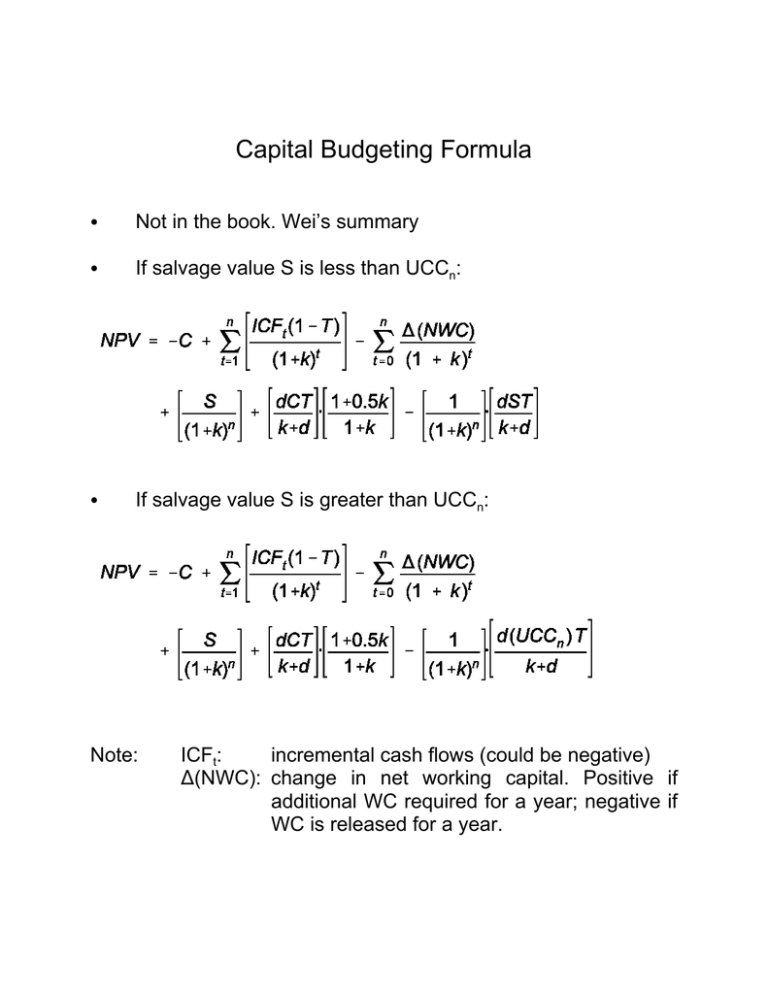

Capital Budgeting Formula

advertisement

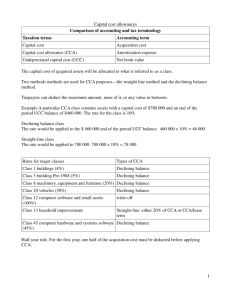

Capital Budgeting Formula C Not in the book. Wei’s summary C If salvage value S is less than UCCn: C If salvage value S is greater than UCCn: Note: ICFt: incremental cash flows (could be negative) )(NWC): change in net working capital. Positive if additional WC required for a year; negative if WC is released for a year. Explaining the Capital Budgeting Formula Let’s use the following example to illustrate the formulas. Suppose you have a project which requires an initial investment (in a piece of equipment) of $200,000. The equipment has a CCA rate of 0.3. The project will last 3 years. At the end of year 3, the equipment will be sold for $35,000. The project will reduce production cost by $110,000 per year. The initial working capital requirement is $25,000. An additional amount of $8,000 is required for year 1. All will be recovered at the end of year 3. The tax rate is 40% and the discount rate is 10%. What is the NPV? Let’s first get the CCA schedule using the half-year rule: Year 0 1 2 3 CCA $30,000 $51,000 $35,700 UCC $200,000 $170,000 $119,000 $83,300 Since the salvage value S = $35,000 is less than UCC3 = $83,300, we use the first formula: Let’s examine one item at a time. 1) The first item is initial investment. C = $200,000. Since it is an investment or cash outflow, we have a negative sign in front it. 2) The second item is the total PV of after tax, incremental cash flows (ICF). It is the net benefit of having a project. In our case, the savings in costs are just like increases in revenues. So, each ICF = $110,000. The entire second item can be written as 110,000(1-0.4)/(1+0.1) + 110,000*(1-0.4)/(1+0.1)2 + 110,000*(1-0.4)/(1+0.1)3 =$109,421. Since this is a benefit, we have a positive sign in front it. 3) The third item is the net working capital. The summation goes from time zero to year n. Notice that we only keep track of the changes (hence the greek letter ∆). In other words, we only worry about the net addition and reductions. In our case, the initial requirement is $25,000, so ∆(NWC)1 = $25,000. The second year, we need another $8,000, so ∆(NWC)1 = $8,000. No new requirement or recovery in the second year, so ∆(NWC)2 = 0. By year 3, we will recover everything, which means ∆(NWC)3 = $33,000. (This is $25,000 + $8,000). Why the negative sign in front of $33,000? Because this is not additional requirement, rather, it is the recovery, the opposite of investment. Now, there is a negative sign in front of the who third item. This is to reflect the fact that a positive NWC represents an investment or a cash outflow. So, the entire third item is 25,000 + 8,000/(1+0.1) - 33,000/(1+0.1)3 = $7,479 In other words, in PV terms we need to invest $7,470 in NWC (this is the financing cost). Since NWC is cash outflow, we have a negative sign in front it. 4) The fourth item is simply the PV of salvage value, which is 35,000/(1+0.1)3 = $26,296 We have a positive sign in front of it, since this is cash inflow. 5) The fifth item is the PV of all the future tax shields from CCA assuming the equipment will last forever, under the half-year rule. It is 0.3*(200,000)(0.4)/(0.1+0.4)*[(1+0.5*0.1)/(1+0.1)] = $57,273. We have a positive sign in front of it, since this is tax savings. 6) The last item is the tax shield adjustment. When we calculate item 5, we assume that the equipment would last forever. But we know that we will lose it after three years. Therefore, we will not be able to enjoy CCA tax shields after year three. We must subtract an amount from item 5 to reflect this lost. At the end of year 3, the UCC is $83,300 and the salvage value is $35,000. If the equipment is not sold and is held forever, then you would continue to depreciate $83,300 from year 3 on. No adjustment is needed in this case, since item 5 is the case of equipment lasting forever. But when you sell it for $35,000, you have recovered $35,000, only the remaining amount (which is $83,300 - $35,000 = $48,300) will continue to generate tax shields forever. In other words, you will lose $35,000 (which is salvage value, S) from the capital base. Since this is lost forever, so the present value of