The Foreign Exchange Market

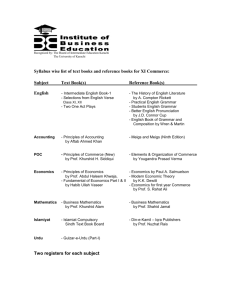

advertisement

The Foreign Exchange Market F Role of the foreign exchange markets F Foreign exchange (FX) basics » Terminology » Types of contracts F Organization and institutional features » Actors - brokers, dealers » Segments - Interbank (wholesale), retail » Tracking a deal » Activities - Hedging, speculation, arbitrage, market making F Dimensions of the FX » By location, contract type, currency of denomination Prof. Levich C45.0001, Economics of IB Chapter 16, p. 1 Role of Foreign Exchange Markets F Member nations of the International Monetary Fund » 182 in 1998, up from 156 in 1991 » With few exceptions, each nation issues its own national money (why?) and controls it value (why?) » Exceptions: EMU (11 nations, one money); Panama (US$); former French colonies (French franc). F In commodity trade between US and Japan » US (Japanese) exporters do not usually accept yen (US$) F Main roles of the FX market » Medium of exchange - facilitate trade in goods and services » Medium of exchange - facilitate purchase/sale of securities » Medium to re-denominate and manage currency risk in stock asset or liability positions Prof. Levich C45.0001, Economics of IB Chapter 16, p. 2 1 Foreign Exchange Contracts (1 of 2) F Spot contract » An exchange of two currencies for “immediate delivery” » A binding commitment » Quoting conventions: u Direct terms (American terms): US$/foreign currency u Indirect terms (European terms): foreign currency/US$ F Foreign exchange swap » Simultaneous borrowing and lending of short-term bank balances in two currencies, for example u Bank A borrows $10 million from Bank B for 1-month u Bank B borrows $10 million worth of £ from Bank A for 1-month » Used to “construct” forward contracts and manage risks Prof. Levich C45.0001, Economics of IB Chapter 16, p. 3 Foreign Exchange Contracts (2 of 2) F Forward contract » Agreement made today for obligatory exchange at specified time in future: 1, 2, 3, 6, 12 months from today » No exchange of funds on agreement day, or at any time until settlement date » Example: u On 11/15/99 buy £1,000,000 1-month forward at $1.60/ £ u On settlement date 12/15/99 when spot pound is $1.55 – Take delivery of £1,000,000, pay out $1,600,000 – “Cash settle”, pay $50,000 to cancel obligation » Quoting conventions u Outright u % premium or discount relative to spot Prof. Levich C45.0001, Economics of IB Chapter 16, p. 4 2 FX Terminology: Appreciation and Depreciation F Because every exchange rate involves two currencies » Appreciation of the US$ against £ ⇔ Depreciation of £ against US$ » Depreciation of the US$ against £ ⇔ Appreciation of £ against US$ F Examples » Change from 1.50 $/£ to 1.75 $/£ ⇒ Appreciation of £ against US$ » Change from 1.50 $/£ to 1.25 $/£ ⇒ Depreciation of £ against US$ F Exact percentage measures depend on the base rate » x% depreciation of the Mexican peso ⇒ x% more pesos to buy $1 u from 4 MP/$ to 8 MP/$ ⇒ 100% depreciation of the peso » y% appreciation of the US$ ⇒ y% fewer dollar to buy 1 peso u from $0.25/MP to $0.125/MP ⇒ 50% appreciation of the US$ Prof. Levich C45.0001, Economics of IB Chapter 16, p. 5 Structure of the Foreign Exchange Market The Interbank FX Market Chase Bank Dealer Deutsche Bank Dealer Broker Barclays Bank Prof. Levich Hong Kong Shainghai Bank J.P. Morgan Credit Lyonnais Bank of Tokyo C45.0001, Economics of IB Chapter 16, p. 6 3 Structure of the Foreign Exchange Market The Retail and Interbank FX Market General Motors General Electric Microsoft Chase Bank Dealer Motorola Deutsche Bank Dealer Broker Prof. Levich C45.0001, Economics of IB Chapter 16, p. 7 Growth in Global FX Trading 1,600 1500 Billions US$ per day 1,400 1190 1,200 1,000 820 800 600 590 400 200 0 1989 Prof. Levich 1992 C45.0001, Economics of IB 1995 1998 Chapter 16, p. 8 4 Daily Volume of FX Trading by Location percentage market share Others 16% London 32% Australia 2% Based on April 1998 BIS survey of trading in 43 countries Paris 4% Frankfurt 5% Final estimate of global FX trading: Zurich 4% Hong Kong 4% $1.5 trillion/day Singapore 7% New York 18% Tokyo 8% Prof. Levich C45.0001, Economics of IB Chapter 16, p. 9 Daily Volume of FX Trading by Location in billions of US$ 637 351 321 149 139 79 72 rs he Ot a ali str Au C45.0001, Economics of IB 47 ris Pa rt kfu an Fr h ric Zu ng Ko ng Ho e or ap ng Si rk Yo o ky To w Ne on nd Lo Prof. Levich 94 82 Chapter 16, p. 10 5 Percentage Share of Trading by Currency of Denomination Source: April 1998 BIS Survey 100 90 80 70 60 50 40 30 20 10 0 US$ DM Yen Pound French franc Swiss franc Canadian dollar Australian dollar ECU and other EMS Others Note: Percentage shares sum to 200% because two currencies are involved in eash transaction Prof. Levich C45.0001, Economics of IB Chapter 16, p. 11 Daily Volume of Trading by Contract Type 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% 1989 1992 Spot Prof. Levich 1995 Outright Forward 1998 FX Swap C45.0001, Economics of IB Chapter 16, p. 12 6 Table 3.7 Daily Trading Statistics for an Actual Spot DM Interbank Dealer Trading Statistics for an Actual Spot DM Interbank Dealer Direct Transactions Brokered Transactions Total Transactions Number of Transactions 190 77 267 Value of Transactions $0.8 billion $0.4 billion $1.2 billion Median Transaction Size $3.0 million $4.0 million na Median Spread Size DM 0.0003 na na Note: The above figures are daily averages for a single trader in the spot DM interbank market for the period Monday, August 3, 1992 - Friday, August 7, 1992. Source: Richard K. Lyons, "Tests of Microstructural Hypotheses in the Foreign Exchange Market," Journal of Financial Economics 39 (1995): 321-351. Prof. Levich C45.0001, Economics of IB Chapter 16, p. 13 Net Trading Positions, August 3 - August 7, 1992 for DM/US$ Spot Trader (in US$ Millions) 50 30 10 -10 -30 Monday Tuesday Wednesday Thursday Friday -50 Transactions in Chronological Order, by Day of the Week Prof. Levich C45.0001, Economics of IB Chapter 16, p. 14 7