sales and cash collections

z Identify various cash outflows

z Subtract outflows from inflows and determine

investing and financing needs

z

General growth in

fixed assets

and permanent

current assets

Time

With a compromise policy, the firm keeps a reserve of liquidity that it uses

to initially finance seasonal variations in current asset needs. Short-term

borrowing is used when the reserve is exhausted.

McGraw-Hill/Irwin

tool in short-run financial planning

Identify short-term needs and potential opportunities

z Identify when short-term financing may be required

z

©2001 The McGraw-Hill Companies All Rights Reserved

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

16.14

Short-Term Borrowing

z

z

z

z

z

Example: Factoring

Unsecured loans

z

16.15

Selling receivables to someone else at a discount

Example: You have an average of $1 million in

receivables and you borrow money by factoring

receivables with a discount of 2.5%. The receivables

turnover is 12 times per year.

z What is the APR?

z

Line of credit – prearranged agreement with a bank that allows the

firm to borrow up to a certain amount on a short-term basis

Committed – formal legal arrangement that may require a

commitment fee and generally has a floating interest rate

Non-committed – informal agreement with a bank that is similar to

credit card debt for individuals

Revolving credit – non-committed agreement with a longer time

between evaluations

Secured loans – loan secured by receivables or inventory or

both

z

z

z

z

What is the effective rate?

z

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

Period rate = .025/.975 = 2.564%

APR = 12(2.564%) = 30.769%

EAR = 1.0256412 – 1 = 35.502%

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

16.16

Chapter 16 Quick Quiz

What is the operating cycle and the cash cycle?

What are the differences between flexible and

restrictive short-term financial policies?

z What factors do we need to consider when choosing a

financial policy?

z What factors go into determining a cash budget and

why is it valuable?

z

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

3