tax shields from this amount is dST/(k+d) (here we don’t use the half-year formula anymore since it is year 3 already). What about 1/(1+k)n? This is simply to bring the PV of tax shield loss to today. In our case, the entire sixth item is 1/(1+0.1)3 [0.3*35,000*0.4/(0.1+0.3)] = $7,889. We have a negative sign in front of it, since we lose it. Put all items together: NPV = -$200,000 + $109,421 - $7,479 + $26,296 + $57,273 - $7,889 = - $22,378 **************** If we change the example just by one number: make the salvage value to be $90,000. In this case, since S > UCC3, we will use the second formula. Why? Since by selling the equipment, you will have recovered all the remaining book value of the equipment ($83,300). You should not enjoy any CCA tax shields from that point on. That is why we put the entire UCC in the formula. Anyway, in this case, we only need to adjust the fourth item (which is now $90000/(1.1)3 = $67,618) and the last item (which is now 1/(1+0.1)3 [0.3*83,300*0.4/(0.1+0.3)] = $18,775). So the new NPV is NPV = -$200,000 + $109,421 - $7,479 + $67,618 + $57,273 - $18,775 = $8,058 Example A new machine: CCA class: Life Price Freight & installation: Salvage value: Additional NWC: Effect on costs: 8 (d=20%) 4 years $100,000 $20,000 $30,000 $10,000 decrease costs by $50,000 per year Tax rate: Cost of capital (k): 40% 10% Depreciation base: C = $100,000 + $20,000 = $120,000 (No additional NWC required during life. But in general, NWC changes every year) Time Line Method C Depreciation schedule (half year rule) CCA Year 0 1 2 3 4 C $12,000 21,600 17,280 13,824 UCC $120,000 108,000 86,400 69,120 55,296 Cash flow analysis Machine cost NWC CIF(1-T) CCA*T Operating CF Salvage value CCA tax shields * NWC recovery 0 ($120,000) ($10,000) Net CF PV of CF ($130,000) ($130,000) NPV $17,499 1 2 3 4 $30,000 4,800 $34,800 $30,000 8,640 $38,640 $30,000 6,912 $36,912 $30,000 5,530 $35,530 $30,000 6,746 $10,000 $34,800 $31,636 $38,640 $31,934 $36,912 $27,733 $82,276 $56,196 CCA tax shields: UCC4 = $55,296, S = $30,000, Remaining capital continuing to generate tax shield: 55,296 - 30,000 = 25,296 Then, dCT / (k + d) = 0.2(25,296)(0.4)/(0.1 + 0.2) = $6,746. Formula Method C Depreciation schedule (half year rule) Year 0 1 2 3 4 C CCA $12,000 21,600 17,280 13,824 UCC $120,000 108,000 86,400 69,120 55,296 UCC4 = $55,296 > S =$30,000, Therefore use C = $120,000 )(NWC)0 = $10,000 )(NWC)4 = - $10,000 ICFt = 50,000 (t = 1,4) T = 0.4 k = 0.1 NPV = $17,499 )(NWC)t = 0 (T = 1, 2, 3) S = $30,000 d = 0.2 n=4 What if salvage value is $60,000? Everything else remains the same. The Time Line Method Here, we only need to make two changes. First, change the salvage value from $30,000 to $60,000; second, delete the line headed with “CCA tax shield”. Why delete this item? In the previous case when S < UCC4, we lose S = $30,000 from the capital base, since this is how much you have recovered from the sale of the old machine. In other words, the book value of capital investment at year 4 after selling the old machine is $55,296 - $30,000 = $25,296. So, from year 5 and on, you only continue to enjoy tax shields from this amount, which is the remaining book value of the capital cost. This is the base we used to calculate the PV of all future CCA tax shields of $6,746. Now, if the salvage value is $60,000, which is bigger than UCC4 = $55,296, you will recover all the book value of capital investment. So you will not enjoy any future tax shields from CCA, since there is no CCA to deduct anymore! That is why we don’t have that line “CCA tax shield” anymore. All you get from CCA tax shields are the four numbers for each year under CCA*T: $4,800, $8,640, $6,912, and $5,530. In any event, in this case, the time line method will lead to the following results: Machine cost NWC CIF(1-T) CCA*T Operating CF Salvage value NWC recovery 0 ($120,000) ($10,000) Net CF PV of CF ($130,000) ($130,000) NPV $33,381 1 2 3 4 $30,000 4,800 $34,800 $30,000 8,640 $38,640 $30,000 6,912 $36,912 $30,000 5,530 $35,530 $60,000 $10,000 $34,800 $31,636 $38,640 $31,934 $36,912 $27,733 $105,530 $72,078 The formula Method Everything is the same as before, except that S = $60,000 and UCC4 = $55,296, then you can doublecheck that you get NPV = $33,381.